IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

IR20 - Residents and non-residents liability to tax in the United ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This guidance does not apply from 6 April 2009. The guidance it conta<strong>in</strong>s is replaced by <strong>the</strong><br />

guidance provided <strong>in</strong> HMRC6 – Residence, Domicile <strong>and</strong> <strong>the</strong> Remittance Basis. It is kept<br />

available for those people who need <strong>to</strong> make reference <strong>to</strong> <strong>IR20</strong> for <strong>the</strong>ir <strong>tax</strong> affairs before<br />

5 April 2009.<br />

Fur<strong>the</strong>r <strong>in</strong>formation<br />

8.11 In <strong>the</strong> space available <strong>in</strong> this Chapter it is only possible <strong>to</strong> offer general guidance on<br />

some of <strong>the</strong> more important <strong>to</strong>pics. For more detailed <strong>in</strong>formation about capital ga<strong>in</strong>s<br />

<strong>tax</strong> you can obta<strong>in</strong> ‘Capital Ga<strong>in</strong>s Tax - An <strong>in</strong>troduction’ from any Tax Office or<br />

HM Revenue & Cus<strong>to</strong>ms Enquiry Centre.<br />

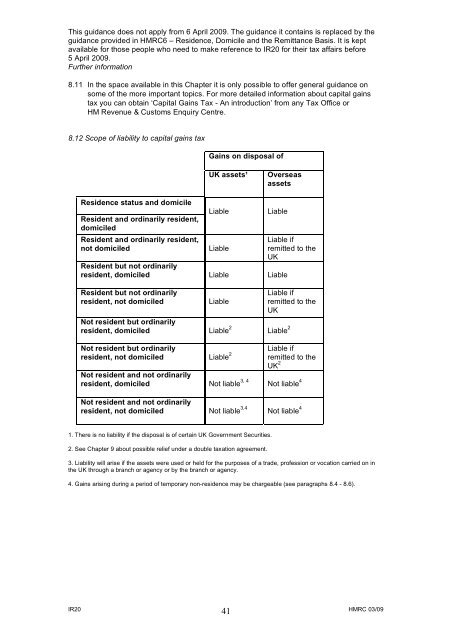

8.12 Scope of <strong>liability</strong> <strong>to</strong> capital ga<strong>in</strong>s <strong>tax</strong><br />

Residence status <strong>and</strong> domicile<br />

Resident <strong>and</strong> ord<strong>in</strong>arily resident,<br />

domiciled<br />

Resident <strong>and</strong> ord<strong>in</strong>arily resident,<br />

not domiciled<br />

Resident but not ord<strong>in</strong>arily<br />

resident, domiciled<br />

Resident but not ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Not resident but ord<strong>in</strong>arily<br />

resident, domiciled<br />

Not resident but ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Not resident <strong>and</strong> not ord<strong>in</strong>arily<br />

resident, domiciled<br />

Not resident <strong>and</strong> not ord<strong>in</strong>arily<br />

resident, not domiciled<br />

Ga<strong>in</strong>s on disposal of<br />

UK assets�<br />

Liable<br />

Liable<br />

Liable<br />

Liable<br />

Liable 2<br />

Liable 2<br />

3, 4<br />

Not liable<br />

Not liable 3,4<br />

1. There is no <strong>liability</strong> if <strong>the</strong> disposal is of certa<strong>in</strong> UK Government Securities.<br />

2. See Chapter 9 about possible relief under a double <strong>tax</strong>ation agreement.<br />

Overseas<br />

assets<br />

Liable<br />

Liable if<br />

remitted <strong>to</strong> <strong>the</strong><br />

UK<br />

Liable<br />

Liable if<br />

remitted <strong>to</strong> <strong>the</strong><br />

UK<br />

Liable 2<br />

Liable if<br />

remitted <strong>to</strong> <strong>the</strong><br />

UK 2<br />

Not liable 4<br />

Not liable 4<br />

3. Liability will arise if <strong>the</strong> assets were used or held for <strong>the</strong> purposes of a trade, profession or vocation carried on <strong>in</strong><br />

<strong>the</strong> UK through a branch or agency or by <strong>the</strong> branch or agency.<br />

4. Ga<strong>in</strong>s aris<strong>in</strong>g dur<strong>in</strong>g a period of temporary <strong>non</strong>-residence may be chargeable (see paragraphs 8.4 - 8.6).<br />

<strong>IR20</strong> 41<br />

HMRC 03/09