The Changing Structure of the Electric Power Industry 2000: An ... - EIA

The Changing Structure of the Electric Power Industry 2000: An ... - EIA

The Changing Structure of the Electric Power Industry 2000: An ... - EIA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

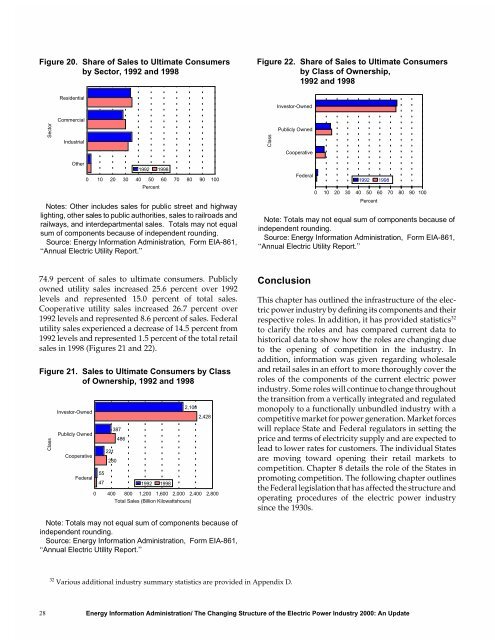

Figure 20. Share <strong>of</strong> Sales to Ultimate Consumers<br />

by Sector, 1992 and 1998<br />

28<br />

Sector<br />

Residential<br />

Commercial<br />

Industrial<br />

O<strong>the</strong>r<br />

1992 1998<br />

0 10 20 30 40 50<br />

Percent<br />

60 70 80 90 100<br />

Notes: O<strong>the</strong>r includes sales for public street and highway<br />

lighting, o<strong>the</strong>r sales to public authorities, sales to railroads and<br />

railways, and interdepartmental sales. Totals may not equal<br />

sum <strong>of</strong> components because <strong>of</strong> independent rounding.<br />

Source: Energy Information Administration, Form <strong>EIA</strong>-861,<br />

“<strong>An</strong>nual <strong>Electric</strong> Utility Report.”<br />

74.9 percent <strong>of</strong> sales to ultimate consumers. Publicly<br />

owned utility sales increased 25.6 percent over 1992<br />

levels and represented 15.0 percent <strong>of</strong> total sales.<br />

Cooperative utility sales increased 26.7 percent over<br />

1992 levels and represented 8.6 percent <strong>of</strong> sales. Federal<br />

utility sales experienced a decrease <strong>of</strong> 14.5 percent from<br />

1992 levels and represented 1.5 percent <strong>of</strong> <strong>the</strong> total retail<br />

sales in 1998 (Figures 21 and 22).<br />

Figure 21. Sales to Ultimate Consumers by Class<br />

<strong>of</strong> Ownership, 1992 and 1998<br />

Class<br />

Investor-Owned<br />

Publicly Owned<br />

Cooperative<br />

Federal<br />

55<br />

47<br />

221<br />

280<br />

387<br />

486<br />

1992 1998<br />

2,100<br />

2,428<br />

0 400 800 1,200 1,600 2,000 2,400 2,800<br />

Total Sales (Billion Kilowattshours)<br />

Note: Totals may not equal sum <strong>of</strong> components because <strong>of</strong><br />

independent rounding.<br />

Source: Energy Information Administration, Form <strong>EIA</strong>-861,<br />

“<strong>An</strong>nual <strong>Electric</strong> Utility Report.”<br />

32 Various additional industry summary statistics are provided in Appendix D.<br />

Figure 22. Share <strong>of</strong> Sales to Ultimate Consumers<br />

by Class <strong>of</strong> Ownership,<br />

1992 and 1998<br />

Investor-Owned<br />

Publicly Owned<br />

Cooperative<br />

Federal<br />

Energy Information Administration/ <strong>The</strong> <strong>Changing</strong> <strong>Structure</strong> <strong>of</strong> <strong>the</strong> <strong>Electric</strong> <strong>Power</strong> <strong>Industry</strong> <strong>2000</strong>: <strong>An</strong> Update<br />

Class<br />

1992 1998<br />

0 10 20 30 40 50 60 70 80 90 100<br />

Percent<br />

Note: Totals may not equal sum <strong>of</strong> components because <strong>of</strong><br />

independent rounding.<br />

Source: Energy Information Administration, Form <strong>EIA</strong>-861,<br />

“<strong>An</strong>nual <strong>Electric</strong> Utility Report.”<br />

Conclusion<br />

This chapter has outlined <strong>the</strong> infrastructure <strong>of</strong> <strong>the</strong> electric<br />

power industry by defining its components and <strong>the</strong>ir<br />

respective roles. In addition, it has provided statistics 32<br />

to clarify <strong>the</strong> roles and has compared current data to<br />

historical data to show how <strong>the</strong> roles are changing due<br />

to <strong>the</strong> opening <strong>of</strong> competition in <strong>the</strong> industry. In<br />

addition, information was given regarding wholesale<br />

and retail sales in an effort to more thoroughly cover <strong>the</strong><br />

roles <strong>of</strong> <strong>the</strong> components <strong>of</strong> <strong>the</strong> current electric power<br />

industry. Some roles will continue to change throughout<br />

<strong>the</strong> transition from a vertically integrated and regulated<br />

monopoly to a functionally unbundled industry with a<br />

competitive market for power generation. Market forces<br />

will replace State and Federal regulators in setting <strong>the</strong><br />

price and terms <strong>of</strong> electricity supply and are expected to<br />

lead to lower rates for customers. <strong>The</strong> individual States<br />

are moving toward opening <strong>the</strong>ir retail markets to<br />

competition. Chapter 8 details <strong>the</strong> role <strong>of</strong> <strong>the</strong> States in<br />

promoting competition. <strong>The</strong> following chapter outlines<br />

<strong>the</strong> Federal legislation that has affected <strong>the</strong> structure and<br />

operating procedures <strong>of</strong> <strong>the</strong> electric power industry<br />

since <strong>the</strong> 1930s.