PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial RepoRt ValoRa 2009<br />

notEs to tHE consolIdatEd fInancIal statEmEnts<br />

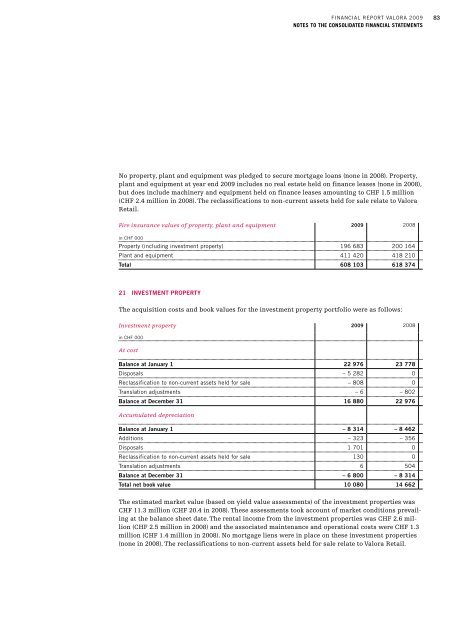

No property, plant and equipment was pledged to secure mortgage loans (none in 2008). Property,<br />

plant and equipment at year end 2009 includes no real estate held on finance leases (none in 2008),<br />

but does include machinery and equipment held on finance leases amounting to CHF 1.5 million<br />

(CHF 2.4 million in 2008). The reclassifications to non-current assets held for sale relate to <strong>Valora</strong><br />

Retail.<br />

Fire insurance values of property, plant and equipment 2009 2008<br />

in cHF 000<br />

property (including investment property) 196 683 200 164<br />

plant and equipment 411 420 418 210<br />

Total 608 103 618 374<br />

21 INVEsTMENT ProPErTY<br />

The acquisition costs and book values for the investment property portfolio were as follows:<br />

Investment property 2009 2008<br />

in cHF 000<br />

At cost<br />

Balance at January 1 22 976 23 778<br />

Disposals – 5 282 0<br />

Reclassification to non-current assets held for sale – 808 0<br />

translation adjustments – 6 – 802<br />

Balance at december 31 16 880 22 976<br />

Accumulated depreciation<br />

Balance at January 1 – 8 314 – 8 462<br />

additions – 323 – 356<br />

Disposals 1 701 0<br />

Reclassification to non-current assets held for sale 130 0<br />

translation adjustments 6 504<br />

Balance at december 31 – 6 800 – 8 314<br />

Total net book value 10 080 14 662<br />

The estimated market value (based on yield value assessments) of the investment properties was<br />

CHF 11.3 million (CHF 20.4 in 2008). These assessments took account of market conditions prevailing<br />

at the balance sheet date. The rental income from the investment properties was CHF 2.6 million<br />

(CHF 2.5 million in 2008) and the associated maintenance and operational costs were CHF 1.3<br />

million (CHF 1.4 million in 2008). No mortgage liens were in place on these investment properties<br />

(none in 2008). The reclassifications to non-current assets held for sale relate to <strong>Valora</strong> Retail.<br />

83