2010 Vol. 4 Num. 2 - GCG: Revista de Globalización, Competitividad ...

2010 Vol. 4 Num. 2 - GCG: Revista de Globalización, Competitividad ...

2010 Vol. 4 Num. 2 - GCG: Revista de Globalización, Competitividad ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

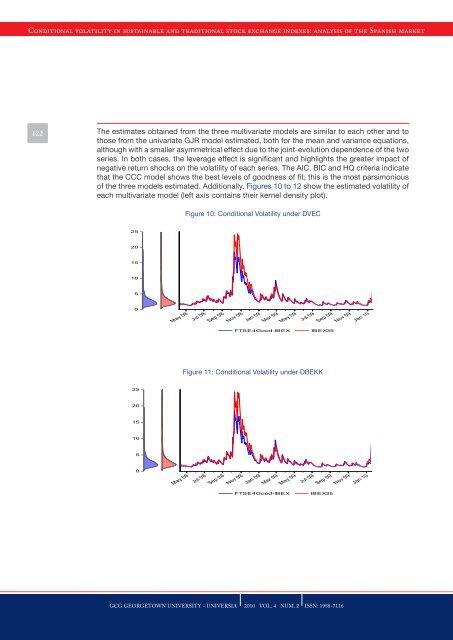

Conditional volatility in sustainable and traditional stock exchange in<strong>de</strong>xes: analysis of the Spanish market122 The estimates obtained from the three multivariate mo<strong>de</strong>ls are similar to each other and tothose from the univariate GJR mo<strong>de</strong>l estimated, both for the mean and variance equations,although with a smaller asymmetrical effect due to the joint-evolution <strong>de</strong>pen<strong>de</strong>nce of the twoseries. In both cases, the leverage effect is significant and highlights the greater impact ofnegative return shocks on the volatility of each series. The AIC, BIC and HQ criteria indicatethat the CCC mo<strong>de</strong>l shows the best levels of goodness of fit; this is the most parsimoniousof the three mo<strong>de</strong>ls estimated. Additionally, Figures 10 to 12 show the estimated volatility ofeach multivariate mo<strong>de</strong>l (left axis contains their kernel <strong>de</strong>nsity plot).Figure 10: Conditional <strong>Vol</strong>atility un<strong>de</strong>r DVEC2520151050May 08Jul 08Sep 08Nov 08Jan 09Mar 09May 09Jul 09Sep 09Nov 09Jan 10FTSE4Good-IBEXIBEX35Figure 11: Conditional <strong>Vol</strong>atility un<strong>de</strong>r DBEKK2520151050May 08Jul 08Sep 08Nov 08Jan 09Mar 09May 09Jul 09Sep 09Nov 09Jan 10FTSE4Good-IBEXIBEX35<strong>GCG</strong> GEORGETOWN UNIVERSITY - UNIVERSIA <strong>2010</strong> VOL. 4 NUM. 2 ISSN: 1988-7116