Financial Inclusion White Paper - NCR

Financial Inclusion White Paper - NCR

Financial Inclusion White Paper - NCR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

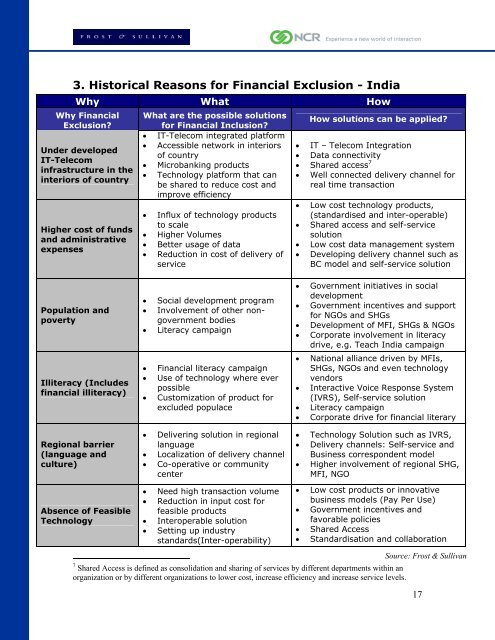

3. Historical Reasons for <strong>Financial</strong> Exclusion - India<br />

Why What How<br />

Why <strong>Financial</strong><br />

Exclusion?<br />

Under developed<br />

IT-Telecom<br />

infrastructure in the<br />

interiors of country<br />

Higher cost of funds<br />

and administrative<br />

expenses<br />

Population and<br />

poverty<br />

Illiteracy (Includes<br />

financial illiteracy)<br />

Regional barrier<br />

(language and<br />

culture)<br />

Absence of Feasible<br />

Technology<br />

What are the possible solutions<br />

for <strong>Financial</strong> <strong>Inclusion</strong>?<br />

• IT-Telecom integrated platform<br />

• Accessible network in interiors<br />

of country<br />

• Microbanking products<br />

• Technology platform that can<br />

be shared to reduce cost and<br />

improve efficiency<br />

• Influx of technology products<br />

to scale<br />

• Higher Volumes<br />

• Better usage of data<br />

• Reduction in cost of delivery of<br />

service<br />

• Social development program<br />

• Involvement of other non-<br />

government bodies<br />

• Literacy campaign<br />

• <strong>Financial</strong> literacy campaign<br />

• Use of technology where ever<br />

possible<br />

• Customization of product for<br />

excluded populace<br />

• Delivering solution in regional<br />

language<br />

• Localization of delivery channel<br />

• Co-operative or community<br />

center<br />

• Need high transaction volume<br />

• Reduction in input cost for<br />

feasible products<br />

• Interoperable solution<br />

• Setting up industry<br />

standards(Inter-operability)<br />

How solutions can be applied?<br />

• IT – Telecom Integration<br />

• Data connectivity<br />

• Shared access 7<br />

• Well connected delivery channel for<br />

real time transaction<br />

• Low cost technology products,<br />

(standardised and inter-operable)<br />

• Shared access and self-service<br />

solution<br />

• Low cost data management system<br />

• Developing delivery channel such as<br />

BC model and self-service solution<br />

• Government initiatives in social<br />

development<br />

• Government incentives and support<br />

for NGOs and SHGs<br />

• Development of MFI, SHGs & NGOs<br />

• Corporate involvement in literacy<br />

drive, e.g. Teach India campaign<br />

• National alliance driven by MFIs,<br />

SHGs, NGOs and even technology<br />

vendors<br />

• Interactive Voice Response System<br />

(IVRS), Self-service solution<br />

• Literacy campaign<br />

• Corporate drive for financial literary<br />

• Technology Solution such as IVRS,<br />

• Delivery channels: Self-service and<br />

Business correspondent model<br />

• Higher involvement of regional SHG,<br />

MFI, NGO<br />

• Low cost products or innovative<br />

business models (Pay Per Use)<br />

• Government incentives and<br />

favorable policies<br />

• Shared Access<br />

• Standardisation and collaboration<br />

7 Shared Access is defined as consolidation and sharing of services by different departments within an<br />

organization or by different organizations to lower cost, increase efficiency and increase service levels.<br />

Source: Frost & Sullivan<br />

17