Conference Resolutions - Centre for Conveyancing Practice

Conference Resolutions - Centre for Conveyancing Practice

Conference Resolutions - Centre for Conveyancing Practice

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

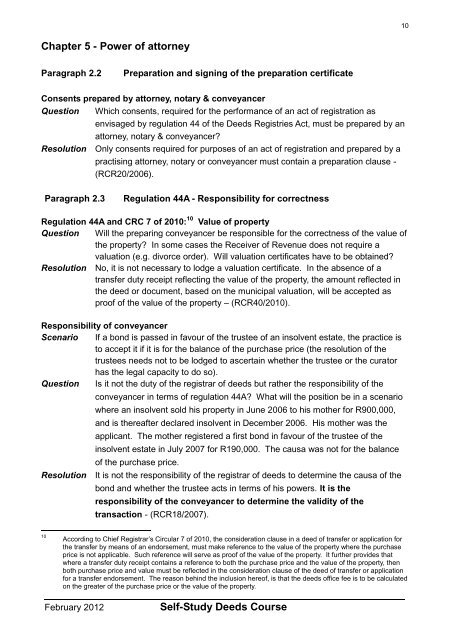

Chapter 5 - Power of attorney<br />

Paragraph 2.2 Preparation and signing of the preparation certificate<br />

Consents prepared by attorney, notary & conveyancer<br />

Question Which consents, required <strong>for</strong> the per<strong>for</strong>mance of an act of registration as<br />

envisaged by regulation 44 of the Deeds Registries Act, must be prepared by an<br />

attorney, notary & conveyancer?<br />

Resolution Only consents required <strong>for</strong> purposes of an act of registration and prepared by a<br />

practising attorney, notary or conveyancer must contain a preparation clause -<br />

(RCR20/2006).<br />

Paragraph 2.3 Regulation 44A - Responsibility <strong>for</strong> correctness<br />

Regulation 44A and CRC 7 of 2010: 10 Value of property<br />

Question Will the preparing conveyancer be responsible <strong>for</strong> the correctness of the value of<br />

the property? In some cases the Receiver of Revenue does not require a<br />

valuation (e.g. divorce order). Will valuation certificates have to be obtained?<br />

Resolution No, it is not necessary to lodge a valuation certificate. In the absence of a<br />

transfer duty receipt reflecting the value of the property, the amount reflected in<br />

the deed or document, based on the municipal valuation, will be accepted as<br />

proof of the value of the property – (RCR40/2010).<br />

Responsibility of conveyancer<br />

Scenario If a bond is passed in favour of the trustee of an insolvent estate, the practice is<br />

to accept it if it is <strong>for</strong> the balance of the purchase price (the resolution of the<br />

trustees needs not to be lodged to ascertain whether the trustee or the curator<br />

has the legal capacity to do so).<br />

Question Is it not the duty of the registrar of deeds but rather the responsibility of the<br />

conveyancer in terms of regulation 44A? What will the position be in a scenario<br />

where an insolvent sold his property in June 2006 to his mother <strong>for</strong> R900,000,<br />

and is thereafter declared insolvent in December 2006. His mother was the<br />

applicant. The mother registered a first bond in favour of the trustee of the<br />

insolvent estate in July 2007 <strong>for</strong> R190,000. The causa was not <strong>for</strong> the balance<br />

of the purchase price.<br />

Resolution It is not the responsibility of the registrar of deeds to determine the causa of the<br />

bond and whether the trustee acts in terms of his powers. It is the<br />

responsibility of the conveyancer to determine the validity of the<br />

transaction - (RCR18/2007).<br />

10 According to Chief Registrar’s Circular 7 of 2010, the consideration clause in a deed of transfer or application <strong>for</strong><br />

the transfer by means of an endorsement, must make reference to the value of the property where the purchase<br />

price is not applicable. Such reference will serve as proof of the value of the property. It further provides that<br />

where a transfer duty receipt contains a reference to both the purchase price and the value of the property, then<br />

both purchase price and value must be reflected in the consideration clause of the deed of transfer or application<br />

<strong>for</strong> a transfer endorsement. The reason behind the inclusion hereof, is that the deeds office fee is to be calculated<br />

on the greater of the purchase price or the value of the property.<br />

February 2012 Self-Study Deeds Course<br />

10