Money laundering through money remittance ... - Council of Europe

Money laundering through money remittance ... - Council of Europe

Money laundering through money remittance ... - Council of Europe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2010 - <strong>Money</strong> Laundering <strong>through</strong> <strong>Money</strong> Remittance and Currency Exchange Providers<br />

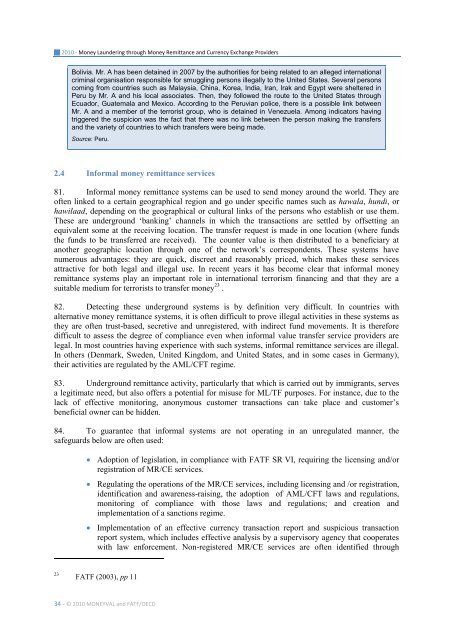

Bolivia. Mr. A has been detained in 2007 by the authorities for being related to an alleged international<br />

criminal organisation responsible for smuggling persons illegally to the United States. Several persons<br />

coming from countries such as Malaysia, China, Korea, India, Iran, Irak and Egypt were sheltered in<br />

Peru by Mr. A and his local associates. Then, they followed the route to the United States <strong>through</strong><br />

Ecuador, Guatemala and Mexico. According to the Peruvian police, there is a possible link between<br />

Mr. A and a member <strong>of</strong> the terrorist group, who is detained in Venezuela. Among indicators having<br />

triggered the suspicion was the fact that there was no link between the person making the transfers<br />

and the variety <strong>of</strong> countries to which transfers were being made.<br />

Source: Peru.<br />

2.4 Informal <strong>money</strong> <strong>remittance</strong> services<br />

81. Informal <strong>money</strong> <strong>remittance</strong> systems can be used to send <strong>money</strong> around the world. They are<br />

<strong>of</strong>ten linked to a certain geographical region and go under specific names such as hawala, hundi, or<br />

hawilaad, depending on the geographical or cultural links <strong>of</strong> the persons who establish or use them.<br />

These are underground „banking‟ channels in which the transactions are settled by <strong>of</strong>fsetting an<br />

equivalent some at the receiving location. The transfer request is made in one location (where funds<br />

the funds to be transferred are received). The counter value is then distributed to a beneficiary at<br />

another geographic location <strong>through</strong> one <strong>of</strong> the network‟s correspondents. These systems have<br />

numerous advantages: they are quick, discreet and reasonably priced, which makes these services<br />

attractive for both legal and illegal use. In recent years it has become clear that informal <strong>money</strong><br />

<strong>remittance</strong> systems play an important role in international terrorism financing and that they are a<br />

suitable medium for terrorists to transfer <strong>money</strong> 23 .<br />

82. Detecting these underground systems is by definition very difficult. In countries with<br />

alternative <strong>money</strong> <strong>remittance</strong> systems, it is <strong>of</strong>ten difficult to prove illegal activities in these systems as<br />

they are <strong>of</strong>ten trust-based, secretive and unregistered, with indirect fund movements. It is therefore<br />

difficult to assess the degree <strong>of</strong> compliance even when informal value transfer service providers are<br />

legal. In most countries having experience with such systems, informal <strong>remittance</strong> services are illegal.<br />

In others (Denmark, Sweden, United Kingdom, and United States, and in some cases in Germany),<br />

their activities are regulated by the AML/CFT regime.<br />

83. Underground <strong>remittance</strong> activity, particularly that which is carried out by immigrants, serves<br />

a legitimate need, but also <strong>of</strong>fers a potential for misuse for ML/TF purposes. For instance, due to the<br />

lack <strong>of</strong> effective monitoring, anonymous customer transactions can take place and customer‟s<br />

beneficial owner can be hidden.<br />

84. To guarantee that informal systems are not operating in an unregulated manner, the<br />

safeguards below are <strong>of</strong>ten used:<br />

Adoption <strong>of</strong> legislation, in compliance with FATF SR VI, requiring the licensing and/or<br />

registration <strong>of</strong> MR/CE services.<br />

Regulating the operations <strong>of</strong> the MR/CE services, including licensing and /or registration,<br />

identification and awareness-raising, the adoption <strong>of</strong> AML/CFT laws and regulations,<br />

monitoring <strong>of</strong> compliance with those laws and regulations; and creation and<br />

implementation <strong>of</strong> a sanctions regime.<br />

Implementation <strong>of</strong> an effective currency transaction report and suspicious transaction<br />

report system, which includes effective analysis by a supervisory agency that cooperates<br />

with law enforcement. Non-registered MR/CE services are <strong>of</strong>ten identified <strong>through</strong><br />

23 FATF (2003), pp 11<br />

34 - © 2010 MONEYVAL and FATF/OECD