BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to Consolidated Financial Statements (Continued)<br />

(21) Contingencies and Commitments (Continued)<br />

Holdco and following the acquisition, a 50% voting interest in Heinz. The acquisition is subject to approval by Heinz<br />

shareholders, receipt of regulatory approvals and other customary closing conditions, and is expected to close in the third<br />

quarter of 2013.<br />

Heinz Company is one of the world’s leading marketers and producers of healthy, convenient and affordable foods<br />

specializing in ketchup, sauces, meals, soups, snacks and infant nutrition. Heinz is a global family of leading branded products,<br />

including Heinz ® Ketchup, sauces, soups, beans, pasta and infant foods (representing over one third of Heinz’s total sales), Ore-<br />

Ida ® potato products, Weight Watchers ® Smart Ones ® entrées, T.G.I. Friday’s ® snacks, and Plasmon infant nutrition.<br />

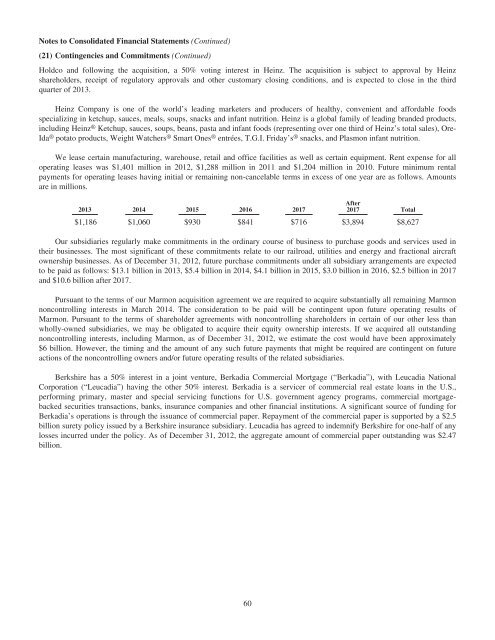

We lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent expense for all<br />

operating leases was $1,401 million in 2012, $1,288 million in 2011 and $1,204 million in 2010. Future minimum rental<br />

payments for operating leases having initial or remaining non-cancelable terms in excess of one year are as follows. Amounts<br />

are in millions.<br />

2013 2014 2015 2016 2017<br />

After<br />

2017 Total<br />

$1,186 $1,060 $930 $841 $716 $3,894 $8,627<br />

Our subsidiaries regularly make commitments in the ordinary course of business to purchase goods and services used in<br />

their businesses. The most significant of these commitments relate to our railroad, utilities and energy and fractional aircraft<br />

ownership businesses. As of December 31, 2012, future purchase commitments under all subsidiary arrangements are expected<br />

to be paid as follows: $13.1 billion in 2013, $5.4 billion in 2014, $4.1 billion in 2015, $3.0 billion in 2016, $2.5 billion in 2017<br />

and $10.6 billion after 2017.<br />

Pursuant to the terms of our Marmon acquisition agreement we are required to acquire substantially all remaining Marmon<br />

noncontrolling interests in March 2014. The consideration to be paid will be contingent upon future operating results of<br />

Marmon. Pursuant to the terms of shareholder agreements with noncontrolling shareholders in certain of our other less than<br />

wholly-owned subsidiaries, we may be obligated to acquire their equity ownership interests. If we acquired all outstanding<br />

noncontrolling interests, including Marmon, as of December 31, 2012, we estimate the cost would have been approximately<br />

$6 billion. However, the timing and the amount of any such future payments that might be required are contingent on future<br />

actions of the noncontrolling owners and/or future operating results of the related subsidiaries.<br />

Berkshire has a 50% interest in a joint venture, Berkadia Commercial Mortgage (“Berkadia”), with Leucadia National<br />

Corporation (“Leucadia”) having the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S.,<br />

performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgagebacked<br />

securities transactions, banks, insurance companies and other financial institutions. A significant source of funding for<br />

Berkadia’s operations is through the issuance of commercial paper. Repayment of the commercial paper is supported by a $2.5<br />

billion surety policy issued by a Berkshire insurance subsidiary. Leucadia has agreed to indemnify Berkshire for one-half of any<br />

losses incurred under the policy. As of December 31, 2012, the aggregate amount of commercial paper outstanding was $2.47<br />

billion.<br />

60