PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

PDF (3.6 MB) - Valora

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

104<br />

Financial RepoRt ValoRa 2009<br />

noteS to tHe conSoliDateD<br />

Financial StateMentS<br />

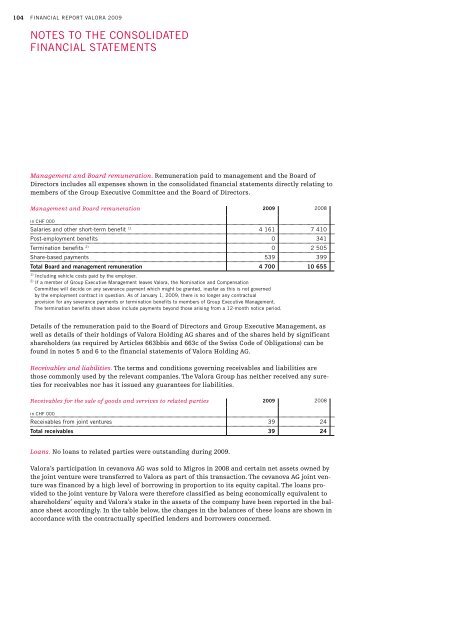

Management and Board remuneration. Remuneration paid to management and the Board of<br />

Directors includes all expenses shown in the consolidated financial statements directly relating to<br />

members of the Group Executive Committee and the Board of Directors.<br />

Management and Board remuneration 2009 2008<br />

in cHF 000<br />

Salaries and other short-term benefit 1) 4 161 7 410<br />

post-employment benefits 0 341<br />

termination benefits 2) 0 2 505<br />

Share-based payments 539 399<br />

Total Board and management remuneration 4 700 10 655<br />

1) including vehicle costs paid by the employer.<br />

2) if a member of Group executive Management leaves <strong>Valora</strong>, the nomination and compensation<br />

committee will decide on any severance payment which might be granted, inasfar as this is not governed<br />

by the employment contract in question. as of January 1, 2009, there is no longer any contractual<br />

provision for any severance payments or termination benefits to members of Group executive Management.<br />

the termination benefits shown above include payments beyond those arising from a 12-month notice period.<br />

Details of the remuneration paid to the Board of Directors and Group Executive Management, as<br />

well as details of their holdings of <strong>Valora</strong> Holding AG shares and of the shares held by significant<br />

shareholders (as required by Articles 663bbis and 663c of the Swiss Code of Obligations) can be<br />

found in notes 5 and 6 to the financial statements of <strong>Valora</strong> Holding AG.<br />

Receivables and liabilities. The terms and conditions governing receivables and liabilities are<br />

those commonly used by the relevant companies. The <strong>Valora</strong> Group has neither received any sureties<br />

for receivables nor has it issued any guarantees for liabilities.<br />

Receivables for the sale of goods and services to related parties 2009 2008<br />

in cHF 000<br />

Receivables from joint ventures 39 24<br />

Total receivables 39 24<br />

Loans. No loans to related parties were outstanding during 2009.<br />

<strong>Valora</strong>’s participation in cevanova AG was sold to Migros in 2008 and certain net assets owned by<br />

the joint venture were transferred to <strong>Valora</strong> as part of this transaction. The cevanova AG joint venture<br />

was financed by a high level of borrowing in proportion to its equity capital. The loans provided<br />

to the joint venture by <strong>Valora</strong> were therefore classified as being economically equivalent to<br />

shareholders’ equity and <strong>Valora</strong>’s stake in the assets of the company have been reported in the balance<br />

sheet accordingly. In the table below, the changes in the balances of these loans are shown in<br />

accordance with the contractually specified lenders and borrowers concerned.