PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial RepoRt ValoRa 2009<br />

notEs to tHE consolIdatEd fInancIal statEmEnts<br />

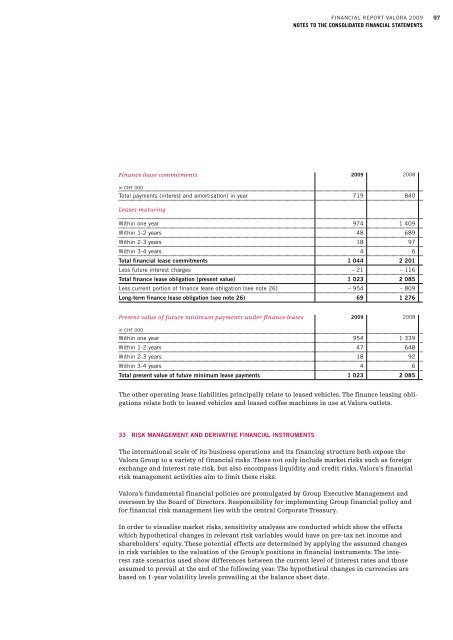

Finance lease commitments 2009 2008<br />

in cHF 000<br />

total payments (interest and amortisation) in year 719 840<br />

Leases maturing<br />

Within one year 974 1 409<br />

Within 1-2 years 48 689<br />

Within 2-3 years 18 97<br />

Within 3-4 years 4 6<br />

Total financial lease commitments 1 044 2 201<br />

less future interest charges – 21 – 116<br />

Total finance lease obligation (present value) 1 023 2 085<br />

less current portion of finance lease obligation (see note 26) – 954 – 809<br />

long-term finance lease obligation (see note 26) 69 1 276<br />

Present value of future minimum payments under finance leases 2009 2008<br />

in cHF 000<br />

Within one year 954 1 339<br />

Within 1-2 years 47 648<br />

Within 2-3 years 18 92<br />

Within 3-4 years 4 6<br />

Total present value of future minimum lease payments 1 023 2 085<br />

The other operating lease liabilities principally relate to leased vehicles. The finance leasing obligations<br />

relate both to leased vehicles and leased coffee machines in use at <strong>Valora</strong> outlets.<br />

33 rIsK MANAGEMENT ANd dErIVATIVE FINANCIAl INsTrUMENTs<br />

The international scale of its business operations and its financing structure both expose the<br />

<strong>Valora</strong> Group to a variety of financial risks. These not only include market risks such as foreign<br />

exchange and interest rate risk, but also encompass liquidity and credit risks. <strong>Valora</strong>’s financial<br />

risk management activities aim to limit these risks.<br />

<strong>Valora</strong>’s fundamental financial policies are promulgated by Group Executive Management and<br />

overseen by the Board of Directors. Responsibility for implementing Group financial policy and<br />

for financial risk management lies with the central Corporate Treasury.<br />

In order to visualise market risks, sensitivity analyses are conducted which show the effects<br />

which hypothetical changes in relevant risk variables would have on pre-tax net income and<br />

shareholders’ equity. These potential effects are determined by applying the assumed changes<br />

in risk variables to the valuation of the Group’s positions in financial instruments. The interest<br />

rate scenarios used show differences between the current level of interest rates and those<br />

assumed to prevail at the end of the following year. The hypothetical changes in currencies are<br />

based on 1-year volatility levels prevailing at the balance sheet date.<br />

97