Money laundering through money remittance ... - Council of Europe

Money laundering through money remittance ... - Council of Europe

Money laundering through money remittance ... - Council of Europe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2010 - <strong>Money</strong> Laundering <strong>through</strong> <strong>Money</strong> Remittance and Currency Exchange Providers<br />

comes from accepting the <strong>money</strong> <strong>of</strong> straw men and persons identified on the basis <strong>of</strong> forged<br />

documents. Some examples <strong>of</strong> <strong>money</strong> <strong>laundering</strong> schemes obtained as part <strong>of</strong> this study involved<br />

straw men who were hired as „employees‟ <strong>of</strong> a foreign company.<br />

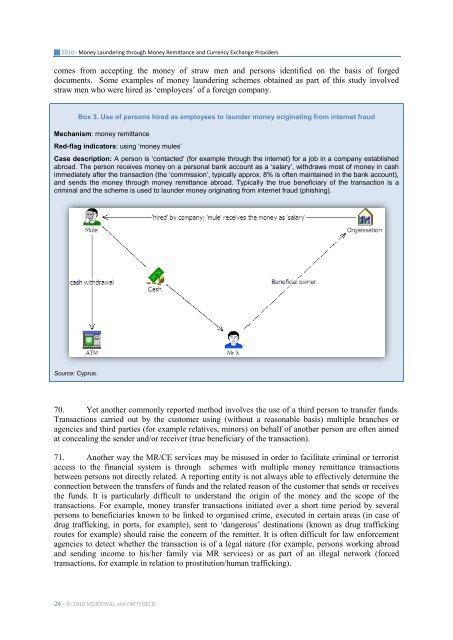

Box 3. Use <strong>of</strong> persons hired as employees to launder <strong>money</strong> originating from internet fraud<br />

Mechanism: <strong>money</strong> <strong>remittance</strong><br />

Red-flag indicators: using „<strong>money</strong> mules‟<br />

Case description: A person is „contacted‟ (for example <strong>through</strong> the internet) for a job in a company established<br />

abroad. The person receives <strong>money</strong> on a personal bank account as a „salary‟, withdraws most <strong>of</strong> <strong>money</strong> in cash<br />

immediately after the transaction (the „commission‟, typically approx. 8% is <strong>of</strong>ten maintained in the bank account),<br />

and sends the <strong>money</strong> <strong>through</strong> <strong>money</strong> <strong>remittance</strong> abroad. Typically the true beneficiary <strong>of</strong> the transaction is a<br />

criminal and the scheme is used to launder <strong>money</strong> originating from internet fraud (phishing).<br />

Source: Cyprus.<br />

70. Yet another commonly reported method involves the use <strong>of</strong> a third person to transfer funds.<br />

Transactions carried out by the customer using (without a reasonable basis) multiple branches or<br />

agencies and third parties (for example relatives, minors) on behalf <strong>of</strong> another person are <strong>of</strong>ten aimed<br />

at concealing the sender and/or receiver (true beneficiary <strong>of</strong> the transaction).<br />

71. Another way the MR/CE services may be misused in order to facilitate criminal or terrorist<br />

access to the financial system is <strong>through</strong> schemes with multiple <strong>money</strong> <strong>remittance</strong> transactions<br />

between persons not directly related. A reporting entity is not always able to effectively determine the<br />

connection between the transfers <strong>of</strong> funds and the related reason <strong>of</strong> the customer that sends or receives<br />

the funds. It is particularly difficult to understand the origin <strong>of</strong> the <strong>money</strong> and the scope <strong>of</strong> the<br />

transactions. For example, <strong>money</strong> transfer transactions initiated over a short time period by several<br />

persons to beneficiaries known to be linked to organised crime, executed in certain areas (in case <strong>of</strong><br />

drug trafficking, in ports, for example), sent to „dangerous‟ destinations (known as drug trafficking<br />

routes for example) should raise the concern <strong>of</strong> the remitter. It is <strong>of</strong>ten difficult for law enforcement<br />

agencies to detect whether the transaction is <strong>of</strong> a legal nature (for example, persons working abroad<br />

and sending income to his/her family via MR services) or as part <strong>of</strong> an illegal network (forced<br />

transactions, for example in relation to prostitution/human trafficking).<br />

24 - © 2010 MONEYVAL and FATF/OECD