Breaking New Grounds in Tobacco Control - Voluntary Health ...

Breaking New Grounds in Tobacco Control - Voluntary Health ...

Breaking New Grounds in Tobacco Control - Voluntary Health ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

operat<strong>in</strong>g mach<strong>in</strong>es <strong>in</strong>stalled <strong>in</strong> the factory<br />

premises.<br />

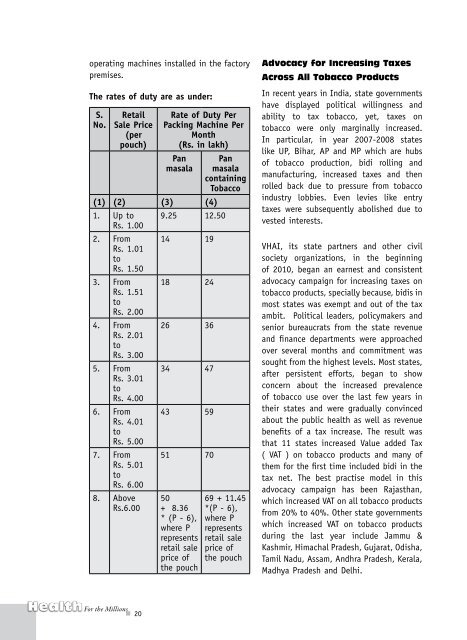

The rates of duty are as under:<br />

S.<br />

No.<br />

Retail<br />

Sale Price<br />

(per<br />

pouch)<br />

For the Millions<br />

n 20<br />

Rate of Duty Per<br />

Pack<strong>in</strong>g Mach<strong>in</strong>e Per<br />

Month<br />

(Rs. <strong>in</strong> lakh)<br />

Pan<br />

masala<br />

(1) (2) (3) (4)<br />

1. Up to<br />

Rs. 1.00<br />

2. From<br />

Rs. 1.01<br />

to<br />

Rs. 1.50<br />

3. From<br />

Rs. 1.51<br />

to<br />

Rs. 2.00<br />

4. From<br />

Rs. 2.01<br />

to<br />

Rs. 3.00<br />

5. From<br />

Rs. 3.01<br />

to<br />

Rs. 4.00<br />

6. From<br />

Rs. 4.01<br />

to<br />

Rs. 5.00<br />

7. From<br />

Rs. 5.01<br />

to<br />

Rs. 6.00<br />

8. Above<br />

Rs.6.00<br />

9.25 12.50<br />

14 19<br />

18 24<br />

26 36<br />

34 47<br />

43 59<br />

51 70<br />

50<br />

+ 8.36<br />

* (P - 6),<br />

where P<br />

represents<br />

retail sale<br />

price of<br />

the pouch<br />

Pan<br />

masala<br />

conta<strong>in</strong><strong>in</strong>g<br />

<strong>Tobacco</strong><br />

69 + 11.45<br />

*(P - 6),<br />

where P<br />

represents<br />

retail sale<br />

price of<br />

the pouch<br />

Advocacy for Increas<strong>in</strong>g Taxes<br />

Across All <strong>Tobacco</strong> Products<br />

In recent years <strong>in</strong> India, state governments<br />

have displayed political will<strong>in</strong>gness and<br />

ability to tax tobacco, yet, taxes on<br />

tobacco were only marg<strong>in</strong>ally <strong>in</strong>creased.<br />

In particular, <strong>in</strong> year 2007-2008 states<br />

like UP, Bihar, AP and MP which are hubs<br />

of tobacco production, bidi roll<strong>in</strong>g and<br />

manufactur<strong>in</strong>g, <strong>in</strong>creased taxes and then<br />

rolled back due to pressure from tobacco<br />

<strong>in</strong>dustry lobbies. Even levies like entry<br />

taxes were subsequently abolished due to<br />

vested <strong>in</strong>terests.<br />

VHAI, its state partners and other civil<br />

society organizations, <strong>in</strong> the beg<strong>in</strong>n<strong>in</strong>g<br />

of 2010, began an earnest and consistent<br />

advocacy campaign for <strong>in</strong>creas<strong>in</strong>g taxes on<br />

tobacco products, specially because, bidis <strong>in</strong><br />

most states was exempt and out of the tax<br />

ambit. Political leaders, policymakers and<br />

senior bureaucrats from the state revenue<br />

and f<strong>in</strong>ance departments were approached<br />

over several months and commitment was<br />

sought from the highest levels. Most states,<br />

after persistent efforts, began to show<br />

concern about the <strong>in</strong>creased prevalence<br />

of tobacco use over the last few years <strong>in</strong><br />

their states and were gradually conv<strong>in</strong>ced<br />

about the public health as well as revenue<br />

benefits of a tax <strong>in</strong>crease. The result was<br />

that 11 states <strong>in</strong>creased Value added Tax<br />

( VAT ) on tobacco products and many of<br />

them for the first time <strong>in</strong>cluded bidi <strong>in</strong> the<br />

tax net. The best practise model <strong>in</strong> this<br />

advocacy campaign has been Rajasthan,<br />

which <strong>in</strong>creased VAT on all tobacco products<br />

from 20% to 40%. Other state governments<br />

which <strong>in</strong>creased VAT on tobacco products<br />

dur<strong>in</strong>g the last year <strong>in</strong>clude Jammu &<br />

Kashmir, Himachal Pradesh, Gujarat, Odisha,<br />

Tamil Nadu, Assam, Andhra Pradesh, Kerala,<br />

Madhya Pradesh and Delhi.