Financial Inclusion White Paper - NCR

Financial Inclusion White Paper - NCR

Financial Inclusion White Paper - NCR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

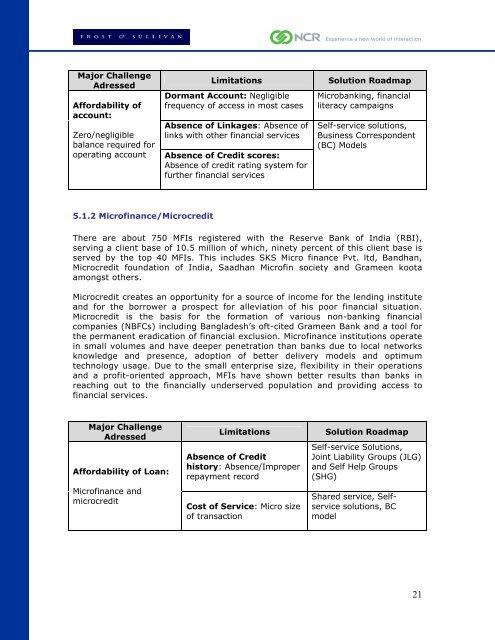

Major Challenge<br />

Adressed<br />

Affordability of<br />

account:<br />

Limitations Solution Roadmap<br />

Dormant Account: Negligible<br />

frequency of access in most cases<br />

Absence of Linkages: Absence of<br />

links with other financial services<br />

Zero/negligible<br />

balance required for<br />

operating account Absence of Credit scores:<br />

5.1.2 Microfinance/Microcredit<br />

Absence of credit rating system for<br />

further financial services<br />

Microbanking, financial<br />

literacy campaigns<br />

Self-service solutions,<br />

Business Correspondent<br />

(BC) Models<br />

There are about 750 MFIs registered with the Reserve Bank of India (RBI),<br />

serving a client base of 10.5 million of which, ninety percent of this client base is<br />

served by the top 40 MFIs. This includes SKS Micro finance Pvt. ltd, Bandhan,<br />

Microcredit foundation of India, Saadhan Microfin society and Grameen koota<br />

amongst others.<br />

Microcredit creates an opportunity for a source of income for the lending institute<br />

and for the borrower a prospect for alleviation of his poor financial situation.<br />

Microcredit is the basis for the formation of various non-banking financial<br />

companies (NBFCs) including Bangladesh’s oft-cited Grameen Bank and a tool for<br />

the permanent eradication of financial exclusion. Microfinance institutions operate<br />

in small volumes and have deeper penetration than banks due to local networks<br />

knowledge and presence, adoption of better delivery models and optimum<br />

technology usage. Due to the small enterprise size, flexibility in their operations<br />

and a profit-oriented approach, MFIs have shown better results than banks in<br />

reaching out to the financially underserved population and providing access to<br />

financial services.<br />

Major Challenge<br />

Adressed<br />

Affordability of Loan:<br />

Microfinance and<br />

microcredit<br />

Limitations Solution Roadmap<br />

Absence of Credit<br />

history: Absence/Improper<br />

repayment record<br />

Cost of Service: Micro size<br />

of transaction<br />

Self-service Solutions,<br />

Joint Liability Groups (JLG)<br />

and Self Help Groups<br />

(SHG)<br />

Shared service, Selfservice<br />

solutions, BC<br />

model<br />

21