BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

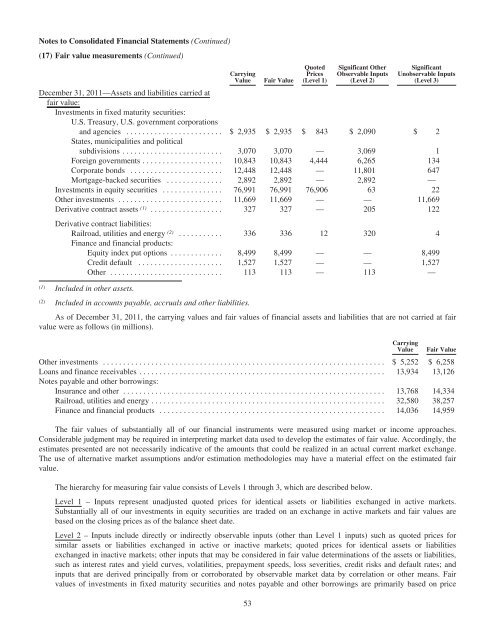

Notes to Consolidated Financial Statements (Continued)<br />

(17) Fair value measurements (Continued)<br />

Carrying<br />

Value Fair Value<br />

Quoted<br />

Prices<br />

(Level 1)<br />

Significant Other<br />

Observable Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable Inputs<br />

(Level 3)<br />

December 31, 2011—Assets and liabilities carried at<br />

fair value:<br />

Investments in fixed maturity securities:<br />

U.S. Treasury, U.S. government corporations<br />

and agencies ........................ $ 2,935 $ 2,935 $ 843 $ 2,090 $ 2<br />

States, municipalities and political<br />

subdivisions ......................... 3,070 3,070 — 3,069 1<br />

Foreign governments .................... 10,843 10,843 4,444 6,265 134<br />

Corporate bonds ....................... 12,448 12,448 — 11,801 647<br />

Mortgage-backed securities .............. 2,892 2,892 — 2,892 —<br />

Investments in equity securities ............... 76,991 76,991 76,906 63 22<br />

Other investments .......................... 11,669 11,669 — — 11,669<br />

Derivative contract assets (1) .................. 327 327 — 205 122<br />

Derivative contract liabilities:<br />

Railroad, utilities and energy (2) ........... 336 336 12 320 4<br />

Finance and financial products:<br />

Equity index put options ............. 8,499 8,499 — — 8,499<br />

Credit default ..................... 1,527 1,527 — — 1,527<br />

Other ............................ 113 113 — 113 —<br />

(1) Included in other assets.<br />

(2) Included in accounts payable, accruals and other liabilities.<br />

As of December 31, 2011, the carrying values and fair values of financial assets and liabilities that are not carried at fair<br />

value were as follows (in millions).<br />

Carrying<br />

Value Fair Value<br />

Other investments ...................................................................... $ 5,252 $ 6,258<br />

Loans and finance receivables .............................................................<br />

Notes payable and other borrowings:<br />

13,934 13,126<br />

Insurance and other ................................................................. 13,768 14,334<br />

Railroad, utilities and energy .......................................................... 32,580 38,257<br />

Finance and financial products ........................................................ 14,036 14,959<br />

The fair values of substantially all of our financial instruments were measured using market or income approaches.<br />

Considerable judgment may be required in interpreting market data used to develop the estimates of fair value. Accordingly, the<br />

estimates presented are not necessarily indicative of the amounts that could be realized in an actual current market exchange.<br />

The use of alternative market assumptions and/or estimation methodologies may have a material effect on the estimated fair<br />

value.<br />

The hierarchy for measuring fair value consists of Levels 1 through 3, which are described below.<br />

Level 1 – Inputs represent unadjusted quoted prices for identical assets or liabilities exchanged in active markets.<br />

Substantially all of our investments in equity securities are traded on an exchange in active markets and fair values are<br />

based on the closing prices as of the balance sheet date.<br />

Level 2 – Inputs include directly or indirectly observable inputs (other than Level 1 inputs) such as quoted prices for<br />

similar assets or liabilities exchanged in active or inactive markets; quoted prices for identical assets or liabilities<br />

exchanged in inactive markets; other inputs that may be considered in fair value determinations of the assets or liabilities,<br />

such as interest rates and yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates; and<br />

inputs that are derived principally from or corroborated by observable market data by correlation or other means. Fair<br />

values of investments in fixed maturity securities and notes payable and other borrowings are primarily based on price<br />

53