BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

BERKSHIRE HATHAWAY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to Consolidated Financial Statements (Continued)<br />

(20) Pension plans (Continued)<br />

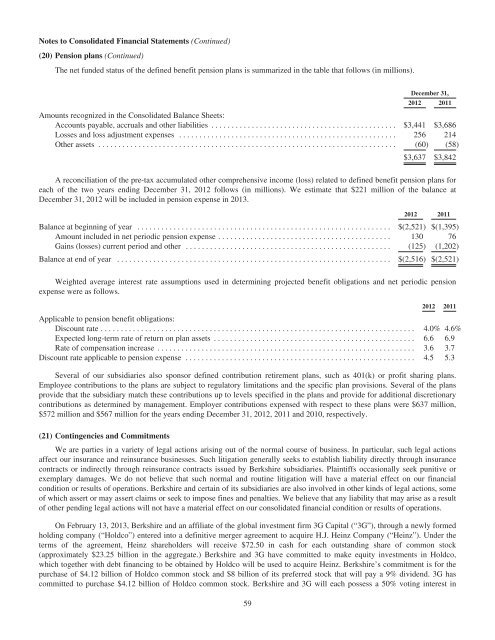

The net funded status of the defined benefit pension plans is summarized in the table that follows (in millions).<br />

December 31,<br />

2012 2011<br />

Amounts recognized in the Consolidated Balance Sheets:<br />

Accounts payable, accruals and other liabilities .............................................. $3,441 $3,686<br />

Losses and loss adjustment expenses ...................................................... 256 214<br />

Other assets .......................................................................... (60) (58)<br />

$3,637 $3,842<br />

A reconciliation of the pre-tax accumulated other comprehensive income (loss) related to defined benefit pension plans for<br />

each of the two years ending December 31, 2012 follows (in millions). We estimate that $221 million of the balance at<br />

December 31, 2012 will be included in pension expense in 2013.<br />

2012 2011<br />

Balance at beginning of year ............................................................... $(2,521) $(1,395)<br />

Amount included in net periodic pension expense ........................................... 130 76<br />

Gains (losses) current period and other ................................................... (125) (1,202)<br />

Balance at end of year .................................................................... $(2,516) $(2,521)<br />

Weighted average interest rate assumptions used in determining projected benefit obligations and net periodic pension<br />

expense were as follows.<br />

2012 2011<br />

Applicable to pension benefit obligations:<br />

Discount rate .............................................................................. 4.0% 4.6%<br />

Expected long-term rate of return on plan assets .................................................. 6.6 6.9<br />

Rate of compensation increase ................................................................ 3.6 3.7<br />

Discount rate applicable to pension expense ......................................................... 4.5 5.3<br />

Several of our subsidiaries also sponsor defined contribution retirement plans, such as 401(k) or profit sharing plans.<br />

Employee contributions to the plans are subject to regulatory limitations and the specific plan provisions. Several of the plans<br />

provide that the subsidiary match these contributions up to levels specified in the plans and provide for additional discretionary<br />

contributions as determined by management. Employer contributions expensed with respect to these plans were $637 million,<br />

$572 million and $567 million for the years ending December 31, 2012, 2011 and 2010, respectively.<br />

(21) Contingencies and Commitments<br />

We are parties in a variety of legal actions arising out of the normal course of business. In particular, such legal actions<br />

affect our insurance and reinsurance businesses. Such litigation generally seeks to establish liability directly through insurance<br />

contracts or indirectly through reinsurance contracts issued by Berkshire subsidiaries. Plaintiffs occasionally seek punitive or<br />

exemplary damages. We do not believe that such normal and routine litigation will have a material effect on our financial<br />

condition or results of operations. Berkshire and certain of its subsidiaries are also involved in other kinds of legal actions, some<br />

of which assert or may assert claims or seek to impose fines and penalties. We believe that any liability that may arise as a result<br />

of other pending legal actions will not have a material effect on our consolidated financial condition or results of operations.<br />

On February 13, 2013, Berkshire and an affiliate of the global investment firm 3G Capital (“3G”), through a newly formed<br />

holding company (“Holdco”) entered into a definitive merger agreement to acquire H.J. Heinz Company (“Heinz”). Under the<br />

terms of the agreement, Heinz shareholders will receive $72.50 in cash for each outstanding share of common stock<br />

(approximately $23.25 billion in the aggregate.) Berkshire and 3G have committed to make equity investments in Holdco,<br />

which together with debt financing to be obtained by Holdco will be used to acquire Heinz. Berkshire’s commitment is for the<br />

purchase of $4.12 billion of Holdco common stock and $8 billion of its preferred stock that will pay a 9% dividend. 3G has<br />

committed to purchase $4.12 billion of Holdco common stock. Berkshire and 3G will each possess a 50% voting interest in<br />

59