Financial Responsibility, Personality Traits and Financial Decision ...

Financial Responsibility, Personality Traits and Financial Decision ...

Financial Responsibility, Personality Traits and Financial Decision ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

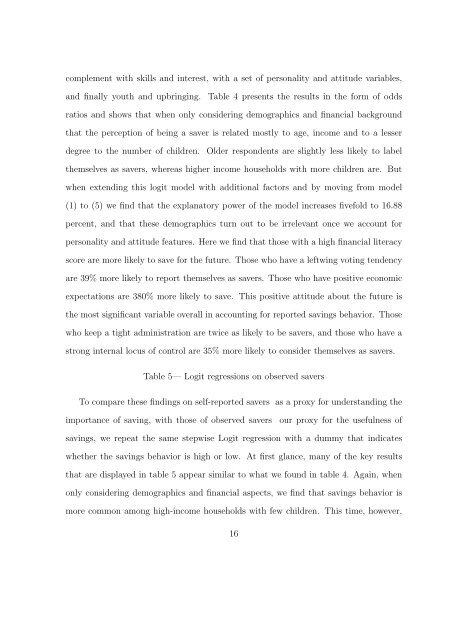

complement with skills <strong>and</strong> interest, with a set of personality <strong>and</strong> attitude variables,<br />

<strong>and</strong> finally youth <strong>and</strong> upbringing. Table 4 presents the results in the form of odds<br />

ratios <strong>and</strong> shows that when only considering demographics <strong>and</strong> financial background<br />

that the perception of being a saver is related mostly to age, income <strong>and</strong> to a lesser<br />

degree to the number of children. Older respondents are slightly less likely to label<br />

themselves as savers, whereas higher income households with more children are. But<br />

when extending this logit model with additional factors <strong>and</strong> by moving from model<br />

(1) to (5) we find that the explanatory power of the model increases fivefold to 16.88<br />

percent, <strong>and</strong> that these demographics turn out to be irrelevant once we account for<br />

personality <strong>and</strong> attitude features. Here we find that those with a high financial literacy<br />

score are more likely to save for the future. Those who have a leftwing voting tendency<br />

are 39% more likely to report themselves as savers. Those who have positive economic<br />

expectations are 380% more likely to save. This positive attitude about the future is<br />

the most significant variable overall in accounting for reported savings behavior. Those<br />

who keep a tight administration are twice as likely to be savers, <strong>and</strong> those who have a<br />

strong internal locus of control are 35% more likely to consider themselves as savers.<br />

Table 5— Logit regressions on observed savers<br />

To compare these findings on self-reported savers as a proxy for underst<strong>and</strong>ing the<br />

importance of saving, with those of observed savers our proxy for the usefulness of<br />

savings, we repeat the same stepwise Logit regression with a dummy that indicates<br />

whether the savings behavior is high or low. At first glance, many of the key results<br />

that are displayed in table 5 appear similar to what we found in table 4. Again, when<br />

only considering demographics <strong>and</strong> financial aspects, we find that savings behavior is<br />

more common among high-income households with few children. This time, however,<br />

16