IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This guidance does not apply from 6 April 2009. The guidance it conta<strong>in</strong>s is replaced by <strong>the</strong><br />

guidance provided <strong>in</strong> HMRC6 – Residence, Domicile <strong>and</strong> <strong>the</strong> Remittance Basis. It is kept<br />

available for those people who need <strong>to</strong> make reference <strong>to</strong> <strong>IR20</strong> for <strong>the</strong>ir <strong>tax</strong> affairs before<br />

5 April 2009.<br />

rate) on any dividends.<br />

You may, however, be entitled <strong>to</strong> a <strong>tax</strong> credit if you are a resident of a country with<br />

which <strong>the</strong> UK has a double <strong>tax</strong>ation agreement, <strong>and</strong> <strong>the</strong> agreement provides for<br />

payment of <strong>the</strong> same <strong>tax</strong> credit as a UK resident would be entitled <strong>to</strong> receive. In that<br />

case, you are liable <strong>to</strong> <strong>in</strong>come <strong>tax</strong> on <strong>the</strong> <strong>to</strong>tal of <strong>the</strong> dividend <strong>and</strong> <strong>tax</strong> credit, at <strong>the</strong> rate<br />

of <strong>tax</strong> laid down <strong>in</strong> <strong>the</strong> agreement.<br />

From 6 April 1999, all double <strong>tax</strong>ation agreements that provide for payment of a <strong>tax</strong><br />

credit on dividends paid by UK companies cont<strong>in</strong>ue <strong>to</strong> give a right <strong>to</strong> claim a <strong>tax</strong> credit <strong>in</strong><br />

excess of <strong>the</strong> amount which <strong>the</strong> UK is entitled <strong>to</strong> reta<strong>in</strong>. However, because <strong>the</strong> rate of<br />

<strong>tax</strong> credit has been reduced (see paragraph 9.11), <strong>the</strong> amount which <strong>the</strong> UK is entitled<br />

<strong>to</strong> reta<strong>in</strong> under those agreements will <strong>in</strong> practice cover <strong>the</strong> whole of <strong>the</strong> <strong>tax</strong> credit. So if<br />

you make a claim under an agreement where a dividend has been paid on or after 6<br />

April 1999, <strong>the</strong>re will be no balance of <strong>tax</strong> credit left for us <strong>to</strong> pay <strong>to</strong> you.<br />

9.13 You may also have <strong>the</strong> right <strong>to</strong> a <strong>tax</strong> credit if you receive UK <strong>tax</strong> allowances <strong>and</strong> reliefs<br />

through a claim <strong>in</strong> accordance with paragraph 7.3. But if you can only claim <strong>the</strong>se<br />

allowances because of <strong>the</strong> terms of a double <strong>tax</strong>ation agreement (<strong>the</strong> f<strong>in</strong>al category <strong>in</strong><br />

paragraph 7.3), whe<strong>the</strong>r you are entitled <strong>to</strong> <strong>the</strong> <strong>tax</strong> credit will depend on <strong>the</strong> terms of <strong>the</strong><br />

agreement.<br />

Capital ga<strong>in</strong>s<br />

9.14 Under many agreements, if you are a resident of ano<strong>the</strong>r country for <strong>the</strong> purposes of <strong>the</strong><br />

agreement, you will often be liable <strong>to</strong> <strong>tax</strong> only <strong>in</strong> <strong>the</strong> o<strong>the</strong>r country on any ga<strong>in</strong>s you<br />

make from dispos<strong>in</strong>g of assets. In that case, you will be exempt from capital ga<strong>in</strong>s <strong>tax</strong> <strong>in</strong><br />

<strong>the</strong> UK even if you are ord<strong>in</strong>arily resident here. If, however, you are carry<strong>in</strong>g on a trade<br />

or runn<strong>in</strong>g a bus<strong>in</strong>ess through a permanent establishment <strong>in</strong> <strong>the</strong> UK, any ga<strong>in</strong>s you<br />

make from dispos<strong>in</strong>g of assets connected with <strong>the</strong> permanent establishment will<br />

cont<strong>in</strong>ue <strong>to</strong> be chargeable <strong>to</strong> capital ga<strong>in</strong>s <strong>tax</strong> <strong>in</strong> <strong>the</strong> UK.<br />

UK <strong>residents</strong><br />

9.15 If you are resident <strong>in</strong> <strong>the</strong> UK <strong>and</strong> have overseas <strong>in</strong>come or ga<strong>in</strong>s which are <strong>tax</strong>able <strong>in</strong><br />

both <strong>the</strong> UK <strong>and</strong> <strong>the</strong> country of orig<strong>in</strong>, you may qualify for relief aga<strong>in</strong>st UK <strong>tax</strong> for all or<br />

part of <strong>the</strong> overseas <strong>tax</strong> you have paid. Even if <strong>the</strong>re is no double <strong>tax</strong>ation agreement<br />

between <strong>the</strong> UK <strong>and</strong> <strong>the</strong> o<strong>the</strong>r country concerned, you may still be entitled <strong>to</strong> relief<br />

under special provisions <strong>in</strong> <strong>the</strong> UK’s <strong>tax</strong> legislation.<br />

List of <strong>the</strong> UK’s double <strong>tax</strong>ation agreements<br />

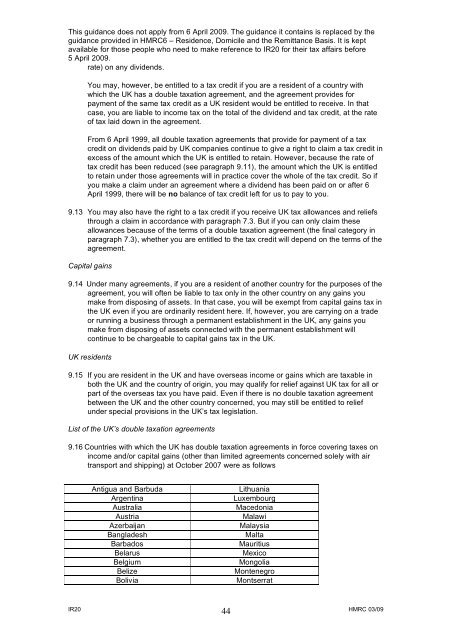

9.16 Countries with which <strong>the</strong> UK has double <strong>tax</strong>ation agreements <strong>in</strong> force cover<strong>in</strong>g <strong>tax</strong>es on<br />

<strong>in</strong>come <strong>and</strong>/or capital ga<strong>in</strong>s (o<strong>the</strong>r than limited agreements concerned solely with air<br />

transport <strong>and</strong> shipp<strong>in</strong>g) at Oc<strong>to</strong>ber 2007 were as follows<br />

Antigua <strong>and</strong> Barbuda Lithuania<br />

Argent<strong>in</strong>a Luxembourg<br />

Australia Macedonia<br />

Austria Malawi<br />

Azerbaijan Malaysia<br />

Bangladesh Malta<br />

Barbados Mauritius<br />

Belarus Mexico<br />

Belgium Mongolia<br />

Belize Montenegro<br />

Bolivia Montserrat<br />

<strong>IR20</strong> 44<br />

HMRC 03/09