Conference Resolutions - Centre for Conveyancing Practice

Conference Resolutions - Centre for Conveyancing Practice

Conference Resolutions - Centre for Conveyancing Practice

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

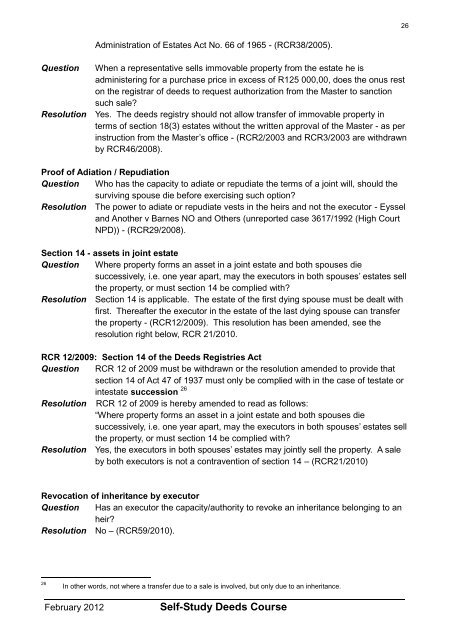

Administration of Estates Act No. 66 of 1965 - (RCR38/2005).<br />

Question When a representative sells immovable property from the estate he is<br />

administering <strong>for</strong> a purchase price in excess of R125 000,00, does the onus rest<br />

on the registrar of deeds to request authorization from the Master to sanction<br />

such sale?<br />

Resolution Yes. The deeds registry should not allow transfer of immovable property in<br />

terms of section 18(3) estates without the written approval of the Master - as per<br />

instruction from the Master’s office - (RCR2/2003 and RCR3/2003 are withdrawn<br />

by RCR46/2008).<br />

Proof of Adiation / Repudiation<br />

Question Who has the capacity to adiate or repudiate the terms of a joint will, should the<br />

surviving spouse die be<strong>for</strong>e exercising such option?<br />

Resolution The power to adiate or repudiate vests in the heirs and not the executor - Eyssel<br />

and Another v Barnes NO and Others (unreported case 3617/1992 (High Court<br />

NPD)) - (RCR29/2008).<br />

Section 14 - assets in joint estate<br />

Question Where property <strong>for</strong>ms an asset in a joint estate and both spouses die<br />

successively, i.e. one year apart, may the executors in both spouses’ estates sell<br />

the property, or must section 14 be complied with?<br />

Resolution Section 14 is applicable. The estate of the first dying spouse must be dealt with<br />

first. Thereafter the executor in the estate of the last dying spouse can transfer<br />

the property - (RCR12/2009). This resolution has been amended, see the<br />

resolution right below, RCR 21/2010.<br />

RCR 12/2009: Section 14 of the Deeds Registries Act<br />

Question RCR 12 of 2009 must be withdrawn or the resolution amended to provide that<br />

section 14 of Act 47 of 1937 must only be complied with in the case of testate or<br />

intestate succession 26<br />

Resolution RCR 12 of 2009 is hereby amended to read as follows:<br />

“Where property <strong>for</strong>ms an asset in a joint estate and both spouses die<br />

successively, i.e. one year apart, may the executors in both spouses’ estates sell<br />

the property, or must section 14 be complied with?<br />

Resolution Yes, the executors in both spouses’ estates may jointly sell the property. A sale<br />

by both executors is not a contravention of section 14 – (RCR21/2010)<br />

Revocation of inheritance by executor<br />

Question Has an executor the capacity/authority to revoke an inheritance belonging to an<br />

heir?<br />

Resolution No – (RCR59/2010).<br />

26 In other words, not where a transfer due to a sale is involved, but only due to an inheritance.<br />

February 2012 Self-Study Deeds Course<br />

26