PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

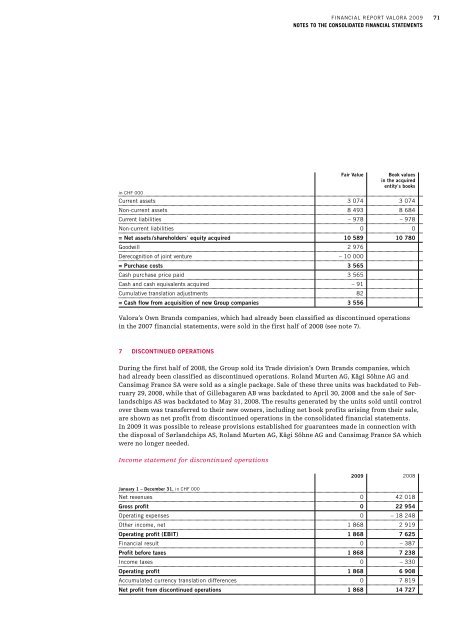

in cHF 000<br />

Financial RepoRt ValoRa 2009<br />

notEs to tHE consolIdatEd fInancIal statEmEnts<br />

Fair Value Book values<br />

in the acquired<br />

entity’s books<br />

current assets 3 074 3 074<br />

non-current assets 8 493 8 684<br />

current liabilities – 978 – 978<br />

non-current liabilities 0 0<br />

= Net assets /shareholders’ equity acquired 10 589 10 780<br />

Goodwill 2 976<br />

Derecognition of joint venture – 10 000<br />

= Purchase costs 3 565<br />

cash purchase price paid 3 565<br />

cash and cash equivalents acquired – 91<br />

cumulative translation adjustments 82<br />

= Cash flow from acquisition of new Group companies 3 556<br />

<strong>Valora</strong>’s Own Brands companies, which had already been classified as discontinued operations<br />

in the 2007 financial statements, were sold in the first half of 2008 (see note 7).<br />

7 dIsCoNTINUEd oPErATIoNs<br />

During the first half of 2008, the Group sold its Trade division’s Own Brands companies, which<br />

had already been classified as discontinued operations. Roland Murten AG, Kägi Söhne AG and<br />

Cansimag France SA were sold as a single package. Sale of these three units was backdated to February<br />

29, 2008, while that of Gillebagaren AB was backdated to April 30, 2008 and the sale of Sørlandschips<br />

AS was backdated to May 31, 2008. The results generated by the units sold until control<br />

over them was transferred to their new owners, including net book profits arising from their sale,<br />

are shown as net profit from discontinued operations in the consolidated financial statements.<br />

In 2009 it was possible to release provisions established for guarantees made in connection with<br />

the disposal of Sørlandchips AS, Roland Murten AG, Kägi Söhne AG and Cansimag France SA which<br />

were no longer needed.<br />

Income statement for discontinued operations<br />

January 1 – december 31, in cHF 000<br />

2009 2008<br />

net revenues 0 42 018<br />

Gross profit 0 22 954<br />

operating expenses 0 – 18 248<br />

other income, net 1 868 2 919<br />

operating profit (EBIT) 1 868 7 625<br />

Financial result 0 – 387<br />

Profit before taxes 1 868 7 238<br />

income taxes 0 – 330<br />

operating profit 1 868 6 908<br />

accumulated currency translation differences 0 7 819<br />

Net profit from discontinued operations 1 868 14 727<br />

71