Download TPS, East Africa 2008 Annual Report - Serena Hotels

Download TPS, East Africa 2008 Annual Report - Serena Hotels

Download TPS, East Africa 2008 Annual Report - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

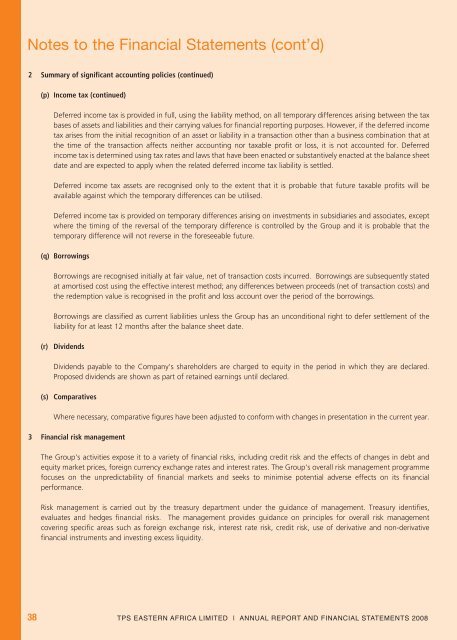

Notes to the Financial Statements (cont’d)<br />

2 Summary of significant accounting policies (continued)<br />

(p) Income tax (continued)<br />

Deferred income tax is provided in full, using the liability method, on all temporary differences arising between the tax<br />

bases of assets and liabilities and their carrying values for financial reporting purposes. However, if the deferred income<br />

tax arises from the initial recognition of an asset or liability in a transaction other than a business combination that at<br />

the time of the transaction affects neither accounting nor taxable profit or loss, it is not accounted for. Deferred<br />

income tax is determined using tax rates and laws that have been enacted or substantively enacted at the balance sheet<br />

date and are expected to apply when the related deferred income tax liability is settled.<br />

Deferred income tax assets are recognised only to the extent that it is probable that future taxable profits will be<br />

available against which the temporary differences can be utilised.<br />

Deferred income tax is provided on temporary differences arising on investments in subsidiaries and associates, except<br />

where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the<br />

temporary difference will not reverse in the foreseeable future.<br />

(q) Borrowings<br />

Borrowings are recognised initially at fair value, net of transaction costs incurred. Borrowings are subsequently stated<br />

at amortised cost using the effective interest method; any differences between proceeds (net of transaction costs) and<br />

the redemption value is recognised in the profit and loss account over the period of the borrowings.<br />

Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the<br />

liability for at least 12 months after the balance sheet date.<br />

(r) Dividends<br />

Dividends payable to the Company's shareholders are charged to equity in the period in which they are declared.<br />

Proposed dividends are shown as part of retained earnings until declared.<br />

(s) Comparatives<br />

Where necessary, comparative figures have been adjusted to conform with changes in presentation in the current year.<br />

3 Financial risk management<br />

The Group's activities expose it to a variety of financial risks, including credit risk and the effects of changes in debt and<br />

equity market prices, foreign currency exchange rates and interest rates. The Group's overall risk management programme<br />

focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on its financial<br />

performance.<br />

Risk management is carried out by the treasury department under the guidance of management. Treasury identifies,<br />

evaluates and hedges financial risks. The management provides guidance on principles for overall risk management<br />

covering specific areas such as foreign exchange risk, interest rate risk, credit risk, use of derivative and non-derivative<br />

financial instruments and investing excess liquidity.<br />

38 <strong>TPS</strong> EASTERN AFRICA LIMITED | ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2008</strong>