Annual Report 2012

Annual Report 2012

Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)<br />

for the year ended 31 December <strong>2012</strong><br />

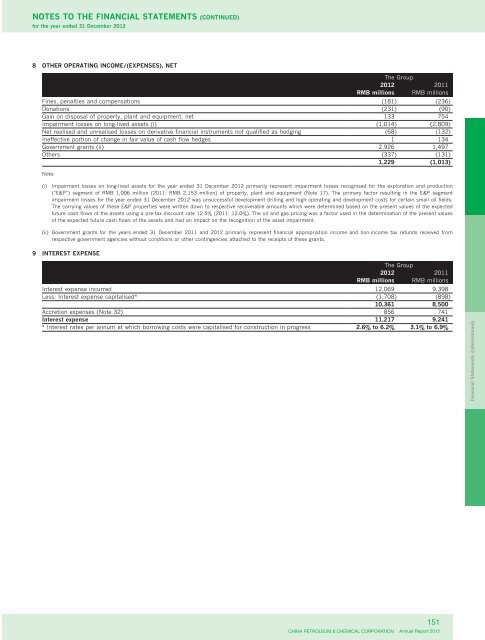

8 OTHER OPERATING INCOME/(EXPENSES), NET<br />

The Group<br />

<strong>2012</strong> 2011<br />

RMB millions RMB millions<br />

Fines, penalties and compensations (181) (236)<br />

Donations (231) (90)<br />

Gain on disposal of property, plant and equipment, net 133 754<br />

Impairment losses on long-lived assets (i) (1,014) (2,809)<br />

Net realised and unrealised losses on derivative financial instruments not qualified as hedging (68) (132)<br />

Ineffective portion of change in fair value of cash flow hedges 1 134<br />

Government grants (ii) 2,926 1,497<br />

Others (337) (131)<br />

1,229 (1,013)<br />

Note:<br />

(i) Impairment losses on long-lived assets for the year ended 31 December <strong>2012</strong> primarily represent impairment losses recognised for the exploration and production<br />

(“E&P”) segment of RMB 1,006 million (2011: RMB 2,153 million) of property, plant and equipment (Note 17). The primary factor resulting in the E&P segment<br />

impairment losses for the year ended 31 December <strong>2012</strong> was unsuccessful development drilling and high operating and development costs for certain small oil fields.<br />

The carrying values of these E&P properties were written down to respective recoverable amounts which were determined based on the present values of the expected<br />

future cash flows of the assets using a pre-tax discount rate 12.5% (2011: 12.0%). The oil and gas pricing was a factor used in the determination of the present values<br />

of the expected future cash flows of the assets and had an impact on the recognition of the asset impairment.<br />

(ii) Government grants for the years ended 31 December 2011 and <strong>2012</strong> primarily represent financial appropriation income and non-income tax refunds received from<br />

respective government agencies without conditions or other contingencies attached to the receipts of these grants.<br />

9 INTEREST EXPENSE<br />

The Group<br />

<strong>2012</strong> 2011<br />

RMB millions RMB millions<br />

Interest expense incurred 12,069 9,398<br />

Less: Interest expense capitalised* (1,708) (898)<br />

10,361 8,500<br />

Accretion expenses (Note 32) 856 741<br />

Interest expense 11,217 9,241<br />

* Interest rates per annum at which borrowing costs were capitalised for construction in progress 2.6% to 6.2% 3.1% to 6.9%<br />

151<br />

CHINA PETROLEUM & CHEMICAL CORPORATION <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Financial Statements (International)