Financial Responsibility, Personality Traits and Financial Decision ...

Financial Responsibility, Personality Traits and Financial Decision ...

Financial Responsibility, Personality Traits and Financial Decision ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

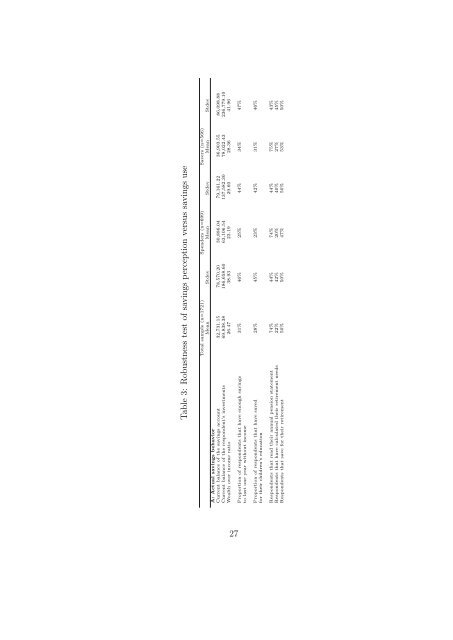

Table 3: Robustness test of savings perception versus savings use<br />

Total sample (n=1721) Spenders (n=699) Savers (n=566)<br />

Mean Stdev Mean Stdev Mean Stdev<br />

A: Actual savings behavior<br />

Current balance of the savings account 32,731.15 78,570.20 30,886.04 79,161.22 36,903.55 86,098.88<br />

Current balance of the respondent’s investments 69,838.38 186,658.60 63,106.54 137,582.30 78,022.43 236,779.10<br />

Wealth over income ratio 26.47 38.93 23.19 29.60 28.36 41.96<br />

27<br />

Proportion of respondents that have enough savings 31% 46% 25% 44% 34% 47%<br />

to last one year without income<br />

Proportion of respondents that have saved 28% 45% 23% 42% 31% 46%<br />

for their children’s education<br />

Respondents that read their annual pension statement 74% 44% 74% 44% 75% 43%<br />

Respondents that have calculated their retirement needs 22% 42% 20% 40% 27% 45%<br />

Respondents that save for their retirement 50% 50% 47% 50% 53% 50%