BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

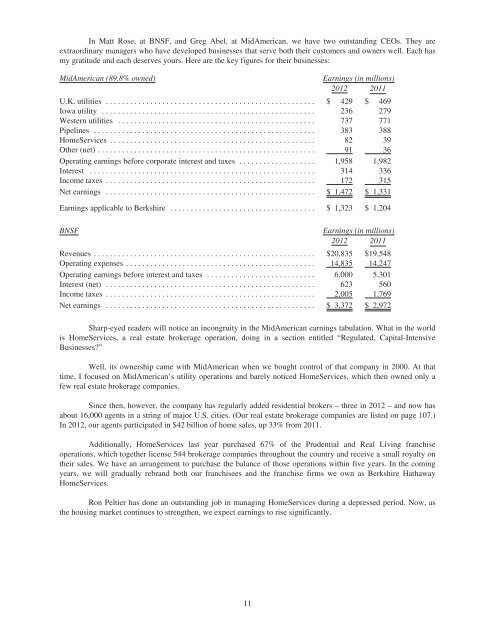

In Matt Rose, at BNSF, and Greg Abel, at MidAmerican, we have two outstanding CEOs. They are<br />

extraordinary managers who have developed businesses that serve both their customers and owners well. Each has<br />

my gratitude and each deserves yours. Here are the key figures for their businesses:<br />

MidAmerican (89.8% owned) Earnings (in millions)<br />

2012 2011<br />

U.K. utilities .................................................... $ 429 $ 469<br />

Iowa utility ..................................................... 236 279<br />

Western utilities ................................................. 737 771<br />

Pipelines ....................................................... 383 388<br />

HomeServices ................................................... 82 39<br />

Other (net) ...................................................... 91 36<br />

Operating earnings before corporate interest and taxes ................... 1,958 1,982<br />

Interest ........................................................ 314 336<br />

Income taxes .................................................... 172 315<br />

Net earnings .................................................... $ 1,472 $ 1,331<br />

Earnings applicable to Berkshire .................................... $ 1,323 $ 1,204<br />

BNSF Earnings (in millions)<br />

2012 2011<br />

Revenues ....................................................... $20,835 $19,548<br />

Operating expenses ............................................... 14,835 14,247<br />

Operating earnings before interest and taxes ........................... 6,000 5,301<br />

Interest (net) .................................................... 623 560<br />

Income taxes .................................................... 2,005 1,769<br />

Net earnings .................................................... $ 3,372 $ 2,972<br />

Sharp-eyed readers will notice an incongruity in the MidAmerican earnings tabulation. What in the world<br />

is HomeServices, a real estate brokerage operation, doing in a section entitled “Regulated, Capital-Intensive<br />

Businesses?”<br />

Well, its ownership came with MidAmerican when we bought control of that company in 2000. At that<br />

time, I focused on MidAmerican’s utility operations and barely noticed HomeServices, which then owned only a<br />

few real estate brokerage companies.<br />

Since then, however, the company has regularly added residential brokers – three in 2012 – and now has<br />

about 16,000 agents in a string of major U.S. cities. (Our real estate brokerage companies are listed on page 107.)<br />

In 2012, our agents participated in $42 billion of home sales, up 33% from 2011.<br />

Additionally, HomeServices last year purchased 67% of the Prudential and Real Living franchise<br />

operations, which together license 544 brokerage companies throughout the country and receive a small royalty on<br />

their sales. We have an arrangement to purchase the balance of those operations within five years. In the coming<br />

years, we will gradually rebrand both our franchisees and the franchise firms we own as Berkshire Hathaway<br />

HomeServices.<br />

Ron Peltier has done an outstanding job in managing HomeServices during a depressed period. Now, as<br />

the housing market continues to strengthen, we expect earnings to rise significantly.<br />

11