PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

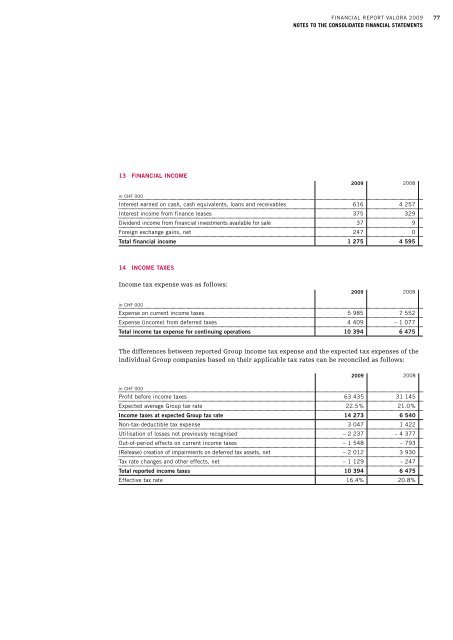

13 FINANCIAl INCoME<br />

in cHF 000<br />

Financial RepoRt ValoRa 2009<br />

notEs to tHE consolIdatEd fInancIal statEmEnts<br />

2009 2008<br />

interest earned on cash, cash equivalents, loans and receivables 616 4 257<br />

interest income from finance leases 375 329<br />

Dividend income from financial investments available for sale 37 9<br />

Foreign exchange gains, net 247 0<br />

Total financial income 1 275 4 595<br />

14 INCoME TAxEs<br />

Income tax expense was as follows:<br />

in cHF 000<br />

2009 2008<br />

expense on current income taxes 5 985 7 552<br />

expense (income) from deferred taxes 4 409 – 1 077<br />

Total income tax expense for continuing operations 10 394 6 475<br />

The differences between reported Group income tax expense and the expected tax expenses of the<br />

individual Group companies based on their applicable tax rates can be reconciled as follows:<br />

in cHF 000<br />

2009 2008<br />

profit before income taxes 63 435 31 145<br />

expected average Group tax rate 22.5 % 21.0 %<br />

Income taxes at expected Group tax rate 14 273 6 540<br />

non-tax-deductible tax expense 3 047 1 422<br />

Utilisation of losses not previously recognised – 2 237 – 4 377<br />

out-of-period effects on current income taxes – 1 548 – 793<br />

(Release) creation of impairments on deferred tax assets, net – 2 012 3 930<br />

tax rate changes and other effects, net – 1 129 – 247<br />

Total reported income taxes 10 394 6 475<br />

effective tax rate 16.4% 20.8%<br />

77