The Changing Structure of the Electric Power Industry 2000: An ... - EIA

The Changing Structure of the Electric Power Industry 2000: An ... - EIA

The Changing Structure of the Electric Power Industry 2000: An ... - EIA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

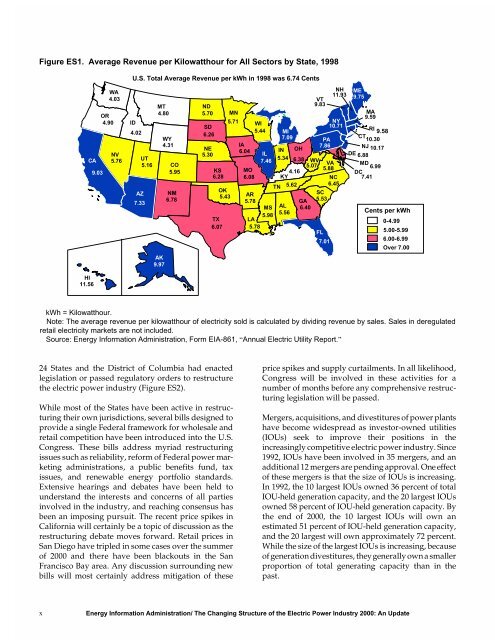

Figure ES1. Average Revenue per Kilowatthour for All Sectors by State, 1998<br />

x<br />

CA<br />

HI<br />

11.56<br />

9.03<br />

WA<br />

4.03<br />

OR<br />

4.90<br />

NV<br />

5.76<br />

U.S. Total Average Revenue per kWh in 1998 was 6.74 Cents<br />

ID<br />

4.02<br />

UT<br />

5.16<br />

AZ<br />

7.33<br />

MT<br />

4.80<br />

AK<br />

9.97<br />

WY<br />

4.31<br />

CO<br />

5.95<br />

NM<br />

6.78<br />

ND<br />

5.70<br />

SD<br />

6.26<br />

NE<br />

5.30<br />

KS<br />

6.28<br />

MN<br />

5.71 WI<br />

5.44<br />

IA<br />

6.04<br />

MO<br />

6.08<br />

11.93<br />

9.83<br />

MA<br />

9.59<br />

10.30<br />

IN OH<br />

10.17<br />

6.88<br />

5.34 6.38 WV<br />

5.07<br />

VA<br />

5.88<br />

6.99<br />

4.16<br />

KY<br />

OK<br />

5.43<br />

TX<br />

AR<br />

5.78<br />

LA<br />

5.62<br />

MS 6.40<br />

5.98<br />

5.56<br />

6.45<br />

5.53<br />

6.07 5.78<br />

FL<br />

7.01<br />

AL<br />

IL<br />

7.46<br />

NH ME<br />

VT<br />

9.75<br />

NY<br />

10.71<br />

MI<br />

RI<br />

9.58<br />

7.09<br />

CT<br />

PA<br />

7.86<br />

NJ<br />

DE<br />

MD<br />

DC<br />

NC 7.41<br />

TN<br />

GA<br />

SC<br />

Cents per kWh<br />

0-4.99<br />

5.00-5.99<br />

6.00-6.99<br />

Over 7.00<br />

kWh = Kilowatthour.<br />

Note: <strong>The</strong> average revenue per kilowatthour <strong>of</strong> electricity sold is calculated by dividing revenue by sales. Sales in deregulated<br />

retail electricity markets are not included.<br />

Source: Energy Information Administration, Form <strong>EIA</strong>-861, “<strong>An</strong>nual <strong>Electric</strong> Utility Report.”<br />

24 States and <strong>the</strong> District <strong>of</strong> Columbia had enacted<br />

legislation or passed regulatory orders to restructure<br />

<strong>the</strong> electric power industry (Figure ES2).<br />

While most <strong>of</strong> <strong>the</strong> States have been active in restructuring<br />

<strong>the</strong>ir own jurisdictions, several bills designed to<br />

provide a single Federal framework for wholesale and<br />

retail competition have been introduced into <strong>the</strong> U.S.<br />

Congress. <strong>The</strong>se bills address myriad restructuring<br />

issues such as reliability, reform <strong>of</strong> Federal power marketing<br />

administrations, a public benefits fund, tax<br />

issues, and renewable energy portfolio standards.<br />

Extensive hearings and debates have been held to<br />

understand <strong>the</strong> interests and concerns <strong>of</strong> all parties<br />

involved in <strong>the</strong> industry, and reaching consensus has<br />

been an imposing pursuit. <strong>The</strong> recent price spikes in<br />

California will certainly be a topic <strong>of</strong> discussion as <strong>the</strong><br />

restructuring debate moves forward. Retail prices in<br />

San Diego have tripled in some cases over <strong>the</strong> summer<br />

<strong>of</strong> <strong>2000</strong> and <strong>the</strong>re have been blackouts in <strong>the</strong> San<br />

Francisco Bay area. <strong>An</strong>y discussion surrounding new<br />

bills will most certainly address mitigation <strong>of</strong> <strong>the</strong>se<br />

price spikes and supply curtailments. In all likelihood,<br />

Congress will be involved in <strong>the</strong>se activities for a<br />

number <strong>of</strong> months before any comprehensive restructuring<br />

legislation will be passed.<br />

Mergers, acquisitions, and divestitures <strong>of</strong> power plants<br />

have become widespread as investor-owned utilities<br />

(IOUs) seek to improve <strong>the</strong>ir positions in <strong>the</strong><br />

increasingly competitive electric power industry. Since<br />

1992, IOUs have been involved in 35 mergers, and an<br />

additional 12 mergers are pending approval. One effect<br />

<strong>of</strong> <strong>the</strong>se mergers is that <strong>the</strong> size <strong>of</strong> IOUs is increasing.<br />

In 1992, <strong>the</strong> 10 largest IOUs owned 36 percent <strong>of</strong> total<br />

IOU-held generation capacity, and <strong>the</strong> 20 largest IOUs<br />

owned 58 percent <strong>of</strong> IOU-held generation capacity. By<br />

<strong>the</strong> end <strong>of</strong> <strong>2000</strong>, <strong>the</strong> 10 largest IOUs will own an<br />

estimated 51 percent <strong>of</strong> IOU-held generation capacity,<br />

and <strong>the</strong> 20 largest will own approximately 72 percent.<br />

While <strong>the</strong> size <strong>of</strong> <strong>the</strong> largest IOUs is increasing, because<br />

<strong>of</strong> generation divestitures, <strong>the</strong>y generally own a smaller<br />

proportion <strong>of</strong> total generating capacity than in <strong>the</strong><br />

past.<br />

Energy Information Administration/ <strong>The</strong> <strong>Changing</strong> <strong>Structure</strong> <strong>of</strong> <strong>the</strong> <strong>Electric</strong> <strong>Power</strong> <strong>Industry</strong> <strong>2000</strong>: <strong>An</strong> Update