IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This guidance does not apply from 6 April 2009. The guidance it conta<strong>in</strong>s is replaced by <strong>the</strong><br />

guidance provided <strong>in</strong> HMRC6 – Residence, Domicile <strong>and</strong> <strong>the</strong> Remittance Basis. It is kept<br />

available for those people who need <strong>to</strong> make reference <strong>to</strong> <strong>IR20</strong> for <strong>the</strong>ir <strong>tax</strong> affairs before<br />

5 April 2009.<br />

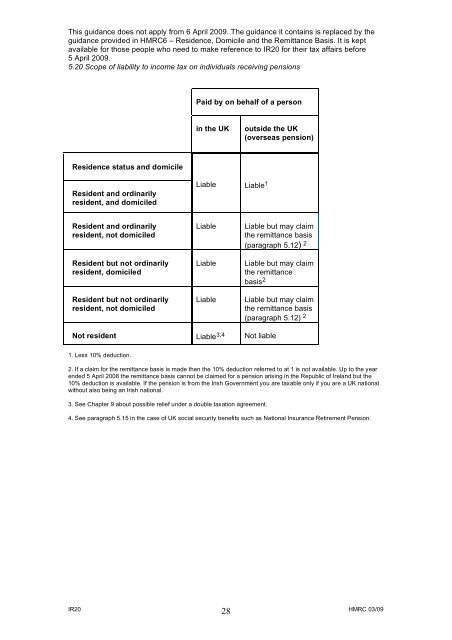

5.20 Scope of <strong>liability</strong> <strong>to</strong> <strong>in</strong>come <strong>tax</strong> on <strong>in</strong>dividuals receiv<strong>in</strong>g pensions<br />

Residence status <strong>and</strong> domicile<br />

Resident <strong>and</strong> ord<strong>in</strong>arily<br />

resident, <strong>and</strong> domiciled<br />

Resident <strong>and</strong> ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Resident but not ord<strong>in</strong>arily<br />

resident, domiciled<br />

Resident but not ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Not resident<br />

1. Less 10% deduction.<br />

Paid by on behalf of a person<br />

<strong>in</strong> <strong>the</strong> UK<br />

Liable<br />

Liable<br />

Liable<br />

Liable<br />

Liable 3,4<br />

outside <strong>the</strong> UK<br />

(overseas pension)<br />

Liable 1<br />

Liable but may claim<br />

<strong>the</strong> remittance basis<br />

(paragraph 5.12) 2<br />

Liable but may claim<br />

<strong>the</strong> remittance<br />

basis 2<br />

Liable but may claim<br />

<strong>the</strong> remittance basis<br />

(paragraph 5.12) 2<br />

Not liable<br />

2. If a claim for <strong>the</strong> remittance basis is made <strong>the</strong>n <strong>the</strong> 10% deduction referred <strong>to</strong> at 1 is not available. Up <strong>to</strong> <strong>the</strong> year<br />

ended 5 April 2008 <strong>the</strong> remittance basis cannot be claimed for a pension aris<strong>in</strong>g <strong>in</strong> <strong>the</strong> Republic of Irel<strong>and</strong> but <strong>the</strong><br />

10% deduction is available. If <strong>the</strong> pension is from <strong>the</strong> Irish Government you are <strong>tax</strong>able only if you are a UK national<br />

without also be<strong>in</strong>g an Irish national.<br />

3. See Chapter 9 about possible relief under a double <strong>tax</strong>ation agreement.<br />

4. See paragraph 5.15 <strong>in</strong> <strong>the</strong> case of UK social security benefits such as National Insurance Retirement Pension.<br />

<strong>IR20</strong> 28<br />

HMRC 03/09