IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This guidance does not apply from 6 April 2009. The guidance it conta<strong>in</strong>s is replaced by <strong>the</strong><br />

guidance provided <strong>in</strong> HMRC6 – Residence, Domicile <strong>and</strong> <strong>the</strong> Remittance Basis. It is kept<br />

available for those people who need <strong>to</strong> make reference <strong>to</strong> <strong>IR20</strong> for <strong>the</strong>ir <strong>tax</strong> affairs before<br />

5 April 2009.<br />

10 Appeals<br />

10.1 If you have any dispute with HM Revenue & Cus<strong>to</strong>ms about your residence, ord<strong>in</strong>ary<br />

residence or domicile, or about any claim for relief from UK <strong>tax</strong>, <strong>and</strong> agreement cannot<br />

be reached, you have <strong>the</strong> right <strong>to</strong> have your case considered by an <strong>in</strong>dependent<br />

tribunal.<br />

10.2 If HM Revenue & Cus<strong>to</strong>ms write <strong>to</strong> you giv<strong>in</strong>g a formal decision, <strong>the</strong>y will expla<strong>in</strong> <strong>to</strong> you<br />

how you may appeal <strong>and</strong> how long you have for this purpose. You may choose <strong>to</strong> have<br />

an appeal heard by ei<strong>the</strong>r <strong>the</strong> General Commissioners or <strong>the</strong> Special Commissioners <strong>in</strong><br />

connection with your residence status <strong>and</strong> claims for relief. All appeals <strong>in</strong> connection<br />

with your ord<strong>in</strong>ary residence status <strong>and</strong> domicile are heard by <strong>the</strong> Special<br />

Commissioners.<br />

10.3 Both <strong>the</strong> General Commissioners <strong>and</strong> <strong>the</strong> Special Commissioners are <strong>in</strong>dependent of<br />

HM Revenue & Cus<strong>to</strong>ms. Their decisions on questions of fact are f<strong>in</strong>al, but you can<br />

appeal aga<strong>in</strong>st <strong>the</strong>ir decisions on questions of law <strong>to</strong> <strong>the</strong> High Court. Leaflet DCA ‘Tax<br />

Appeals’ expla<strong>in</strong>s procedures <strong>in</strong> full. It can be obta<strong>in</strong>ed from our website at<br />

www.hmrc.gov.uk or from any HM Revenue & Cus<strong>to</strong>ms office or Enquiry Centre.<br />

Part III Payment of UK National Insurance contributions<br />

11 National Insurance contributions<br />

General<br />

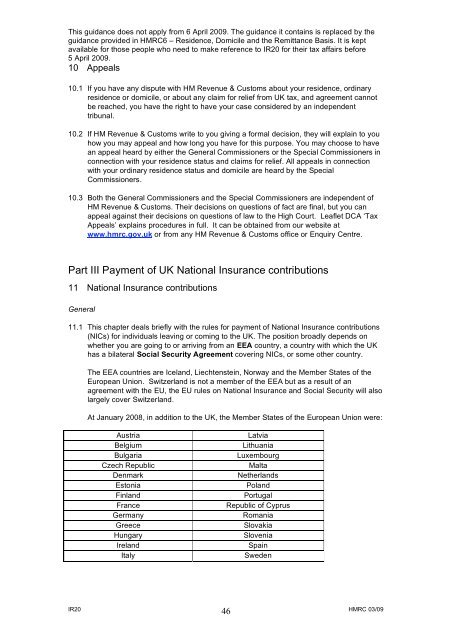

11.1 This chapter deals briefly with <strong>the</strong> rules for payment of National Insurance contributions<br />

(NICs) for <strong>in</strong>dividuals leav<strong>in</strong>g or com<strong>in</strong>g <strong>to</strong> <strong>the</strong> UK. The position broadly depends on<br />

whe<strong>the</strong>r you are go<strong>in</strong>g <strong>to</strong> or arriv<strong>in</strong>g from an EEA country, a country with which <strong>the</strong> UK<br />

has a bilateral Social Security Agreement cover<strong>in</strong>g NICs, or some o<strong>the</strong>r country.<br />

The EEA countries are Icel<strong>and</strong>, Liechtenste<strong>in</strong>, Norway <strong>and</strong> <strong>the</strong> Member States of <strong>the</strong><br />

European Union. Switzerl<strong>and</strong> is not a member of <strong>the</strong> EEA but as a result of an<br />

agreement with <strong>the</strong> EU, <strong>the</strong> EU rules on National Insurance <strong>and</strong> Social Security will also<br />

largely cover Switzerl<strong>and</strong>.<br />

At January 2008, <strong>in</strong> addition <strong>to</strong> <strong>the</strong> UK, <strong>the</strong> Member States of <strong>the</strong> European Union were:<br />

Austria Latvia<br />

Belgium Lithuania<br />

Bulgaria Luxembourg<br />

Czech Republic Malta<br />

Denmark Ne<strong>the</strong>rl<strong>and</strong>s<br />

Es<strong>to</strong>nia Pol<strong>and</strong><br />

F<strong>in</strong>l<strong>and</strong> Portugal<br />

France Republic of Cyprus<br />

Germany Romania<br />

Greece Slovakia<br />

Hungary Slovenia<br />

Irel<strong>and</strong> Spa<strong>in</strong><br />

Italy Sweden<br />

<strong>IR20</strong> 46<br />

HMRC 03/09