Kalpataru Power Transmission (KALPOW) - ICICI Direct

Kalpataru Power Transmission (KALPOW) - ICICI Direct

Kalpataru Power Transmission (KALPOW) - ICICI Direct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

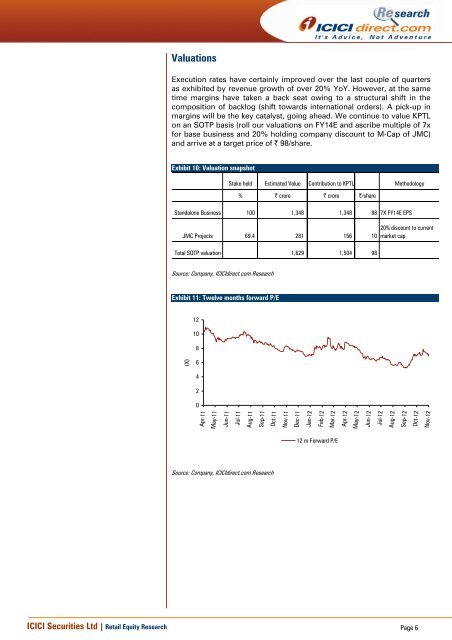

Valuations<br />

Execution rates have certainly improved over the last couple of quarters<br />

as exhibited by revenue growth of over 20% YoY. However, at the same<br />

time margins have taken a back seat owing to a structural shift in the<br />

composition of backlog (shift towards international orders). A pick-up in<br />

margins will be the key catalyst, going ahead. We continue to value KPTL<br />

on an SOTP basis (roll our valuations on FY14E and ascribe multiple of 7x<br />

for base business and 20% holding company discount to M-Cap of JMC)<br />

and arrive at a target price of | 98/share.<br />

Exhibit 10: Valuation snapshot<br />

Exhibit 11: Twelve months forward P/E<br />

(X)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Apr-11<br />

May-11<br />

Jun-11<br />

<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 6<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Stake held Estimated Value Contribution to KPTL Methodology<br />

% | crore | crore |/share<br />

Standalone Business 100 1,348 1,348 88 7X FY14E EPS<br />

JMC Projects 69.4 281 156 10<br />

Total SOTP valuation 1,629 1,504 98<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Nov-11<br />

Dec-11<br />

Jan-12<br />

Feb-12<br />

Mar-12<br />

12 m Forward P/E<br />

Apr-12<br />

May-12<br />

Jun-12<br />

Jul-12<br />

20% discount to current<br />

market cap<br />

Aug-12<br />

Sep-12<br />

Oct-12<br />

Nov-12