BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to Consolidated Financial Statements (Continued)<br />

(16) Dividend restrictions – Insurance subsidiaries<br />

Payments of dividends by our insurance subsidiaries are restricted by insurance statutes and regulations. Without prior<br />

regulatory approval, our principal insurance subsidiaries may declare up to approximately $10.6 billion as ordinary dividends<br />

before the end of 2013.<br />

Combined shareholders’ equity of U.S. based property/casualty insurance subsidiaries determined pursuant to statutory<br />

accounting rules (Statutory Surplus as Regards Policyholders) was approximately $106 billion at December 31, 2012 and<br />

$95 billion at December 31, 2011. Statutory surplus differs from the corresponding amount determined on the basis of GAAP<br />

due to differences in accounting for certain assets and liabilities. For instance, deferred charges reinsurance assumed, deferred<br />

policy acquisition costs, certain unrealized gains and losses on investments in fixed maturity securities and related deferred<br />

income taxes are recognized for GAAP but not for statutory reporting purposes. In addition, under statutory reporting, goodwill<br />

is amortized over 10 years, whereas under GAAP, goodwill is not amortized and is subject to periodic tests for impairment.<br />

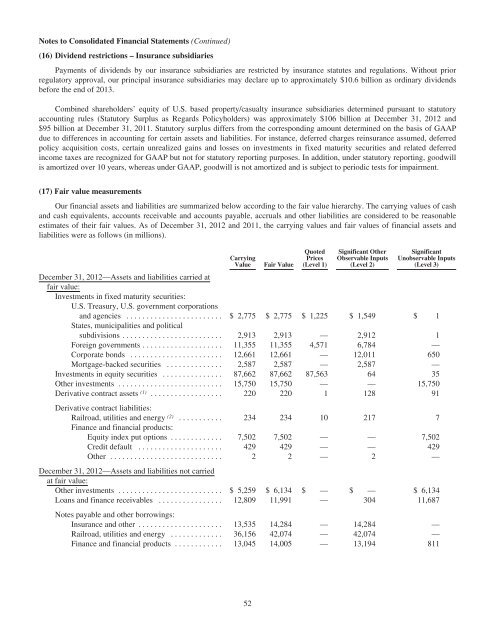

(17) Fair value measurements<br />

Our financial assets and liabilities are summarized below according to the fair value hierarchy. The carrying values of cash<br />

and cash equivalents, accounts receivable and accounts payable, accruals and other liabilities are considered to be reasonable<br />

estimates of their fair values. As of December 31, 2012 and 2011, the carrying values and fair values of financial assets and<br />

liabilities were as follows (in millions).<br />

Carrying<br />

Value Fair Value<br />

Quoted<br />

Prices<br />

(Level 1)<br />

Significant Other<br />

Observable Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable Inputs<br />

(Level 3)<br />

December 31, 2012—Assets and liabilities carried at<br />

fair value:<br />

Investments in fixed maturity securities:<br />

U.S. Treasury, U.S. government corporations<br />

and agencies ........................ $ 2,775 $ 2,775 $ 1,225 $ 1,549 $ 1<br />

States, municipalities and political<br />

subdivisions ......................... 2,913 2,913 — 2,912 1<br />

Foreign governments .................... 11,355 11,355 4,571 6,784 —<br />

Corporate bonds ....................... 12,661 12,661 — 12,011 650<br />

Mortgage-backed securities .............. 2,587 2,587 — 2,587 —<br />

Investments in equity securities ............... 87,662 87,662 87,563 64 35<br />

Other investments .......................... 15,750 15,750 — — 15,750<br />

Derivative contract assets (1) .................. 220 220 1 128 91<br />

Derivative contract liabilities:<br />

Railroad, utilities and energy (2) ........... 234 234 10 217 7<br />

Finance and financial products:<br />

Equity index put options ............. 7,502 7,502 — — 7,502<br />

Credit default ..................... 429 429 — — 429<br />

Other ............................ 2 2 — 2 —<br />

December 31, 2012—Assets and liabilities not carried<br />

at fair value:<br />

Other investments .......................... $ 5,259 $ 6,134 $ — $ — $ 6,134<br />

Loans and finance receivables ................ 12,809 11,991 — 304 11,687<br />

Notes payable and other borrowings:<br />

Insurance and other ..................... 13,535 14,284 — 14,284 —<br />

Railroad, utilities and energy ............. 36,156 42,074 — 42,074 —<br />

Finance and financial products ............ 13,045 14,005 — 13,194 811<br />

52