Download TPS, East Africa 2008 Annual Report - Serena Hotels

Download TPS, East Africa 2008 Annual Report - Serena Hotels

Download TPS, East Africa 2008 Annual Report - Serena Hotels

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

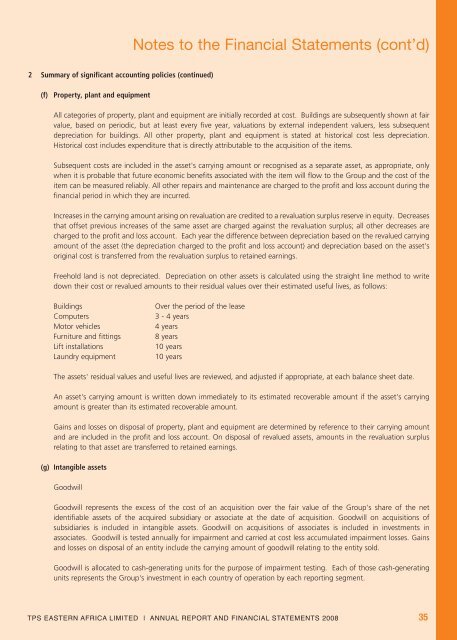

2 Summary of significant accounting policies (continued)<br />

(f) Property, plant and equipment<br />

Notes to the Financial Statements (cont’d)<br />

All categories of property, plant and equipment are initially recorded at cost. Buildings are subsequently shown at fair<br />

value, based on periodic, but at least every five year, valuations by external independent valuers, less subsequent<br />

depreciation for buildings. All other property, plant and equipment is stated at historical cost less depreciation.<br />

Historical cost includes expenditure that is directly attributable to the acquisition of the items.<br />

Subsequent costs are included in the asset's carrying amount or recognised as a separate asset, as appropriate, only<br />

when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the<br />

item can be measured reliably. All other repairs and maintenance are charged to the profit and loss account during the<br />

financial period in which they are incurred.<br />

Increases in the carrying amount arising on revaluation are credited to a revaluation surplus reserve in equity. Decreases<br />

that offset previous increases of the same asset are charged against the revaluation surplus; all other decreases are<br />

charged to the profit and loss account. Each year the difference between depreciation based on the revalued carrying<br />

amount of the asset (the depreciation charged to the profit and loss account) and depreciation based on the asset's<br />

original cost is transferred from the revaluation surplus to retained earnings.<br />

Freehold land is not depreciated. Depreciation on other assets is calculated using the straight line method to write<br />

down their cost or revalued amounts to their residual values over their estimated useful lives, as follows:<br />

Buildings Over the period of the lease<br />

Computers 3 - 4 years<br />

Motor vehicles 4 years<br />

Furniture and fittings 8 years<br />

Lift installations 10 years<br />

Laundry equipment 10 years<br />

The assets' residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date.<br />

An asset's carrying amount is written down immediately to its estimated recoverable amount if the asset's carrying<br />

amount is greater than its estimated recoverable amount.<br />

Gains and losses on disposal of property, plant and equipment are determined by reference to their carrying amount<br />

and are included in the profit and loss account. On disposal of revalued assets, amounts in the revaluation surplus<br />

relating to that asset are transferred to retained earnings.<br />

(g) Intangible assets<br />

Goodwill<br />

Goodwill represents the excess of the cost of an acquisition over the fair value of the Group's share of the net<br />

identifiable assets of the acquired subsidiary or associate at the date of acquisition. Goodwill on acquisitions of<br />

subsidiaries is included in intangible assets. Goodwill on acquisitions of associates is included in investments in<br />

associates. Goodwill is tested annually for impairment and carried at cost less accumulated impairment losses. Gains<br />

and losses on disposal of an entity include the carrying amount of goodwill relating to the entity sold.<br />

Goodwill is allocated to cash-generating units for the purpose of impairment testing. Each of those cash-generating<br />

units represents the Group's investment in each country of operation by each reporting segment.<br />

<strong>TPS</strong> EASTERN AFRICA LIMITED | ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2008</strong> 35