Organización de Multinacionales. Caso Banco de Santander

Organización de Multinacionales. Caso Banco de Santander

Organización de Multinacionales. Caso Banco de Santander

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

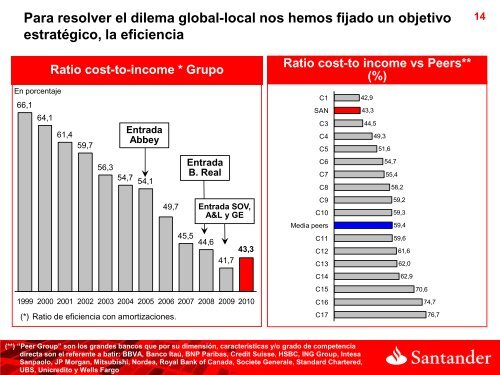

Para resolver el dilema global-local nos hemos fijado un objetivoestratégico, la eficiencia14En porcentaje66,164,1Ratio cost-to-income * Grupo61,459,756,3EntradaAbbey(*) Ratio <strong>de</strong> eficiencia con amortizaciones.EntradaB. Real54,7 54,149,7 Entrada SOV,A&L y GE45,5 44,643,341,71999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010Ratio cost-to income vs Peers**(%)C1SANC3C4C5C6C7C8C9C10Media peersC11C12C13C14C15C16C1742,943,344,549,351,654,755,458,259,259,359,459,661,662,062,970,674,776,7(**) “Peer Group” son los gran<strong>de</strong>s bancos que por su dimensión, características y/o grado <strong>de</strong> competenciadirecta son el referente a batir: BBVA, <strong>Banco</strong> Itaú, BNP Paribas, Credit Suisse, HSBC, ING Group, IntesaSanpaolo, JP Morgan, Mitsubishi, Nor<strong>de</strong>a, Royal Bank of Canada, Societe Generale, Standard Chartered,UBS, Unicredito y Wells Fargo