Money laundering through money remittance ... - Council of Europe

Money laundering through money remittance ... - Council of Europe

Money laundering through money remittance ... - Council of Europe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2010 - <strong>Money</strong> Laundering <strong>through</strong> <strong>Money</strong> Remittance and Currency Exchange Providers<br />

otherwise outside the networks <strong>of</strong> the international banking system. However, investigations in some<br />

countries have shown that the services provided by some MR businesses have also been linked to<br />

human trafficking and the repayment <strong>of</strong> „human trafficking agents‟. As an example, in certain<br />

trafficking cases, <strong>money</strong> <strong>remittance</strong> providers have been used to pay mules, intermediaries, airplane<br />

tickets, etc.<br />

74. Other ML methods detected in cases involving MR/CE services include transactions with<br />

companies incorporated in countries with low or no taxation (no or insufficient AML/CFT measures,<br />

known routes for ML/TF, etc.), the use <strong>of</strong> new payment methods to launder funds, <strong>of</strong>ten without a<br />

physical presence, and the potential for <strong>of</strong>fshore service providers to access a foreign market online or<br />

via a wireless ATM network, evading AML/CFT requirements <strong>of</strong> jurisdictions.<br />

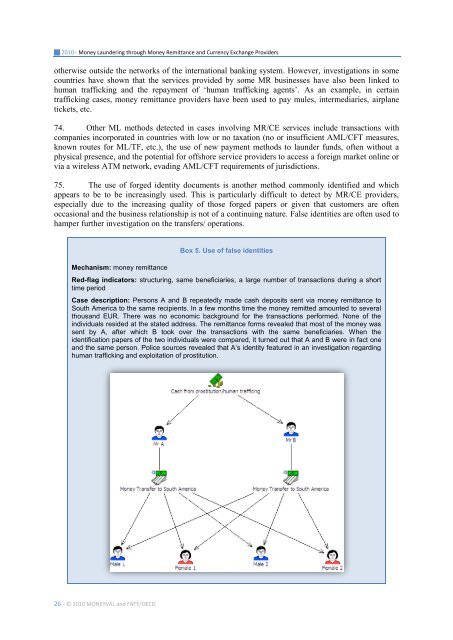

75. The use <strong>of</strong> forged identity documents is another method commonly identified and which<br />

appears to be to be increasingly used. This is particularly difficult to detect by MR/CE providers,<br />

especially due to the increasing quality <strong>of</strong> those forged papers or given that customers are <strong>of</strong>ten<br />

occasional and the business relationship is not <strong>of</strong> a continuing nature. False identities are <strong>of</strong>ten used to<br />

hamper further investigation on the transfers/ operations.<br />

Mechanism: <strong>money</strong> <strong>remittance</strong><br />

26 - © 2010 MONEYVAL and FATF/OECD<br />

Box 5. Use <strong>of</strong> false identities<br />

Red-flag indicators: structuring, same beneficiaries, a large number <strong>of</strong> transactions during a short<br />

time period<br />

Case description: Persons A and B repeatedly made cash deposits sent via <strong>money</strong> <strong>remittance</strong> to<br />

South America to the same recipients. In a few months time the <strong>money</strong> remitted amounted to several<br />

thousand EUR. There was no economic background for the transactions performed. None <strong>of</strong> the<br />

individuals resided at the stated address. The <strong>remittance</strong> forms revealed that most <strong>of</strong> the <strong>money</strong> was<br />

sent by A, after which B took over the transactions with the same beneficiaries. When the<br />

identification papers <strong>of</strong> the two individuals were compared, it turned out that A and B were in fact one<br />

and the same person. Police sources revealed that A‟s identity featured in an investigation regarding<br />

human trafficking and exploitation <strong>of</strong> prostitution.