Financial Inclusion White Paper - NCR

Financial Inclusion White Paper - NCR

Financial Inclusion White Paper - NCR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

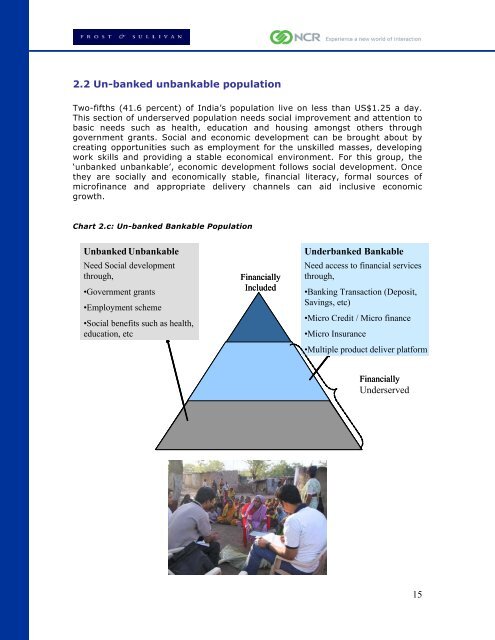

2.2 Un-banked unbankable population<br />

Two-fifths (41.6 percent) of India’s population live on less than US$1.25 a day.<br />

This section of underserved population needs social improvement and attention to<br />

basic needs such as health, education and housing amongst others through<br />

government grants. Social and economic development can be brought about by<br />

creating opportunities such as employment for the unskilled masses, developing<br />

work skills and providing a stable economical environment. For this group, the<br />

‘unbanked unbankable’, economic development follows social development. Once<br />

they are socially and economically stable, financial literacy, formal sources of<br />

microfinance and appropriate delivery channels can aid inclusive economic<br />

growth.<br />

Chart 2.c: Un-banked Bankable Population<br />

Unbanked – Unbankable<br />

Need Social development<br />

through,<br />

• Government grants<br />

• Employment scheme<br />

• Social benefits such as health,<br />

education, etc<br />

<strong>Financial</strong>ly<br />

Included<br />

Unbanked Underbanked –Bankable Bankable<br />

Need access to financial services<br />

through,<br />

•Banking •Banking Transaction (Deposit,<br />

Savings, etc)<br />

•Micro •Micro Credit / Micro finance<br />

•Micro •Micro Insurance<br />

•Multiple •Multiple product deliver platform<br />

<strong>Financial</strong>ly<br />

Underserved<br />

15