Patel Engineering (PATEN)

Patel Engineering (PATEN)

Patel Engineering (PATEN)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

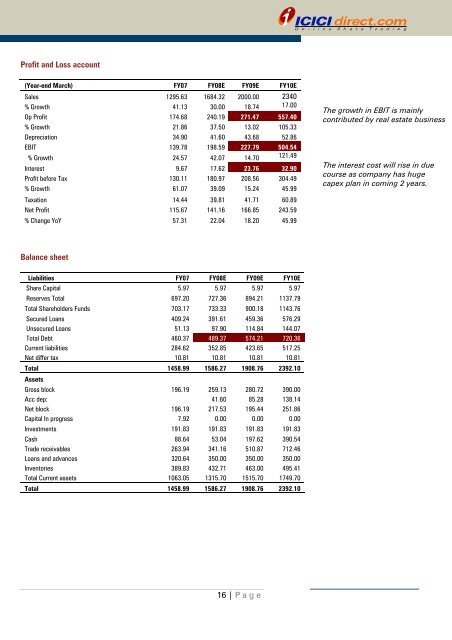

Profit and Loss account<br />

(Year-end March) FY07 FY08E FY09E FY10E<br />

Sales 1295.63 1684.32 2000.00 2340<br />

% Growth 41.13 30.00 18.74 17.00<br />

Op Profit 174.68 240.19 271.47 557.40<br />

% Growth 21.86 37.50 13.02 105.33<br />

Depreciation 34.90 41.60 43.68 52.86<br />

EBIT 139.78 198.59 227.79 504.54<br />

% Growth 24.57 42.07 14.70 121.49<br />

Interest 9.67 17.62 23.76 32.90<br />

Profit before Tax 130.11 180.97 208.56 304.49<br />

% Growth 61.07 39.09 15.24 45.99<br />

Taxation 14.44 39.81 41.71 60.89<br />

Net Profit 115.67 141.16 166.85 243.59<br />

% Change YoY 57.31 22.04 18.20 45.99<br />

Balance sheet<br />

Liabilities FY07 FY08E FY09E FY10E<br />

Share Capital 5.97 5.97 5.97 5.97<br />

Reserves Total 697.20 727.36 894.21 1137.79<br />

Total Shareholders Funds 703.17 733.33 900.18 1143.76<br />

Secured Loans 409.24 391.61 459.36 576.29<br />

Unsecured Loans 51.13 97.90 114.84 144.07<br />

Total Debt 460.37 489.37 574.21 720.36<br />

Current liabilities 284.62 352.85 423.65 517.25<br />

Net differ tax 10.81 10.81 10.81 10.81<br />

Total<br />

Assets<br />

1458.99 1586.27 1908.76 2392.10<br />

Gross block 196.19 259.13 280.72 390.00<br />

Acc dep: 41.60 85.28 138.14<br />

Net block 196.19 217.53 195.44 251.86<br />

Capital In progress 7.92 0.00 0.00 0.00<br />

Investments 191.83 191.83 191.83 191.83<br />

Cash 88.64 53.04 197.62 390.54<br />

Trade receivables 263.94 341.16 510.87 712.46<br />

Loans and advances 320.64 350.00 350.00 350.00<br />

Inventories 389.83 432.71 463.00 495.41<br />

Total Current assets 1063.05 1315.70 1515.70 1749.70<br />

Total 1458.99 1586.27 1908.76 2392.10<br />

16 | P age<br />

The growth in EBIT is mainly<br />

contributed by real estate business<br />

The interest cost will rise in due<br />

course as company has huge<br />

capex plan in coming 2 years.