Patel Engineering (PATEN)

Patel Engineering (PATEN)

Patel Engineering (PATEN)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

March 27, 2008| <strong>Engineering</strong> & Construction<br />

Initiating Coverage<br />

<strong>Patel</strong> <strong>Engineering</strong> (<strong>PATEN</strong>)<br />

Realty engine …<br />

<strong>Patel</strong> <strong>Engineering</strong> is a mid-sized infrastructure player with a strong<br />

presence in high-margin hydropower construction projects. With a<br />

burgeoning order book and access to leading-edge technology, <strong>Patel</strong><br />

appears well placed to capitalise on the current infrastructure spending in<br />

the country. The company has also initiated moves to unlock the value of<br />

its urban land bank by transferring the rights to <strong>Patel</strong> Realty, a 100%<br />

subsidiary.<br />

• Set to capitalise on increased thrust on infrastructure<br />

<strong>Patel</strong>’s core competence is the construction of dams and powerhouses. With<br />

the increased focus on enhancing power generation capacity, the company's<br />

strength in terms of technology and experience is likely to ensure that it has<br />

an edge over competitors. <strong>Patel</strong> has contributed to a total of 7,000 MW out<br />

of the country’s total operating hydropower capacity of 32,000 MW.<br />

Assuming a 40% execution ratio and a 22% market share, the company is<br />

well poised to grab the underlying opportunity of nearly Rs 30,800 crore.<br />

• Robust order book, revenue mix in of favour high-margins projects<br />

The company’s order book amounts to Rs 5,500 crore. Hydropower projects<br />

accounted for 56% of the order book and irrigation 21%. The balance 23%<br />

was from transportation and urban infrastructure projects. Order inflows<br />

amounted to Rs 1,230 crore in H1FY08 against Rs 700 crore in H1FY07. The<br />

average size improved from Rs 150 crore to Rs 300 crore, with execution<br />

period of around 36 months. We expect the strategy of focusing on highmargin,<br />

high-value hydro power projects to boost margins.<br />

• Premium land bank; NAV at Rs 344 per share<br />

The company plans to monetize its historically held land bank by transferring<br />

the rights to a 100% subsidiary, <strong>Patel</strong> Realty. <strong>Patel</strong> has land bank of 986<br />

acres spread across tier I and tier-II cities such as Hyderabad (640 acres),<br />

Chennai (232 acres), Bangalore (82 acres), Mysore (21 acres), Mumbai (6<br />

acres), and Navi Mumbai (Panvel - 20 acres). It proposes to exploit the<br />

existing land bank in different phases and has already initialized phase 1 in<br />

Mumbai. The total developable area is estimated at 130 million sq ft (around<br />

12% of which will be developed in the first phase).<br />

Valuations<br />

Riding on its experience in constructing tunnels and pump houses for<br />

hydropower projects, <strong>Patel</strong> has also strengthened its position in the irrigation<br />

sector We have valued the stock using a SOTP valuation. We have valued<br />

the core business at 15x FY09 earnings, translating into Rs 418 per share.<br />

The NAV for the real estate segment works out to Rs 344 per share. We<br />

believe it should trade at a 20% discount which gives us a value of Rs 275<br />

per share. This gives us a total value of Rs 693.<br />

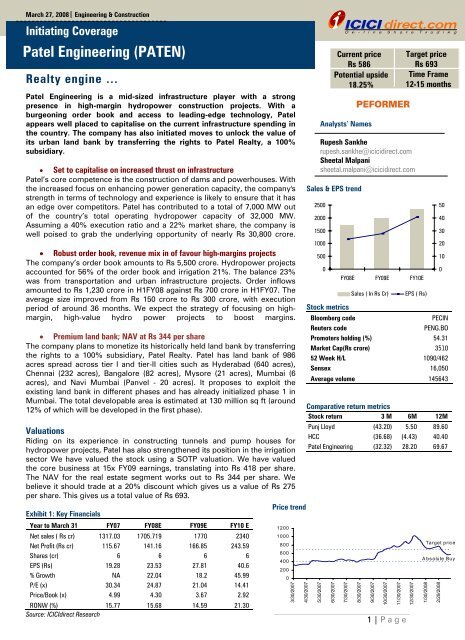

Exhibit 1: Key Financials<br />

Year to March 31 FY07 FY08E FY09E FY10 E<br />

Net sales ( Rs cr) 1317.03 1705.719 1770 2340<br />

Net Profit (Rs cr) 115.67 141.16 166.85 243.59<br />

Shares (cr) 6 6 6 6<br />

EPS (Rs) 19.28 23.53 27.81 40.6<br />

% Growth NA 22.04 18.2 45.99<br />

P/E (x) 30.34 24.87 21.04 14.41<br />

Price/Book (x) 4.99 4.30 3.67 2.92<br />

RONW (%) 15.77 15.68 14.59 21.30<br />

Source: ICICIdirect Research<br />

Price trend<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

3/30/2007<br />

Current price<br />

Rs 586<br />

Potential upside<br />

18.25%<br />

Sales & EPS trend<br />

2500<br />

2000<br />

1500<br />

1000<br />

Analysts’ Names<br />

Rupesh Sankhe<br />

rupesh.sankhe@icicidirect.com<br />

Sheetal Malpani<br />

sheetal.malpani@icicidirect.com<br />

500<br />

0<br />

Stock metrics<br />

FY08E FY09E FY10E<br />

Sales ( In Rs Cr) EPS ( Rs)<br />

1 | P age<br />

Target price<br />

Rs 693<br />

Time Frame<br />

12-15 months<br />

Bloomberg code PECIN<br />

Reuters code PENG.BO<br />

Promoters holding (%) 54.31<br />

Market Cap(Rs crore) 3510<br />

52 Week H/L 1090/462<br />

Sensex 16,050<br />

Average volume 145643<br />

Comparative return metrics<br />

Stock return 3 M 6M 12M<br />

Punj Lloyd (43.20) 5.50 89.60<br />

HCC (36.68) (4.43) 40.40<br />

<strong>Patel</strong> <strong>Engineering</strong> (32.32) 28.20 69.67<br />

4/30/2007<br />

5/30/2007<br />

6/30/2007<br />

7/30/2007<br />

PEFORMER<br />

8/30/2007<br />

9/30/2007<br />

10/30/2007<br />

11/30/2007<br />

12/30/2007<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Target price<br />

Absolute Buy<br />

1/30/2008<br />

2/29/2008

Company Background<br />

<strong>Patel</strong> <strong>Engineering</strong> is a prominent player in the hydro power and irrigation<br />

space. The company's strength in terms of technology and experience is<br />

likely to ensure that it has an edge over competitors in this space. Riding<br />

on its experience in constructing tunnels and pump houses for<br />

hydropower projects, <strong>Patel</strong> has also strengthened its position in the<br />

irrigation sector.<br />

Its project basket includes tunnels, dams, underground hydroelectric and<br />

irrigation projects, water conductor systems, nuclear and thermal power<br />

projects, bridges and marine works, highways, and residential and<br />

commercial complexes. The company has carved out a niche in<br />

underground works in the hydroelectric, transport and urban<br />

infrastructure space with its technical expertise in RCC works and micro<br />

tunneling.<br />

Source: ICICIdirect Research<br />

<strong>Patel</strong> <strong>Engineering</strong><br />

Multipurpose power Irrigation Projects Transportation<br />

56% of current order<br />

book (Rs 3,080 crore)<br />

21% of current order<br />

book (Rs 1,155 crore)<br />

Share holding pattern<br />

Shareholder % holding<br />

Promoters 54.31<br />

Institutional investors 19.37<br />

General Public 26.15<br />

Promoter & Institutional holding trend (%)<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

23% of current order<br />

book (Rs 1,265 crore)<br />

EBITDA: 17-22% EBITDA: 10-13% EBITDA: 7-9%<br />

Source: Company, ICICIdirect Research<br />

ICICIdirect | Equity Research<br />

Q3 2007 Q2 2007 Q1 2007 Q4 2006<br />

Promoters Institutions General Public<br />

2 | P age<br />

Real Estate<br />

15.6 million sq ft<br />

developmental plan<br />

in phase 1<br />

EBITDA: 45-50%

INVESTMENT RATIONALE<br />

• To capitalise on increased thrust on infrastructure<br />

<strong>Patel</strong>’s core competence is construction of dams and<br />

powerhouses. With the increased focus on enhancing power<br />

generation capacity, the company's strength in terms of<br />

technology and experience is likely to ensure that it has an edge<br />

over competitors. The 11th Five-Year Plan (2007-2012) has<br />

envisaged $492 billion for infrastructure spending.<br />

Through its subsidiaries in the US, <strong>Patel</strong> has access to<br />

technology that gives it an advantage to bid for new projects.<br />

Roller Compacted Concrete (RCC) technology for building dams<br />

reduces project execution time and cost by replacing cement<br />

with fly ash. RCC is internationally accepted and has already been<br />

used by the company in Maharashtra.<br />

Exhibit 3: Order-book break-down by segment (FY07)<br />

22%<br />

19%<br />

Source:: Company, ICICIdirect Research<br />

12%<br />

Exhibit 4: Hydropower opportunity<br />

Particulars 11<br />

3 | Page th Five Year Plan 12 th Five Year Plan Total<br />

MW 20,000 50,000 70,000<br />

Implementation ratio (%) 40 40 40<br />

Cost per MW (Rs crore) 5 5 5<br />

Total cost (Rs crore) 40,000 100,000 140,000<br />

<strong>Patel</strong>’s market share (%) 22 22 22<br />

Opportunity size for <strong>Patel</strong>(Rs.crore) 8,800<br />

Source: Planning Commission, ICICIdirect Research<br />

22,000 30,800<br />

16%<br />

31%<br />

Power Roads Real estate Water and irrigation Others<br />

Hydro and thermal power: A huge opportunity<br />

The Central government plans to increase power generation<br />

capacity by 20,000 MW in the 11th Five Year Plan, and 50,000 MW<br />

in the 12th Plan. Currently, <strong>Patel</strong> has a 22% market share in hydro<br />

and thermal power projects. At an investment of Rs 5 crore per<br />

MW and assuming a 40% implementation ratio, we believe the<br />

potential opportunity size for the company is Rs 30,800 crore.<br />

<strong>Patel</strong> is already a major player in the hydropower space and has<br />

contributed to a total of 7,000 MW out of the country’s total<br />

operating hydropower capacity of 32,000 MW.<br />

<strong>Patel</strong> is present in power, roads,<br />

and irrigation segment and will be<br />

a major beneficiary of the<br />

increased thrust on infrastructure

The present installed capacity is largely in the states’ sector (about<br />

55%) and this is followed by the central sector (33%), and the<br />

balance by the private sector. Going forward, most of the<br />

investments would come from the private sector due to paucity of<br />

funds by state and central governments, and the increased ability of<br />

the private sector to mobilize funds for these projects.<br />

Exhibit 5: Planned capacity additions (MW)<br />

Thermal Hydro Total<br />

Year Incr. add Cum. Add Incr. add Cum. Add Incr. add Cum. Add<br />

FY08 13,000 114,000 2,000 40,000 15,000 154,000<br />

FY09 18,000 132,000 2,000 42,000 20,000 174,000<br />

FY10 7,000 139,000 4,000 46,000 11,000 185,000<br />

FY11 4,000 143,000 7,000 53,000 11,000 196,000<br />

FY12 3,000 146,000 4,000 57,000 7,000 203,000<br />

Total 45,000 19,000 64,000<br />

Source: ICICIdirect, Research<br />

Additional power requirement in India will be nearly 70,000-75000<br />

MW in the 12 th Five Year Plan (2012-17) under different economic<br />

scenarios. Majority of the additional requirement will come from<br />

hydro and thermal power, where <strong>Patel</strong> has significant presence.<br />

Exhibit 6: Total capacity addition required in 12th Five Year Plan<br />

GDP/Electricity<br />

Installed Additional capacity<br />

GDP growth<br />

Elasticity Peak demand<br />

capacity<br />

required<br />

8% 0.8 215700 280300 70800<br />

8% 0.9 224600 291700 82200<br />

9% 0.8 224600 291700 82200<br />

9% 0.9 233300 303800 94300<br />

10% 0.8 232300 302300 92800<br />

10% 0.9 244000 317300 107500<br />

Source: ICICIdirect, Research<br />

Exhibit 7: Thermal power capacity expansion (MW)<br />

70000<br />

60000<br />

50000<br />

40000<br />

30000<br />

20000<br />

10000<br />

0<br />

Source: ICICIdirect Research<br />

8th Plan 9th Plan 10th Plan 11th Plan<br />

4 | P age<br />

The government’s initiatives<br />

of “Power for All” and other<br />

programmes would require<br />

significant capacity additions<br />

from private sector players<br />

The demand supply mismatch is<br />

going to continue going forward<br />

and <strong>Patel</strong> could leverage its<br />

experience to further strengthen its<br />

market position.<br />

This huge plan by the Central<br />

government augurs well for <strong>Patel</strong><br />

<strong>Engineering</strong>, due to its track record<br />

in the thermal sector and would<br />

benefit from these government<br />

initiatives

Exhibit 8: On-going hydro power projects<br />

Project State Client<br />

Construction of RCC Dam for Ghatghar<br />

Irrigation Department of<br />

Pumped Storage Scheme Maharashtra<br />

Maharashtra State<br />

Hydro Electric Project, Stage IV –<br />

Department of<br />

Extension of HRT<br />

Civil and Hydro-mechanical works for<br />

Diversion Dam and Part Head Race<br />

Tunnel for Parbati H.E. Project – Lot PB.1<br />

Maharashtra<br />

Maharashtra State<br />

(4 x 200MW)<br />

Sewa H.E. Project, Stage-II - Lot-SW.2 of<br />

Himachal Pradesh NHPC<br />

120MW (3 x 40MW)<br />

Teesta Low Dam H.E. Project, Stage-III -<br />

Jammu & Kashmir NHPC<br />

Lot TL-1 of 132 MW (4 x 33MW)<br />

Kameng Hydro Electric Project, Package I,<br />

West Bengal NHPC<br />

II and III,<br />

PB III : Lot 1:Construction of Diversion<br />

Cum Spillway Tunnels including Gates,<br />

Coffer dams, Rockfill dam, Spillway,<br />

Intake Structures and Part Head Race<br />

Arunachal Pradesh NEEPCO<br />

Tunnel, Stage III ( 4 x 130 MW )<br />

Source: Company, ICICIdirect Research<br />

Himachal Pradesh NHPC<br />

Water and irrigation projects<br />

According to the 11 th Five Year Plan, the government has targeted 10<br />

million hectares under Accelerated Irrigation Benefit Program. Riding on its<br />

experience in constructing tunnels and pump-houses for hydropower<br />

projects, <strong>Patel</strong> has also strengthened its position in the irrigation sector. It<br />

has now bagged orders for lift irrigation projects in Andhra Pradesh as an<br />

EPC (<strong>Engineering</strong>, Procurement and Construction) contractor. Entry into<br />

EPC has enabled it to move up the value chain and is likely to fetch better<br />

operating margins.<br />

Exhibit 9: Order book for irrigation projects (Rs crore)<br />

March 31, 2005 1,150<br />

March 31, 2006 1,500<br />

March 31, 2007 1,280<br />

December 31, 2007<br />

Source: Company.ICICIdirect Research<br />

1,190<br />

5 | P age

Exhibit 10: On-going irrigation projects<br />

Project State Client Value (Rs<br />

crore)<br />

Bhima Lift Irrigation Project, Lift-I, Andhra<br />

Pradesh<br />

Kalwakurthy Lift Irrigation Project, Stage-<br />

I Pumping Station with 5 x 30MW Pump<br />

Motors<br />

Jawahar Lift Irrigation Project, Stage-I &<br />

II<br />

Source: Company, ICICIdirect Research<br />

Andhra<br />

Pradesh<br />

Andhra<br />

Pradesh<br />

Irrigation & CAD<br />

Department, Andhra<br />

Pradesh<br />

Irrigation & CAD<br />

Department, Andhra<br />

Pradesh<br />

Irrigation & CAD<br />

Department, Andhra<br />

Pradesh<br />

Road and transport: Moving towards annuity based projects<br />

According to Crisil, over the next five years, investment in the roads sector<br />

is expected to increase at a CAGR of 24%. During this period, it is expected<br />

that investments amounting to US$19 billion would be incurred on roads<br />

related projects. Private investment is expected to bring in US$1.8 billion<br />

as an equity component in respect of the NHAI BOT projects that are<br />

expected to be awarded in the next five years.<br />

<strong>Patel</strong> has a considerable experience in various segments in building<br />

highways, tunnels and flyovers. Recently it has started focusing on annuity<br />

projects and BOT projects, whereas earlier it was focusing on cash<br />

projects. This move will provide a lot of stability towards the cash flows<br />

and thus will give impetus to the company for future projects.<br />

<strong>Patel</strong> currently has two projects underway which are on annuity based and<br />

these projects are low risk as the company is assured of fixed annuity<br />

payment irrespective of the traffic movement and toll collection. These<br />

projects will provide the stability to the cash flows. In this case, the only<br />

drawback is that the margins are on the lower side.<br />

Exhibit 11: Annuity-based road projects<br />

Project cost (Rs<br />

Project Length ( km)<br />

crore) Debt to equity<br />

AP7 61 600 3 to 1<br />

KNT 1 53 440 3 to 1<br />

Source: Company, ICICIdirect Research<br />

Exhibit 12: Order book for road and transport projects (Rs crore)<br />

Mar 31, 2005 100<br />

Mar 31, 2006 850<br />

Mar 31, 2007 1180<br />

Dec 31, 2007 1265<br />

Source: Company, ICICIdirect Research<br />

6 | P age<br />

210<br />

480<br />

640<br />

<strong>Patel</strong>’s order book has been<br />

growing consistently

Exhibit 13: Transport projects underway<br />

Project State Client name<br />

Karnataka<br />

Rehabilitation of Road from Alnavar to<br />

State<br />

Yellapur in Belgaum and Uttar Kannada<br />

East-West Corridor, Assam, Contract<br />

Karnataka<br />

highways<br />

Package No. EW-II (AS-18) Assam NHAI<br />

Northeast<br />

Construction of Single Line BG Tunnel<br />

Frontier<br />

No. 7 & No 10<br />

Lumding to Lanka section I/c Lanka<br />

Bypass of NH-54 in Assam on East<br />

Assam<br />

Railway<br />

West Corridor under Phase-II (AS - 15) Assam NHAI<br />

Rehabilitation of Road from Pune Nagar<br />

New Pune<br />

Road Ramvadi Jakar Naka to New Pune<br />

Municipal<br />

Municipal Co. limit.<br />

Source: Company, ICICIdirect Research<br />

Maharashtra<br />

Corporation<br />

Robust order book – revenue mix in of favour high-margins projects<br />

<strong>Patel</strong>’s order book amounts to Rs 5,500 crore comprising multi-purpose<br />

power projects, irrigation & water supply and transport & others.<br />

Currently the company has L1 status for contracts worth Rs 200 cr and<br />

has bid for projects worth Rs 9,000 crore. The order book composition<br />

has changed in the favour of high-margin multi-purpose power projects<br />

in the last 2-3 years. The company has a very well-diversified order book<br />

with the right mix of short as well as long gestation project. <strong>Patel</strong> has<br />

maintained its presence by ensuring balance mix of projects in its<br />

pipeline without over depending on single stream of projects.<br />

Exhibit 14: Order-book (% break-up for last 3 years)<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Source: Company, ICICIdirect Research<br />

FY06 FY07 FY08<br />

Multipurpose Irrigation Transportation<br />

7 | P age<br />

<strong>Patel</strong> has maintained its leadership<br />

position in hydropower business due<br />

to its technological edge over its<br />

peers and this will help it to maintain<br />

margins better

Order-book mix shifting towards high-margin business<br />

The revenue mix is moving in favour of hydro and multipurpose<br />

power projects where the margins are higher. The order mix is<br />

expected to improve the margins of the company by 150 bps in next<br />

financial year. These projects are long gestation projects, but the<br />

business mix is moving in favour of power (56% to 66%), where<br />

margins are higher than irrigation and transport projects.<br />

Exhibit 15: Projected order-book mix for next 3 years<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

4<br />

40<br />

56<br />

22<br />

38<br />

40<br />

20<br />

26 24 19<br />

25 16 16<br />

55 58 60<br />

FY05 FY06 FY07 FY08 FY09E FY10E<br />

Source: Company, ICICIdirect Research<br />

Multipurpose Power Irrigation and water supply Transpor and others<br />

The company has a focused approach on high margin projects and a<br />

right mix of short as well as long gestation projects. The company’s<br />

EBITDA margins are on the higher end of the comparable peer set<br />

spectrum (13.6%- FY07).<br />

Plans to unlock value from land bank; Real estate; NAV at Rs 344 per<br />

share<br />

<strong>Patel</strong> has forayed into real estate development and has transferred<br />

the development rights of 987 acres of land in various cities to its<br />

100% subsidiary, <strong>Patel</strong> Realty. The company has finalised<br />

development plans for 124 acres at the initial stage. Apart from this,<br />

<strong>Patel</strong> also has another 186 acres of land which it does not wish to<br />

take on hand for development as on date.<br />

Exhibit 16: Land bank details<br />

Location Area ( acres)<br />

Hyderabad 650<br />

Chennai 190<br />

Bangalore 100<br />

Panvel 20<br />

Mumbai 6.5<br />

Mysore 20<br />

Total<br />

Source: Company, ICICIdirect Research<br />

986.5<br />

8 | P age<br />

15<br />

66

Exhibit 17: Percentage distribution of land bank<br />

19%<br />

Source: Company, ICICIdirect Research<br />

9%<br />

3%<br />

69%<br />

Mumbai Hyderabad Chennai Bangalore<br />

Profits from phase 1 developmental estimated at Rs 1,990 crore<br />

The company plans to develop nearly 15.63 million sq ft by FY14.<br />

The initial developmental phase will cover properties in Mumbai,<br />

Bangalore and Hyderabad. The company expects sales of Rs 4,860<br />

crore and net profit of Rs 1,990 crore. It plans to fund all its real<br />

estate projects through short-term debt and internal accruals. Most<br />

of the revenues from real estate projects are likely to come post<br />

FY09.<br />

Exhibit 18: Phase developmental plans<br />

Location Area (mn sq ft) Completion time<br />

Expected sales<br />

( Rs crore)<br />

9 | P age<br />

Expected profit<br />

(Rs crore)<br />

Jogeshwari Corp Park 0.08 July 2008 80 60<br />

Jogeshwari Corp Tower 0.75 June 2011 750 520<br />

Gachibowli, Hyderabad 2.7 Sept 2011 1008 352<br />

Electronic City, Bangalore 12.1 Sep t2014 3025 1058<br />

Total<br />

Source: Company, ICICIdirect Research<br />

15.63 4863 1990

NEW DEVELOPMENTS<br />

MoU with Arunachal Pradesh government<br />

<strong>Patel</strong> <strong>Engineering</strong> has entered into a MoU with the Arunachal<br />

Pradesh government for setting up a 100 MW Gongri hydel project<br />

in West Kameng district. The project shall be implemented on a<br />

BOOT basis for a lease period of 40 years from the commercial<br />

operation date. The expected revenue from the project is Rs 120<br />

crore a year. The company is already executing the Kameng 600<br />

MW hydel project for NEEPCO on cash contract. Therefore,<br />

logistics will be easily managed and there will be saving in<br />

overhead costs as well. This will help <strong>Patel</strong> to boost its margins<br />

further.<br />

Looking to acquire coal mines in foreign countries<br />

The company is looking to acquire coal mines in South Africa,<br />

Mozambique and Indonesia. The company is looking to have coal<br />

requirements for next 15-20 years and plans to raise funds for the<br />

same. The company is planning a capex requirement of nearly Rs<br />

100 crore.The acquisition of cola mines will provide raw material<br />

for its power projects as coal is in short supply in relation to its<br />

demand<br />

JV with KNR constructions: Bagged projects worth Rs 200 crore<br />

<strong>Patel</strong> <strong>Engineering</strong>, in a joint venture with KNR constructions,<br />

recently bagged a contract worth Rs 200 crore from NHAI for sixlane<br />

road between Madurai and Kanyakumari in Tamil Nadu.<br />

10 | P age

RISKS & CONCERNS<br />

Increasing competition in power sector<br />

Many big players have identified the power sector as major<br />

opportunity and they are bidding aggressively to get the<br />

hydropower projects. The main players emerging in this segment<br />

is L&T and Jai Prakash Hydro. With new companies such as India<br />

bulls Power and GMR Energy entering the fray, competition will<br />

only go up going forward.<br />

Lack of clarity on real estate development<br />

Any downturn in the real estate sector would impact the bottomline<br />

of the company over a long period of time, as the company<br />

has plans to foray into real estate. The company has given little<br />

clarity on the developmental plan and just given the details on the<br />

12% of the total developmental plan.<br />

Execution risk<br />

Project execution risk and payment risk are the major risks<br />

associated with the construction companies.<br />

11 | P age

FINANCIAL SUMMARY<br />

Sales and net profit to post steady rise<br />

<strong>Patel</strong> will have stable sales growth for next 2 years, but the revenue<br />

mix will change from low margin business to high margin business.<br />

From FY10 onwards, real estate business will start contributing to the<br />

top line. The net margins from the real estate would be around 25%<br />

and give overall margins of 14% on the net profit level. We expect<br />

sales to rise at a 22% CAGR from Rs 1,300 crore in FY07 to Rs 2,340<br />

crore in FY10E.<br />

Exhibit 19: Revenue mix<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

Source: ICICIdirect Research<br />

FY09E FY10E<br />

Power Irrigation Transport Real estate<br />

Exhibit 20: Steady growth in sales and net profits<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

Source: ICICIdirect Research<br />

FY08E FY09E FY10E<br />

Sales ( In Rs Cr) Net Profit Margin (%)<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

12 | P age<br />

From FY10, real estate business will start<br />

to contribute to the PEC top line, thus it<br />

will further improve the margins. Also<br />

multipurpose power contribution will<br />

increase relatively to irrigation and<br />

transport business

High margin revenue mix to boost operating efficiency<br />

<strong>Patel</strong>’s main business of hydropower construction and irrigation<br />

projects has yielded superior operating profit margins (OPM) over<br />

the years. We expect the company would improve its margins going<br />

forward. Once the high margin real estate business starts<br />

contributing, the margins are expected to further improve. <strong>Patel</strong>’s<br />

margins are expected to rise from 14% in FY08 to 15% in FY09, and<br />

further to 24% in FY10E. From FY08E to FY09E, margins will improve<br />

due to higher proportion of revenue from hydropower business and<br />

then in FY10E, margins are likely to show jump as real estate<br />

business starts to contribute. The real estate business will have<br />

operating margins between 45-50%.<br />

Exhibit 21: Operating margins trend<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

14.260<br />

8.38<br />

Source: ICICIdirect Research<br />

15.774<br />

9.53<br />

FY08E FY09E FY10E<br />

Operating Margin Net Margins<br />

23.821<br />

13.06<br />

13 | P age

VALUATION<br />

Core business valuation<br />

<strong>Patel</strong>’s core business comprises of multipurpose power, irrigation<br />

and transport business. The company has set up in-house<br />

capability for the purpose of its business lines. We expect net sales<br />

to grow at a 22% CAGR over FY07-FY10E, while the EPS will see a<br />

28% CAGR during the same period due to higher margins.<br />

Margins are expected to improve due to scalability, experience and<br />

higher margin revenue mix which would help company to make<br />

higher margins and thus would command higher P/E multiple. We<br />

have valued the company at 15x its FY09E EPS which gives us a<br />

value of its Core business at Rs 418. FY09E EPS reflects earnings<br />

form core business and does not include any income form real<br />

estate business.<br />

Exhibit 22: P/E band<br />

900<br />

700<br />

500<br />

300<br />

100<br />

Apr-05<br />

Jul-05<br />

Source: ICICIdirect Research<br />

Oct-05<br />

Jan-06<br />

Apr-06<br />

Jul-06<br />

`<br />

Oct-06<br />

Jan-07<br />

Apr-07<br />

Jul-07<br />

Oct-07<br />

Jan-08<br />

14 | P age<br />

30X<br />

25X<br />

21X<br />

18X

Real estate business valuation<br />

The company’s real estate plans are still in the nascent stages and<br />

there is lack of clarity as far as developmental plan is concerned.<br />

The management just revealed developmental plans on 15.6<br />

million sq ft out of total developmental plan of 135 million sq ft. We<br />

have done the valuation of the real estate business by taking the<br />

current realization from the land and adding the developer’s<br />

margins. The developer’s margin is assumed at 30%. The base<br />

case value per share comes to Rs 344 at the NAV.Under current<br />

market conditions most real estate companies are trading at 20%<br />

discount to theirs NAVs and we believe that same should be<br />

applied to patel real estate business and hence we assigned per<br />

share value of real estate business at Rs 275 per share<br />

Exhibit 23: Real estate valuation matrix<br />

Pessimistic case Base Case<br />

15 | P age<br />

Optimistic<br />

case<br />

Land ( Acre)<br />

Mumbai<br />

Jogeshwari Mumbai 6 12 16 20<br />

Panvel Mumbai 20 2.8 4 6<br />

Total realizations from Mumbai 128 176 240<br />

Add :Net developmental margin 20.00% 25.6 35.2 48<br />

Total value of Mumbai property 153.6 211.2 288<br />

Chennai 232 0.4 0.7 1<br />

Total realizations from Chennai 92.8 162.4 232<br />

Add :Net Developmental margin 20.00% 18.56 32.48 46.4<br />

Total value of Chennai property 111.36 194.88 278.4<br />

Bangalore 82 5.5 7.5 9<br />

Realizations from Bangalore 451 615 738<br />

Add: Net Developers margin 20.00% 90.2 123 147.6<br />

Total value of Bangalore property 541.2 738 885.6<br />

Hyderabad 174 6.5 9 10<br />

Realizations from Hyderabad 1131 1566 1740<br />

Add :Net developmental margin 20.00% 226.2 313.2 348<br />

Total value of Hyderabad property 1357.2 1879.2 2088<br />

Total Value of Land 2163.36 3023.28 3540<br />

Less :Taxes 757.18 1058.15 1239<br />

Net Asset Value 1406.18 1965.13 2301<br />

No of shares 5.7 5.7 5.7<br />

Value per share 246.7 344.76 403.68<br />

Source: ICICIdirect, Research<br />

Exhibit 24: SOTP valuation<br />

Particulars Rs per share Valuation comment<br />

Core business 418 15 X FY09 E Earnings<br />

Real estate 275 At 20% dis. to NAV<br />

Total 693<br />

Source: ICICIdirect, Research

Profit and Loss account<br />

(Year-end March) FY07 FY08E FY09E FY10E<br />

Sales 1295.63 1684.32 2000.00 2340<br />

% Growth 41.13 30.00 18.74 17.00<br />

Op Profit 174.68 240.19 271.47 557.40<br />

% Growth 21.86 37.50 13.02 105.33<br />

Depreciation 34.90 41.60 43.68 52.86<br />

EBIT 139.78 198.59 227.79 504.54<br />

% Growth 24.57 42.07 14.70 121.49<br />

Interest 9.67 17.62 23.76 32.90<br />

Profit before Tax 130.11 180.97 208.56 304.49<br />

% Growth 61.07 39.09 15.24 45.99<br />

Taxation 14.44 39.81 41.71 60.89<br />

Net Profit 115.67 141.16 166.85 243.59<br />

% Change YoY 57.31 22.04 18.20 45.99<br />

Balance sheet<br />

Liabilities FY07 FY08E FY09E FY10E<br />

Share Capital 5.97 5.97 5.97 5.97<br />

Reserves Total 697.20 727.36 894.21 1137.79<br />

Total Shareholders Funds 703.17 733.33 900.18 1143.76<br />

Secured Loans 409.24 391.61 459.36 576.29<br />

Unsecured Loans 51.13 97.90 114.84 144.07<br />

Total Debt 460.37 489.37 574.21 720.36<br />

Current liabilities 284.62 352.85 423.65 517.25<br />

Net differ tax 10.81 10.81 10.81 10.81<br />

Total<br />

Assets<br />

1458.99 1586.27 1908.76 2392.10<br />

Gross block 196.19 259.13 280.72 390.00<br />

Acc dep: 41.60 85.28 138.14<br />

Net block 196.19 217.53 195.44 251.86<br />

Capital In progress 7.92 0.00 0.00 0.00<br />

Investments 191.83 191.83 191.83 191.83<br />

Cash 88.64 53.04 197.62 390.54<br />

Trade receivables 263.94 341.16 510.87 712.46<br />

Loans and advances 320.64 350.00 350.00 350.00<br />

Inventories 389.83 432.71 463.00 495.41<br />

Total Current assets 1063.05 1315.70 1515.70 1749.70<br />

Total 1458.99 1586.27 1908.76 2392.10<br />

16 | P age<br />

The growth in EBIT is mainly<br />

contributed by real estate business<br />

The interest cost will rise in due<br />

course as company has huge<br />

capex plan in coming 2 years.

Cash Flow statement<br />

FY07 FY08E FY09E FY10E<br />

Profit before Tax 123.06 180.97 208.56 304.49<br />

Depreciation 26.74 41.60 43.68 52.86<br />

Cash flows before WC 165.01 222.57 252.24 357.35<br />

Net increase in Current Assets 316.66 252.65 200.00 234.00<br />

Net increase in current Liabilities 54.53 68.23 70.80 93.60<br />

Others 25.97 0.00 0.00 0.00<br />

Cash flows after WC changes<br />

Extraordinary items<br />

-138.30 38.15 123.04 216.95<br />

Purchase of fixed assets -51.54 -62.94 -21.59 -109.28<br />

Others/investment -150.54 0.00 0.00<br />

Cash flows from investing activities -202.08 -62.94 -21.59 -109.28<br />

Equity capital 425.00 0.00 0.00 0.00<br />

Inc./Dec in loan funds 9.57 29.00 84.84 146.15<br />

Others/taxes 57.56 39.81 41.71 60.90<br />

Cash flows from financing activities 377.01 -10.81 43.13 85.26<br />

Operating bal cash and cash equivalents 52.01 88.64 53.04 197.62<br />

Closing Cash 88.64 53.04 197.62 390.54<br />

Ratios<br />

(Year-end March) FY07 FY08E FY09E FY10E<br />

EPS 19.28 23.53 27.81 40.60<br />

Book Value 117.20 135.98 159.50 200.10<br />

Net Profit Margin (%) 8.93 8.38 8.34<br />

10.41<br />

RONW (%) 15.77 15.68 14.59 21.30<br />

ROCE (%) 12.32 13.10 15.15 15.97<br />

Enterprise Value 3,881.73 3,835.33 3,775.59 3,728.82<br />

EV/EBIDTA 22.22 15.97 11.97 6.69<br />

Sales to Equity 1.84 1.99 1.98 1.86<br />

Market Cap 3,510.00 3,510.00 3,510.00 3,510.00<br />

Market Cap to sales 2.71 2.08 1.76 1.50<br />

Price to Book Value 4.99 4.30 3.67 2.92<br />

PE 30.34 24.87 21.04 14.41<br />

No. of Shares 6.00 6.00 6.00 6.00<br />

DuPont Analysis<br />

FY07 FY08E FY09E FY10E<br />

PAT/PBT 0.89 0.78 0.80 0.80<br />

PBT/EBIT 0.93 0.91 0.77 0.60<br />

EBIT/sales 0.11 0.12 0.14 0.22<br />

Sales/asset 0.63 0.82 0.88 0.84<br />

Asset/equity 2.75 2.24 1.92 2.40<br />

RONW (%) 15.77 15.68 14.59 21.30<br />

17 | P age<br />

The real estate business will<br />

improve the return ratios due to<br />

better profitability

RATING RATIONALE<br />

ICICIdirect endeavors to provide objective opinions and recommendations. ICICIdirect assigns ratings to its<br />

stocks according to their notional target price vs. current market price and then categorises them as<br />

Outperformer, Performer, Hold, and Underperformer. The performance horizon is 2 years unless specified and<br />

the notional target price is defined as the analysts' valuation for a stock.<br />

Outperformer: 20% or more;<br />

Performer: Between 10% and 20%;<br />

Hold: +10% return;<br />

Underperformer: -10% or more.<br />

Harendra Kumar Head - Research & Advisory harendra.kumar@icicidirect.com<br />

ICICIdirect Research Desk,<br />

ICICI Securities Limited,<br />

Mafatlal House, Ground Floor,<br />

163, H T Parekh Marg,<br />

Churchgate, Mumbai – 400 020<br />

research@icicidirect.com<br />

Disclaimer<br />

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered<br />

in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form,<br />

without prior written consent of ICICI Securities Ltd (I-Sec). The author of the report does not hold any investment in any of the<br />

companies mentioned in this report. I-Sec may be holding a small number of shares/position in the above-referred companies as on<br />

date of release of this report. This report is based on information obtained from public sources and sources believed to be reliable, but<br />

no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is<br />

solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or<br />

subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice<br />

or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed<br />

and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on<br />

their own investment objectives, financial positions and needs of specific recipient. This report may not be taken in substitution for the<br />

exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. I-Sec and<br />

affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not<br />

necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. I-Sec may have<br />

issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. This report<br />

is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality,<br />

state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or<br />

which would subject I-Sec and affiliates to any registration or licensing requirement within such jurisdiction. The securities described<br />

herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this<br />

document may come are required to inform themselves of and to observe such restriction.<br />

18| P age