La banca en México, 1994-2000 - economía mexicana Nueva ...

La banca en México, 1994-2000 - economía mexicana Nueva ...

La banca en México, 1994-2000 - economía mexicana Nueva ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

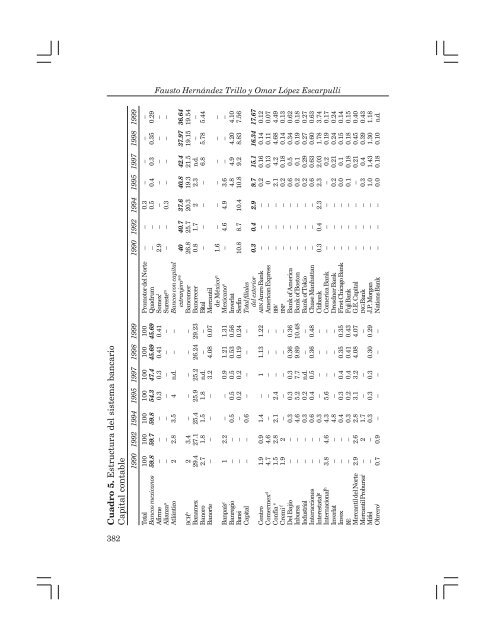

Fausto Hernández Trillo y Omar López EscarpulliCuadro 5. Estructura del sistema <strong>banca</strong>rioCapital contable1990 1992 <strong>1994</strong> 1995 1997 1998 1999 1990 1992 <strong>1994</strong> 1995 1997 1998 1999Total 100 100 100 100 100 100 100 Promotor del Norte – – 0.3 – – – –Bancos mexicanos 59.8 59.7 59.8 54.3 47.4 45.69 45.69 Quadrum – – 0.5 0.4 0.3 0.35 0.29Afirme – – – 0.3 0.3 0.41 0.41 Somex l 2.9 – – – – – –Alianza a – – – – – – – Sureste m – – 0.3 – – – –Atlántico 2 2.8 3.5 4 n.d. – – Bancos con capitalextranjero** 40 40.7 37.6 40.8 42.4 37.97 36.64BCH b 2 3.4 – – – – – Bancomer 26.8 25.7 20.3 19.3 21.5 19.15 19.54Banamex 29.4 27.1 25.4 25.9 25.2 26.24 29.23 Bancrecer 0.8 1.7 2 2.3 n.d. – –Banoro 2.7 1.8 1.5 1.8 n.d. – – Bital – – – – 6.8 5.78 5.44Banorte – – – – 3.2 4.08 0.07 Mercantilde <strong>México</strong> n 1.6 – – – – – –Banpaís c 1 2.2 – – 0.9 1.21 1.31 Mexicano o – 4.6 4.9 3.6 – – –Banregio – – 0.5 0.5 0.5 0.53 0.56 Inverlat 4.8 4.9 4.20 4.10Bansi – – – 0.2 0.2 0.19 0.24 Serfin 10.8 8.7 10.4 10.8 9.2 8.83 7.56Capital – – 0.6 – – – – Total filialesdel exterior 0.3 0.4 2.9 9.7 15.1 16.34 17.67C<strong>en</strong>tro 1.9 0.9 1.4 – 1 1.13 1.22 ABN Amro Bank – – – 0.2 0.16 0.14 0.12Comermex d 4.7 4.6 – – – – – American Express – – – 0 0.13 0.11 0.07Confía e 1.5 2.8 2.1 2.4 – – – BBV – – – 2.1 4.2 4.68 4.49Cremi f 1.9 2 – – – – – BNP – – – 0.2 0.18 0.14 0.13Del Bajío – – 0.3 0.3 0.3 0.36 0.36 Bank of America – – – 0.6 0.5 0.34 0.62Inbursa – – 4.6 5.2 7.7 9.89 10.48 Bank of Boston – – – 0.2 0.1 0.19 0.18Industrial – – 0.3 0.2 n.d. – – Bank of Tokio – – – 0.2 0.29 0.27 0.27Interacciones – – 0.6 0.4 0.5 0.36 0.48 Chase Manhattan – – – 0.6 0.63 0.60 0.63Interestatal g – – 0.3 – – – – Citibank 0.3 0.4 2.3 2.3 2.03 1.78 3.74Internacional h 3.8 4.6 4.3 5.6 – – – Comerica Bank – – – – 0.2 0.19 0.17Inverlat – – 4.8 – – – – Dresdner Bank – – – 0.2 0.21 0.24 0.24Invex – – 0.4 0.3 0.4 0.35 0.35 First Chicago Bank – – – 0.0 0.1 0.15 0.14IXE – – 0.3 0.2 0.4 0.41 0.43 Fuji Bank – – – 0.1 0.18 0.18 0.15Mercantil del Norte 2.9 2.6 2.8 3.1 3.2 4.08 4.07 G.E. Capital – – – – 0.21 0.45 0.40Mercantil Probursa i – 2 1.7 – – – ING Bank – – – 0.3 0.4 0.39 0.43Mifel – – 0.3 0.3 0.3 0.30 0.29 J.P. Morgan – – – 1.0 1.43 1.30 1.18Obrero j 0.7 0.9 – – – – – Nations Bank – – – 0.0 0.18 0.10 n.d.382