Demande de remboursement de l'impôt à la ... - Etat de Genève

Demande de remboursement de l'impôt à la ... - Etat de Genève

Demande de remboursement de l'impôt à la ... - Etat de Genève

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

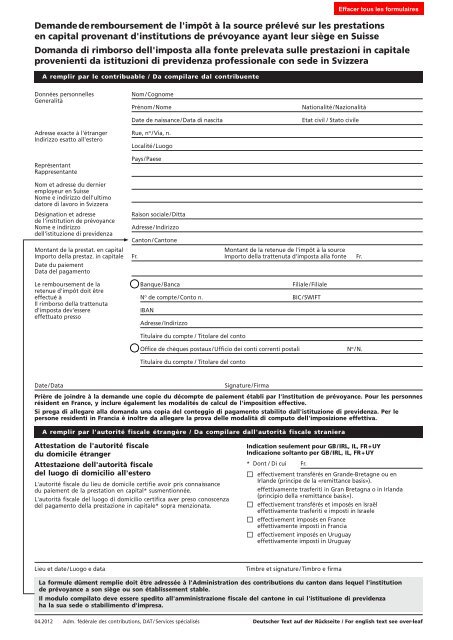

<strong>Deman<strong>de</strong></strong> <strong>de</strong> <strong>remboursement</strong> <strong>de</strong> l'impôt à <strong>la</strong> source prélevé sur les prestationsen capital provenant d'institutions <strong>de</strong> prévoyance ayant leur siège en SuisseDomanda di rimborso <strong>de</strong>ll'imposta al<strong>la</strong> fonte prelevata sulle prestazioni in capitaleprovenienti da istituzioni di previ<strong>de</strong>nza professionale con se<strong>de</strong> in SvizzeraA remplir par le contribuable / Da compi<strong>la</strong>re dal contribuenteDonnées personnellesGeneralitàNom / CognomePrénom / NomeDate <strong>de</strong> naissance / Data di nascitaNationalité / Nazionalità<strong>Etat</strong> civil / Stato civileAdresse exacte à l'étranger Rue, n o / Via, n.Indirizzo esatto all'esteroLocalité / LuogoReprésentantRappresentantePays / PaeseNom et adresse du <strong>de</strong>rnieremployeur en SuisseNome e indirizzo <strong>de</strong>ll'ultimodatore di <strong>la</strong>voro in SvizzeraDésignation et adresseRaison sociale / Ditta<strong>de</strong> l'institution <strong>de</strong> prévoyanceNome e indirizzoAdresse / Indirizzo<strong>de</strong>ll'istituzione di previ<strong>de</strong>nzaCanton / CantoneMontant <strong>de</strong> <strong>la</strong> prestat. en capitalMontant <strong>de</strong> <strong>la</strong> retenue <strong>de</strong> l'impôt à <strong>la</strong> sourceImporto <strong>de</strong>l<strong>la</strong> prestaz. in capitale Fr. Importo <strong>de</strong>l<strong>la</strong> trattenuta d'imposta al<strong>la</strong> fonte Fr.Date du paiementData <strong>de</strong>l pagamentoLe <strong>remboursement</strong> <strong>de</strong> <strong>la</strong>retenue d'impôt doit être Banque / Banca Filiale / Filialeeffectué à N o <strong>de</strong> compte / Conto n. BIC / SWIFTIl rimborso <strong>de</strong>l<strong>la</strong> trattenutad'imposta <strong>de</strong>v'essereIBANeffettuato pressoAdresse / IndirizzoTitu<strong>la</strong>ire du compte / Tito<strong>la</strong>re <strong>de</strong>l conto Office <strong>de</strong> chèques postaux / Ufficio <strong>de</strong>i conti correnti postali N o / N.Titu<strong>la</strong>ire du compte / Tito<strong>la</strong>re <strong>de</strong>l contoDate / DataSignature / FirmaPrière <strong>de</strong> joindre à <strong>la</strong> <strong>de</strong>man<strong>de</strong> une copie du décompte <strong>de</strong> paiement établi par l'institution <strong>de</strong> prévoyance. Pour les personnesrési<strong>de</strong>nt en France, y inclure également les modalités <strong>de</strong> calcul <strong>de</strong> l'imposition effective.Si prega di allegare al<strong>la</strong> domanda una copia <strong>de</strong>l conteggio di pagamento stabilito dall'istituzione di previ<strong>de</strong>nza. Per lepersone resi<strong>de</strong>nti in Francia è inoltre da allegare <strong>la</strong> prova <strong>de</strong>lle modalità di computo <strong>de</strong>ll'imposizione effettiva.A remplir par l'autorité fiscale étrangère / Da compi<strong>la</strong>re dall'autorità fiscale stranieraAttestation <strong>de</strong> l'autorité fiscaledu domicile étrangerAttestazione <strong>de</strong>ll'autorità fiscale<strong>de</strong>l luogo di domicilio all'esteroL'autorité fiscale du lieu <strong>de</strong> domicile certifie avoir pris connaissancedu paiement <strong>de</strong> <strong>la</strong> prestation en capital* susmentionnée.L'autorità fiscale <strong>de</strong>l luogo di domicilio certifica aver preso conoscenza<strong>de</strong>l pagamento <strong>de</strong>l<strong>la</strong> prestazione in capitale* sopra menzionata.Indication seulement pour GB / IRL, IL, FR + UYIndicazione soltanto per GB / IRL, IL, FR + UY* Dont / Di cui Fr. effectivement transférés en Gran<strong>de</strong>-Bretagne ou enIr<strong>la</strong>n<strong>de</strong> (principe <strong>de</strong> <strong>la</strong> «remittance basis»).effettivamente trasferiti in Gran Bretagna o in Ir<strong>la</strong>nda(principio <strong>de</strong>l<strong>la</strong> «remittance basis»). effectivement transférés et imposés en Israëleffettivamente trasferiti e imposti in Israele effectivement imposés en Franceeffettivamente imposti in Francia effectivement imposés en Uruguayeffettivamente imposti in UruguayLieu et date / Luogo e dataTimbre et signature / Timbro e firmaLa formule dûment remplie doit être adressée à l'Administration <strong>de</strong>s contributions du canton dans lequel l'institution<strong>de</strong> prévoyance a son siège ou son établissement stable.Il modulo compi<strong>la</strong>to <strong>de</strong>ve essere spedito all'amministrazione fiscale <strong>de</strong>l cantone in cui l'istituzione di previ<strong>de</strong>nzaha <strong>la</strong> sua se<strong>de</strong> o stabilimento d'impresa.04.2012 Adm. fédérale <strong>de</strong>s contributions, DAT / Services spécialisés Deutscher Text auf <strong>de</strong>r Rückseite / For english text see over-leaf

Antrag auf Rückerstattung <strong>de</strong>r Quellensteuer auf Kapitalleistungen vonVorsorgeeinrichtungen mit Sitz in <strong>de</strong>r SchweizC<strong>la</strong>im to refund the withholding tax on settlements in cash by pension fundswith registered office in Switzer<strong>la</strong>ndVom Steuerpflichtigen auszufüllen / To be filled in by the taxpayerPersonalienPersonalsGenaue Wohnadresseim Aus<strong>la</strong>ndExact foreign home addressVertreterRepresentative agentName / NameVorname / First nameGeburtsdatum / Date of birthStrasse, Nr. / Street, no.Ort / CityLand / CountryNationalität / NationalityZivilstand / Civil statusName und Adresse <strong>de</strong>s letztenArbeitgebers in <strong>de</strong>r SchweizName and address of the <strong>la</strong>stemployer in Switzer<strong>la</strong>ndName und AdresseFirma / Company<strong>de</strong>r VorsorgeeinrichtungDesignation and addressAdresse / Addressof the pension fundKanton / CantonHöhe <strong>de</strong>r KapitalleistungHöhe <strong>de</strong>s QuellensteuerabzugesAmount of settlement in cash Fr. Amount of tax withheld Fr.Datum <strong>de</strong>r AuszahlungDate of paymentRückerstattung <strong>de</strong>sSteuerabzuges soll erfolgen an Bank / Bank Filiale / BranchThe refund is to be Konto-Nr. / Acc. no. BIC / SWIFTtransferred toIBANAdresse / AddressInhaber <strong>de</strong>s Kontos / Acc. hol<strong>de</strong>r Post / Postal cheque account officeNr. / no.Inhaber <strong>de</strong>s Kontos / Acc. hol<strong>de</strong>rDatum / DateUnterschrift / SignatureDem Antrag ist eine Kopie <strong>de</strong>r Auszahlungsabrechnung <strong>de</strong>r Vorsorgeeinrichtung beizulegen. Für in Frankreich ansässigePersonen sind zusätzlich die Berechnungsmodalitäten <strong>de</strong>r tatsächlichen Besteuerung beizulegen.Please enclose with this c<strong>la</strong>im a copy of the advice of payment of the pension fund. For resi<strong>de</strong>nts of France, please furtherenclose the calcu<strong>la</strong>tion of the effective taxation.Von <strong>de</strong>r ausländischen Steuerbehör<strong>de</strong> auszufüllen / To be filled in by the foreign tax authorityBestätigung <strong>de</strong>r Steuerbehör<strong>de</strong><strong>de</strong>s ausländischen WohnortesCertification from the tax authorityof the foreign domicileDie Steuerbehör<strong>de</strong> <strong>de</strong>s Wohnortes bestätigt,von obiger Kapitalleistung* Kenntnis zu haben.The tax authority of the p<strong>la</strong>ce of resi<strong>de</strong>nce herewith certifiesto know about the above-mentioned settlement in cash*.Angabe nur für GB / IRL, IL, FR + UYInformation only for GB / IRL, IL, FR + UY* Davon / Of which Fr. effektiv nach Grossbritannien o<strong>de</strong>r Ir<strong>la</strong>nd transferiert(Prinzip <strong>de</strong>r «remittance basis»).effectively transferred to Great Britain or Ire<strong>la</strong>nd(principle «remittance basis»). effektiv nach Israel transferiert und dort besteuerteffectively transferred to, and taxed in Israel effektiv in Frankreich besteuerteffectively taxed in France effektiv in Uruguay besteuerteffectively taxed in UruguayOrt und Datum / P<strong>la</strong>ce and dateStempel und Unterschrift / Seal and signatureDas vollständig ausgefüllte Formu<strong>la</strong>r ist <strong>de</strong>r Steuerverwaltung jenes Kantons einzureichen, in <strong>de</strong>m die Vorsorgeeinrichtungihren Sitz bzw. Betriebsstätte hat.The duly completed form must be forwar<strong>de</strong>d to the tax authority of the canton in which the pension fund resp. its permanentestablishment has its registered office.04.2012 Eidg. Steuerverwaltung, DVS / Fachdienste Texte français au verso / Testo italiano a tergo