GLObAL COAL RISK ASSESSmENT - World Resources Institute

GLObAL COAL RISK ASSESSmENT - World Resources Institute

GLObAL COAL RISK ASSESSmENT - World Resources Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

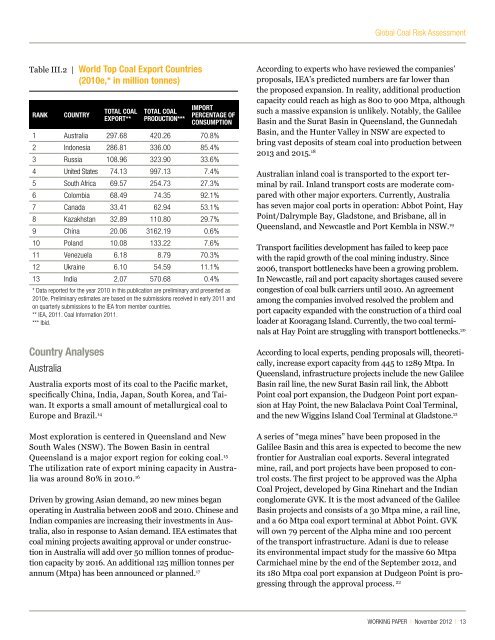

Table III.2 | <strong>World</strong> Top Coal Export Countries<br />

(2010e,* in million tonnes)<br />

RANK COUNTRY<br />

Country Analyses<br />

Australia<br />

TOTAL <strong>COAL</strong><br />

EXPORT**<br />

TOTAL <strong>COAL</strong><br />

PRODUCTION***<br />

IMPORT<br />

PERCENTAGE OF<br />

CONSUMPTION<br />

1 Australia 297.68 420.26 70.8%<br />

2 Indonesia 286.81 336.00 85.4%<br />

3 Russia 108.96 323.90 33.6%<br />

4 United States 74.13 997.13 7.4%<br />

5 South Africa 69.57 254.73 27.3%<br />

6 Colombia 68.49 74.35 92.1%<br />

7 Canada 33.41 62.94 53.1%<br />

8 Kazakhstan 32.89 110.80 29.7%<br />

9 China 20.06 3162.19 0.6%<br />

10 Poland 10.08 133.22 7.6%<br />

11 Venezuela 6.18 8.79 70.3%<br />

12 Ukraine 6.10 54.59 11.1%<br />

13 India 2.07 570.68 0.4%<br />

* Data reported for the year 2010 in this publication are preliminary and presented as<br />

2010e. Preliminary estimates are based on the submissions received in early 2011 and<br />

on quarterly submissions to the IEA from member countries.<br />

** IEA, 2011. Coal Information 2011.<br />

*** Ibid.<br />

Australia exports most of its coal to the Pacific market,<br />

specifically China, India, Japan, South Korea, and Taiwan.<br />

It exports a small amount of metallurgical coal to<br />

Europe and Brazil. 14<br />

Most exploration is centered in Queensland and New<br />

South Wales (NSW). The Bowen Basin in central<br />

Queensland is a major export region for coking coal. 15<br />

The utilization rate of export mining capacity in Australia<br />

was around 80% in 2010. 16<br />

Driven by growing Asian demand, 20 new mines began<br />

operating in Australia between 2008 and 2010. Chinese and<br />

Indian companies are increasing their investments in Australia,<br />

also in response to Asian demand. IEA estimates that<br />

coal mining projects awaiting approval or under construction<br />

in Australia will add over 50 million tonnes of production<br />

capacity by 2016. An additional 125 million tonnes per<br />

annum (Mtpa) has been announced or planned. 17<br />

Global Coal Risk Assessment<br />

According to experts who have reviewed the companies’<br />

proposals, IEA’s predicted numbers are far lower than<br />

the proposed expansion. In reality, additional production<br />

capacity could reach as high as 800 to 900 Mtpa, although<br />

such a massive expansion is unlikely. Notably, the Galilee<br />

Basin and the Surat Basin in Queensland, the Gunnedah<br />

Basin, and the Hunter Valley in NSW are expected to<br />

bring vast deposits of steam coal into production between<br />

2013 and 2015. 18<br />

Australian inland coal is transported to the export terminal<br />

by rail. Inland transport costs are moderate compared<br />

with other major exporters. Currently, Australia<br />

has seven major coal ports in operation: Abbot Point, Hay<br />

Point/Dalrymple Bay, Gladstone, and Brisbane, all in<br />

Queensland, and Newcastle and Port Kembla in NSW. 19<br />

Transport facilities development has failed to keep pace<br />

with the rapid growth of the coal mining industry. Since<br />

2006, transport bottlenecks have been a growing problem.<br />

In Newcastle, rail and port capacity shortages caused severe<br />

congestion of coal bulk carriers until 2010. An agreement<br />

among the companies involved resolved the problem and<br />

port capacity expanded with the construction of a third coal<br />

loader at Kooragang Island. Currently, the two coal terminals<br />

at Hay Point are struggling with transport bottlenecks. 20<br />

According to local experts, pending proposals will, theoretically,<br />

increase export capacity from 445 to 1289 Mtpa. In<br />

Queensland, infrastructure projects include the new Galilee<br />

Basin rail line, the new Surat Basin rail link, the Abbott<br />

Point coal port expansion, the Dudgeon Point port expansion<br />

at Hay Point, the new Balaclava Point Coal Terminal,<br />

and the new Wiggins Island Coal Terminal at Gladstone. 21<br />

A series of “mega mines” have been proposed in the<br />

Galilee Basin and this area is expected to become the new<br />

frontier for Australian coal exports. Several integrated<br />

mine, rail, and port projects have been proposed to control<br />

costs. The first project to be approved was the Alpha<br />

Coal Project, developed by Gina Rinehart and the Indian<br />

conglomerate GVK. It is the most advanced of the Galilee<br />

Basin projects and consists of a 30 Mtpa mine, a rail line,<br />

and a 60 Mtpa coal export terminal at Abbot Point. GVK<br />

will own 79 percent of the Alpha mine and 100 percent<br />

of the transport infrastructure. Adani is due to release<br />

its environmental impact study for the massive 60 Mtpa<br />

Carmichael mine by the end of the September 2012, and<br />

its 180 Mtpa coal port expansion at Dudgeon Point is progressing<br />

through the approval process. 22<br />

WORKING PAPER | November 2012 | 13