Patel Engineering (PATEN)

Patel Engineering (PATEN)

Patel Engineering (PATEN)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

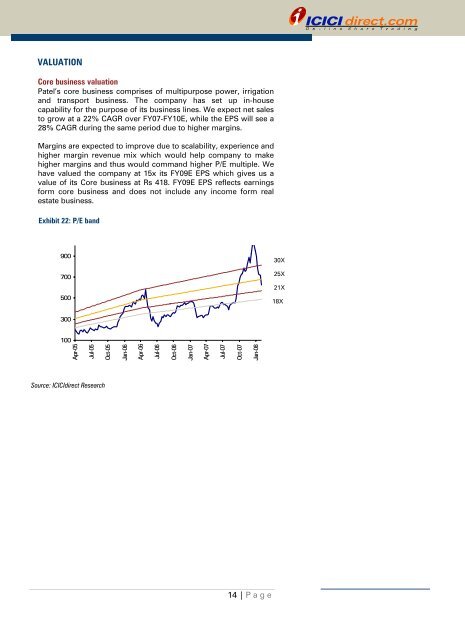

VALUATION<br />

Core business valuation<br />

<strong>Patel</strong>’s core business comprises of multipurpose power, irrigation<br />

and transport business. The company has set up in-house<br />

capability for the purpose of its business lines. We expect net sales<br />

to grow at a 22% CAGR over FY07-FY10E, while the EPS will see a<br />

28% CAGR during the same period due to higher margins.<br />

Margins are expected to improve due to scalability, experience and<br />

higher margin revenue mix which would help company to make<br />

higher margins and thus would command higher P/E multiple. We<br />

have valued the company at 15x its FY09E EPS which gives us a<br />

value of its Core business at Rs 418. FY09E EPS reflects earnings<br />

form core business and does not include any income form real<br />

estate business.<br />

Exhibit 22: P/E band<br />

900<br />

700<br />

500<br />

300<br />

100<br />

Apr-05<br />

Jul-05<br />

Source: ICICIdirect Research<br />

Oct-05<br />

Jan-06<br />

Apr-06<br />

Jul-06<br />

`<br />

Oct-06<br />

Jan-07<br />

Apr-07<br />

Jul-07<br />

Oct-07<br />

Jan-08<br />

14 | P age<br />

30X<br />

25X<br />

21X<br />

18X