Equidad Fiscal en Brasil, Chile, Paraguay y ... - Sector Fiscalidad

Equidad Fiscal en Brasil, Chile, Paraguay y ... - Sector Fiscalidad

Equidad Fiscal en Brasil, Chile, Paraguay y ... - Sector Fiscalidad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

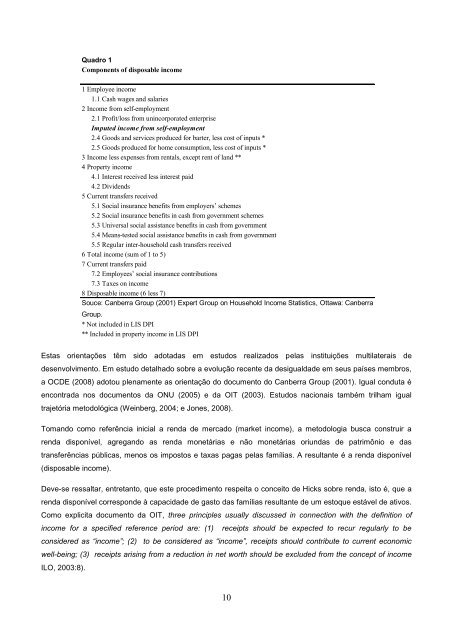

Quadro 1<br />

Compon<strong>en</strong>ts of disposable income<br />

1 Employee income<br />

1.1 Cash wages and salaries<br />

2 Income from self-employm<strong>en</strong>t<br />

2.1 Profit/loss from unincorporated <strong>en</strong>terprise<br />

Imputed income from self-employm<strong>en</strong>t<br />

2.4 Goods and services produced for barter, less cost of inputs *<br />

2.5 Goods produced for home consumption, less cost of inputs *<br />

3 Income less exp<strong>en</strong>ses from r<strong>en</strong>tals, except r<strong>en</strong>t of land **<br />

4 Property income<br />

4.1 Interest received less interest paid<br />

4.2 Divid<strong>en</strong>ds<br />

5 Curr<strong>en</strong>t transfers received<br />

5.1 Social insurance b<strong>en</strong>efits from employers’ schemes<br />

5.2 Social insurance b<strong>en</strong>efits in cash from governm<strong>en</strong>t schemes<br />

5.3 Universal social assistance b<strong>en</strong>efits in cash from governm<strong>en</strong>t<br />

5.4 Means-tested social assistance b<strong>en</strong>efits in cash from governm<strong>en</strong>t<br />

5.5 Regular inter-household cash transfers received<br />

6 Total income (sum of 1 to 5)<br />

7 Curr<strong>en</strong>t transfers paid<br />

7.2 Employees’ social insurance contributions<br />

7.3 Taxes on income<br />

8 Disposable income (6 less 7)<br />

Souce: Canberra Group (2001) Expert Group on Household Income Statistics, Ottawa: Canberra<br />

Group.<br />

* Not included in LIS DPI<br />

** Included in property income in LIS DPI<br />

Estas ori<strong>en</strong>tações têm sido adotadas em estudos realizados pelas instituições multilaterais de<br />

des<strong>en</strong>volvim<strong>en</strong>to. Em estudo detalhado sobre a evolução rec<strong>en</strong>te da desigualdade em seus países membros,<br />

a OCDE (2008) adotou pl<strong>en</strong>am<strong>en</strong>te as ori<strong>en</strong>tação do docum<strong>en</strong>to do Canberra Group (2001). Igual conduta é<br />

<strong>en</strong>contrada nos docum<strong>en</strong>tos da ONU (2005) e da OIT (2003). Estudos nacionais também trilham igual<br />

trajetória metodológica (Weinberg, 2004; e Jones, 2008).<br />

Tomando como referência inicial a r<strong>en</strong>da de mercado (market income), a metodologia busca construir a<br />

r<strong>en</strong>da disponível, agregando as r<strong>en</strong>da monetárias e não monetárias oriundas de patrimônio e das<br />

transferências públicas, m<strong>en</strong>os os impostos e taxas pagas pelas famílias. A resultante é a r<strong>en</strong>da disponível<br />

(disposable income).<br />

Deve-se ressaltar, <strong>en</strong>tretanto, que este procedim<strong>en</strong>to respeita o conceito de Hicks sobre r<strong>en</strong>da, isto é, que a<br />

r<strong>en</strong>da disponível corresponde à capacidade de gasto das famílias resultante de um estoque estável de ativos.<br />

Como explicita docum<strong>en</strong>to da OIT, three principles usually discussed in connection with the definition of<br />

income for a specified refer<strong>en</strong>ce period are: (1) receipts should be expected to recur regularly to be<br />

considered as “income”; (2) to be considered as “income”, receipts should contribute to curr<strong>en</strong>t economic<br />

well-being; (3) receipts arising from a reduction in net worth should be excluded from the concept of income<br />

ILO, 2003:8).<br />

10