IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

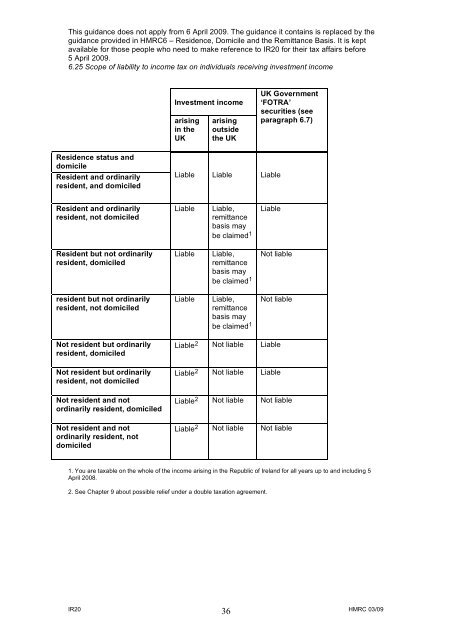

This guidance does not apply from 6 April 2009. The guidance it conta<strong>in</strong>s is replaced by <strong>the</strong><br />

guidance provided <strong>in</strong> HMRC6 – Residence, Domicile <strong>and</strong> <strong>the</strong> Remittance Basis. It is kept<br />

available for those people who need <strong>to</strong> make reference <strong>to</strong> <strong>IR20</strong> for <strong>the</strong>ir <strong>tax</strong> affairs before<br />

5 April 2009.<br />

6.25 Scope of <strong>liability</strong> <strong>to</strong> <strong>in</strong>come <strong>tax</strong> on <strong>in</strong>dividuals receiv<strong>in</strong>g <strong>in</strong>vestment <strong>in</strong>come<br />

Residence status <strong>and</strong><br />

domicile<br />

Resident <strong>and</strong> ord<strong>in</strong>arily<br />

resident, <strong>and</strong> domiciled<br />

Resident <strong>and</strong> ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Resident but not ord<strong>in</strong>arily<br />

resident, domiciled<br />

resident but not ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Not resident but ord<strong>in</strong>arily<br />

resident, domiciled<br />

Not resident but ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Not resident <strong>and</strong> not<br />

ord<strong>in</strong>arily resident, domiciled<br />

Not resident <strong>and</strong> not<br />

ord<strong>in</strong>arily resident, not<br />

domiciled<br />

Investment <strong>in</strong>come<br />

aris<strong>in</strong>g<br />

<strong>in</strong> <strong>the</strong><br />

UK<br />

Liable<br />

Liable<br />

Liable<br />

Liable<br />

Liable 2<br />

Liable 2<br />

Liable 2<br />

Liable 2<br />

aris<strong>in</strong>g<br />

outside<br />

<strong>the</strong> UK<br />

Liable<br />

Liable,<br />

remittance<br />

basis may<br />

be claimed 1<br />

Liable,<br />

remittance<br />

basis may<br />

be claimed 1<br />

Liable,<br />

remittance<br />

basis may<br />

be claimed 1<br />

Not liable<br />

Not liable<br />

Not liable<br />

Not liable<br />

UK Government<br />

‘FOTRA’<br />

securities (see<br />

paragraph 6.7)<br />

Liable<br />

Liable<br />

Not liable<br />

Not liable<br />

Liable<br />

Liable<br />

Not liable<br />

Not liable<br />

1. You are <strong>tax</strong>able on <strong>the</strong> whole of <strong>the</strong> <strong>in</strong>come aris<strong>in</strong>g <strong>in</strong> <strong>the</strong> Republic of Irel<strong>and</strong> for all years up <strong>to</strong> <strong>and</strong> <strong>in</strong>clud<strong>in</strong>g 5<br />

April 2008.<br />

2. See Chapter 9 about possible relief under a double <strong>tax</strong>ation agreement.<br />

<strong>IR20</strong> 36<br />

HMRC 03/09