The Changing Structure of the Electric Power Industry 2000: An ... - EIA

The Changing Structure of the Electric Power Industry 2000: An ... - EIA

The Changing Structure of the Electric Power Industry 2000: An ... - EIA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

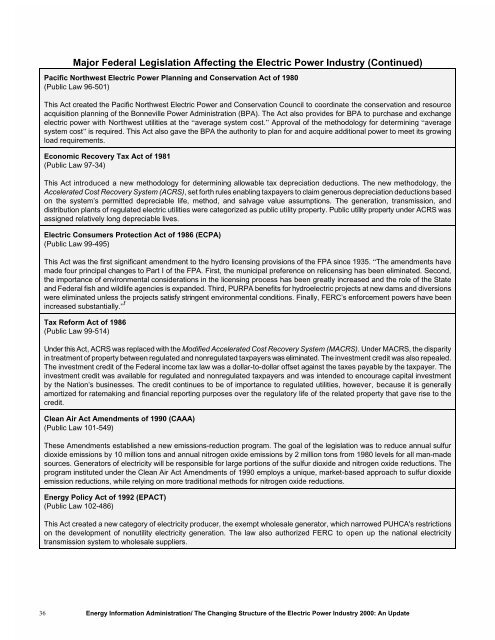

Major Federal Legislation Affecting <strong>the</strong> <strong>Electric</strong> <strong>Power</strong> <strong>Industry</strong> (Continued)<br />

Pacific Northwest <strong>Electric</strong> <strong>Power</strong> Planning and Conservation Act <strong>of</strong> 1980<br />

(Public Law 96-501)<br />

This Act created <strong>the</strong> Pacific Northwest <strong>Electric</strong> <strong>Power</strong> and Conservation Council to coordinate <strong>the</strong> conservation and resource<br />

acquisition planning <strong>of</strong> <strong>the</strong> Bonneville <strong>Power</strong> Administration (BPA). <strong>The</strong> Act also provides for BPA to purchase and exchange<br />

electric power with Northwest utilities at <strong>the</strong> “average system cost.” Approval <strong>of</strong> <strong>the</strong> methodology for determining “average<br />

system cost” is required. This Act also gave <strong>the</strong> BPA <strong>the</strong> authority to plan for and acquire additional power to meet its growing<br />

load requirements.<br />

Economic Recovery Tax Act <strong>of</strong> 1981<br />

(Public Law 97-34)<br />

This Act introduced a new methodology for determining allowable tax depreciation deductions. <strong>The</strong> new methodology, <strong>the</strong><br />

Accelerated Cost Recovery System (ACRS), set forth rules enabling taxpayers to claim generous depreciation deductions based<br />

on <strong>the</strong> system’s permitted depreciable life, method, and salvage value assumptions. <strong>The</strong> generation, transmission, and<br />

distribution plants <strong>of</strong> regulated electric utilities were categorized as public utility property. Public utility property under ACRS was<br />

assigned relatively long depreciable lives.<br />

<strong>Electric</strong> Consumers Protection Act <strong>of</strong> 1986 (ECPA)<br />

(Public Law 99-495)<br />

This Act was <strong>the</strong> first significant amendment to <strong>the</strong> hydro licensing provisions <strong>of</strong> <strong>the</strong> FPA since 1935. “<strong>The</strong> amendments have<br />

made four principal changes to Part I <strong>of</strong> <strong>the</strong> FPA. First, <strong>the</strong> municipal preference on relicensing has been eliminated. Second,<br />

<strong>the</strong> importance <strong>of</strong> environmental considerations in <strong>the</strong> licensing process has been greatly increased and <strong>the</strong> role <strong>of</strong> <strong>the</strong> State<br />

and Federal fish and wildlife agencies is expanded. Third, PURPA benefits for hydroelectric projects at new dams and diversions<br />

were eliminated unless <strong>the</strong> projects satisfy stringent environmental conditions. Finally, FERC’s enforcement powers have been<br />

increased substantially.” f<br />

Tax Reform Act <strong>of</strong> 1986<br />

(Public Law 99-514)<br />

Under this Act, ACRS was replaced with <strong>the</strong> Modified Accelerated Cost Recovery System (MACRS). Under MACRS, <strong>the</strong> disparity<br />

in treatment <strong>of</strong> property between regulated and nonregulated taxpayers was eliminated. <strong>The</strong> investment credit was also repealed.<br />

<strong>The</strong> investment credit <strong>of</strong> <strong>the</strong> Federal income tax law was a dollar-to-dollar <strong>of</strong>fset against <strong>the</strong> taxes payable by <strong>the</strong> taxpayer. <strong>The</strong><br />

investment credit was available for regulated and nonregulated taxpayers and was intended to encourage capital investment<br />

by <strong>the</strong> Nation’s businesses. <strong>The</strong> credit continues to be <strong>of</strong> importance to regulated utilities, however, because it is generally<br />

amortized for ratemaking and financial reporting purposes over <strong>the</strong> regulatory life <strong>of</strong> <strong>the</strong> related property that gave rise to <strong>the</strong><br />

credit.<br />

Clean Air Act Amendments <strong>of</strong> 1990 (CAAA)<br />

(Public Law 101-549)<br />

<strong>The</strong>se Amendments established a new emissions-reduction program. <strong>The</strong> goal <strong>of</strong> <strong>the</strong> legislation was to reduce annual sulfur<br />

dioxide emissions by 10 million tons and annual nitrogen oxide emissions by 2 million tons from 1980 levels for all man-made<br />

sources. Generators <strong>of</strong> electricity will be responsible for large portions <strong>of</strong> <strong>the</strong> sulfur dioxide and nitrogen oxide reductions. <strong>The</strong><br />

program instituted under <strong>the</strong> Clean Air Act Amendments <strong>of</strong> 1990 employs a unique, market-based approach to sulfur dioxide<br />

emission reductions, while relying on more traditional methods for nitrogen oxide reductions.<br />

Energy Policy Act <strong>of</strong> 1992 (EPACT)<br />

(Public Law 102-486)<br />

This Act created a new category <strong>of</strong> electricity producer, <strong>the</strong> exempt wholesale generator, which narrowed PUHCA's restrictions<br />

on <strong>the</strong> development <strong>of</strong> nonutility electricity generation. <strong>The</strong> law also authorized FERC to open up <strong>the</strong> national electricity<br />

transmission system to wholesale suppliers.<br />

36<br />

Energy Information Administration/ <strong>The</strong> <strong>Changing</strong> <strong>Structure</strong> <strong>of</strong> <strong>the</strong> <strong>Electric</strong> <strong>Power</strong> <strong>Industry</strong> <strong>2000</strong>: <strong>An</strong> Update