BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This “what-will-they-do-with-the-money” factor must always be evaluated along with the “what-do-we-have-now” calculation<br />

in order for us, or anybody, to arrive at a sensible estimate of a company’s intrinsic value. That’s because an outside investor stands<br />

by helplessly as management reinvests his share of the company’s earnings. If a CEO can be expected to do this job well, the<br />

reinvestment prospects add to the company’s current value; if the CEO’s talents or motives are suspect, today’s value must be<br />

discounted. The difference in outcome can be huge. A dollar of then-value in the hands of Sears Roebuck’s or Montgomery Ward’s<br />

CEOs in the late 1960s had a far different destiny than did a dollar entrusted to Sam Walton.<br />

General<br />

************<br />

<strong>BERKSHIRE</strong> <strong>HATHAWAY</strong> INC.<br />

COMMON STOCK<br />

Berkshire has two classes of common stock designated Class A common stock and Class B common stock. Each share of<br />

Class A common stock is convertible, at the option of the holder, into 1,500 shares of Class B common stock. Shares of Class B<br />

common stock are not convertible into shares of Class A common stock.<br />

Stock Transfer Agent<br />

Wells Fargo Bank, N.A., P. O. Box 64854, St. Paul, MN 55164-0854 serves as Transfer Agent and Registrar for the Company’s<br />

common stock. Correspondence may be directed to Wells Fargo at the address indicated or at wellsfargo.com/shareownerservices.<br />

Telephone inquiries should be directed to the Shareowner Relations Department at 1-877-602-7411 between 7:00 A.M. and 7:00 P.M.<br />

Central Time. Certificates for re-issue or transfer should be directed to the Transfer Department at the address indicated.<br />

Shareholders of record wishing to convert Class A common stock into Class B common stock may contact Wells Fargo in<br />

writing. Along with the underlying stock certificate, shareholders should provide Wells Fargo with specific written instructions<br />

regarding the number of shares to be converted and the manner in which the Class B shares are to be registered. We recommend that<br />

you use certified or registered mail when delivering the stock certificates and written instructions.<br />

If Class A shares are held in “street name,” shareholders wishing to convert all or a portion of their holding should contact their<br />

broker or bank nominee. It will be necessary for the nominee to make the request for conversion.<br />

Shareholders<br />

Berkshire had approximately 3,200 record holders of its Class A common stock and 18,400 record holders of its Class B<br />

common stock at February 15, 2013. Record owners included nominees holding at least 465,000 shares of Class A common stock and<br />

1,120,000,000 shares of Class B common stock on behalf of beneficial-but-not-of-record owners.<br />

Price Range of Common Stock<br />

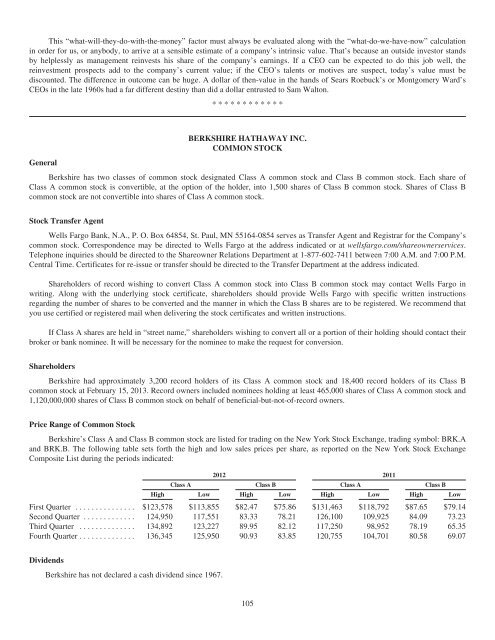

Berkshire’s Class A and Class B common stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A<br />

and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange<br />

Composite List during the periods indicated:<br />

2012 2011<br />

Class A Class B Class A Class B<br />

High Low High Low High Low High Low<br />

First Quarter ............... $123,578 $113,855 $82.47 $75.86 $131,463 $118,792 $87.65 $79.14<br />

Second Quarter ............. 124,950 117,551 83.33 78.21 126,100 109,925 84.09 73.23<br />

Third Quarter .............. 134,892 123,227 89.95 82.12 117,250 98,952 78.19 65.35<br />

Fourth Quarter .............. 136,345 125,950 90.93 83.85 120,755 104,701 80.58 69.07<br />

Dividends<br />

Berkshire has not declared a cash dividend since 1967.<br />

105