Patel Engineering (PATEN)

Patel Engineering (PATEN)

Patel Engineering (PATEN)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

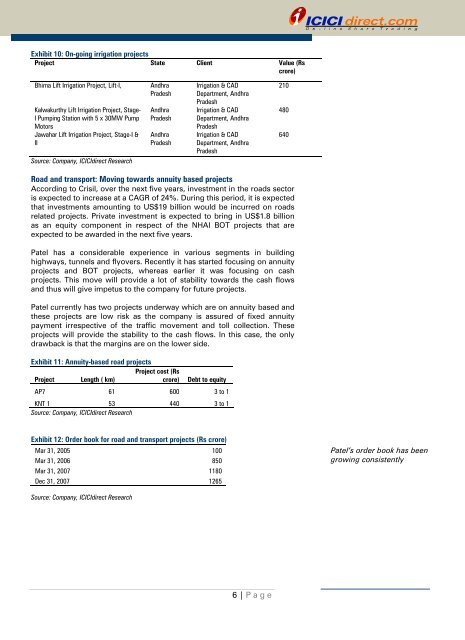

Exhibit 10: On-going irrigation projects<br />

Project State Client Value (Rs<br />

crore)<br />

Bhima Lift Irrigation Project, Lift-I, Andhra<br />

Pradesh<br />

Kalwakurthy Lift Irrigation Project, Stage-<br />

I Pumping Station with 5 x 30MW Pump<br />

Motors<br />

Jawahar Lift Irrigation Project, Stage-I &<br />

II<br />

Source: Company, ICICIdirect Research<br />

Andhra<br />

Pradesh<br />

Andhra<br />

Pradesh<br />

Irrigation & CAD<br />

Department, Andhra<br />

Pradesh<br />

Irrigation & CAD<br />

Department, Andhra<br />

Pradesh<br />

Irrigation & CAD<br />

Department, Andhra<br />

Pradesh<br />

Road and transport: Moving towards annuity based projects<br />

According to Crisil, over the next five years, investment in the roads sector<br />

is expected to increase at a CAGR of 24%. During this period, it is expected<br />

that investments amounting to US$19 billion would be incurred on roads<br />

related projects. Private investment is expected to bring in US$1.8 billion<br />

as an equity component in respect of the NHAI BOT projects that are<br />

expected to be awarded in the next five years.<br />

<strong>Patel</strong> has a considerable experience in various segments in building<br />

highways, tunnels and flyovers. Recently it has started focusing on annuity<br />

projects and BOT projects, whereas earlier it was focusing on cash<br />

projects. This move will provide a lot of stability towards the cash flows<br />

and thus will give impetus to the company for future projects.<br />

<strong>Patel</strong> currently has two projects underway which are on annuity based and<br />

these projects are low risk as the company is assured of fixed annuity<br />

payment irrespective of the traffic movement and toll collection. These<br />

projects will provide the stability to the cash flows. In this case, the only<br />

drawback is that the margins are on the lower side.<br />

Exhibit 11: Annuity-based road projects<br />

Project cost (Rs<br />

Project Length ( km)<br />

crore) Debt to equity<br />

AP7 61 600 3 to 1<br />

KNT 1 53 440 3 to 1<br />

Source: Company, ICICIdirect Research<br />

Exhibit 12: Order book for road and transport projects (Rs crore)<br />

Mar 31, 2005 100<br />

Mar 31, 2006 850<br />

Mar 31, 2007 1180<br />

Dec 31, 2007 1265<br />

Source: Company, ICICIdirect Research<br />

6 | P age<br />

210<br />

480<br />

640<br />

<strong>Patel</strong>’s order book has been<br />

growing consistently