PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98<br />

Financial RepoRt ValoRa 2009<br />

noteS to tHe conSoliDateD<br />

Financial StateMentS<br />

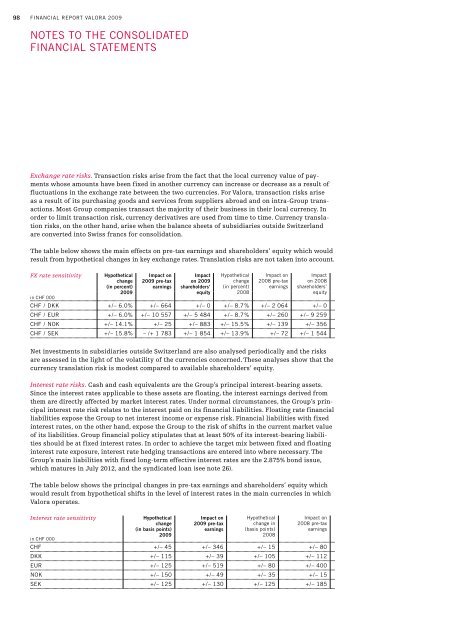

Exchange rate risks. Transaction risks arise from the fact that the local currency value of payments<br />

whose amounts have been fixed in another currency can increase or decrease as a result of<br />

fluctuations in the exchange rate between the two currencies. For <strong>Valora</strong>, transaction risks arise<br />

as a result of its purchasing goods and services from suppliers abroad and on intra-Group transactions.<br />

Most Group companies transact the majority of their business in their local currency. In<br />

order to limit transaction risk, currency derivatives are used from time to time. Currency translation<br />

risks, on the other hand, arise when the balance sheets of subsidiaries outside Switzerland<br />

are converted into Swiss francs for consolidation.<br />

The table below shows the main effects on pre-tax earnings and shareholders’ equity which would<br />

result from hypothetical changes in key exchange rates. Translation risks are not taken into account.<br />

FX rate sensitivity Hypothetical<br />

change<br />

(in percent)<br />

2009<br />

in cHF 000<br />

Impact on<br />

2009 pre-tax<br />

earnings<br />

Impact<br />

on 2009<br />

shareholders’<br />

equity<br />

Hypothetical<br />

change<br />

(in percent)<br />

2008<br />

impact on<br />

2008 pre-tax<br />

earnings<br />

impact<br />

on 2008<br />

shareholders’<br />

equity<br />

cHF / DKK + / – 6.0% + / – 664 + / – 0 + / – 8.7 % + / – 2 064 + / – 0<br />

cHF / eUR + / – 6.0% + / – 10 557 + / – 5 484 + / – 8.7 % + / – 260 + / – 9 259<br />

cHF / noK + / – 14.1% + / – 25 + / – 883 + / – 15.5 % + / – 139 + / – 356<br />

cHF / SeK + / – 15.8% – / + 1 783 + / – 1 854 + / – 13.9 % + / – 72 + / – 1 544<br />

Net investments in subsidiaries outside Switzerland are also analysed periodically and the risks<br />

are assessed in the light of the volatility of the currencies concerned. These analyses show that the<br />

currency translation risk is modest compared to available shareholders’ equity.<br />

Interest rate risks. Cash and cash equivalents are the Group’s principal interest-bearing assets.<br />

Since the interest rates applicable to these assets are floating, the interest earnings derived from<br />

them are directly affected by market interest rates. Under normal circumstances, the Group’s principal<br />

interest rate risk relates to the interest paid on its financial liabilities. Floating rate financial<br />

liabilities expose the Group to net interest income or expense risk. Financial liabilities with fixed<br />

interest rates, on the other hand, expose the Group to the risk of shifts in the current market value<br />

of its liabilities. Group financial policy stipulates that at least 50% of its interest-bearing liabilities<br />

should be at fixed interest rates. In order to achieve the target mix between fixed and floating<br />

interest rate exposure, interest rate hedging transactions are entered into where necessary. The<br />

Group’s main liabilities with fixed long-term effective interest rates are the 2.875% bond issue,<br />

which matures in July 2012, and the syndicated loan (see note 26).<br />

The table below shows the principal changes in pre-tax earnings and shareholders’ equity which<br />

would result from hypothetical shifts in the level of interest rates in the main currencies in which<br />

<strong>Valora</strong> operates.<br />

Interest rate sensitivity Hypothetical<br />

change<br />

(in basis points)<br />

2009<br />

in cHF 000<br />

Impact on<br />

2009 pre-tax<br />

earnings<br />

Hypothetical<br />

change in<br />

(basis points)<br />

2008<br />

impact on<br />

2008 pre-tax<br />

earnings<br />

cHF + / – 45 + / – 346 + / – 15 + / – 80<br />

DKK + / – 115 + / – 39 + / – 105 + / – 112<br />

eUR + / – 125 + / – 519 + / – 80 + / – 400<br />

noK + / – 150 + / – 49 + / – 35 + / – 15<br />

SeK + / – 125 + / – 130 + / – 125 + / – 185