Download TPS, East Africa 2008 Annual Report - Serena Hotels

Download TPS, East Africa 2008 Annual Report - Serena Hotels

Download TPS, East Africa 2008 Annual Report - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

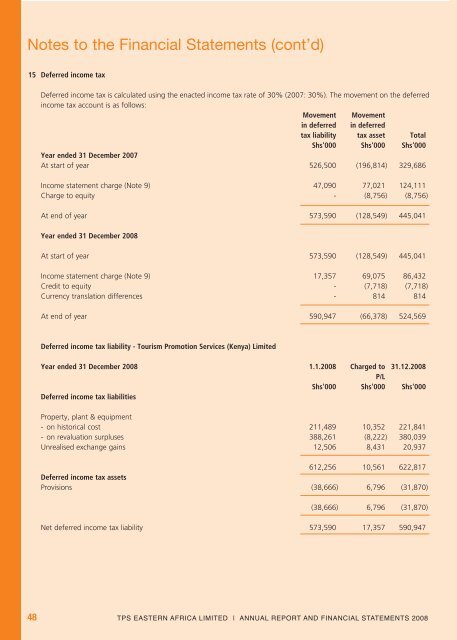

Notes to the Financial Statements (cont’d)<br />

15 Deferred income tax<br />

Deferred income tax is calculated using the enacted income tax rate of 30% (2007: 30%). The movement on the deferred<br />

income tax account is as follows:<br />

Movement Movement<br />

in deferred in deferred<br />

tax liability tax asset Total<br />

Shs'000 Shs'000 Shs'000<br />

Year ended 31 December 2007<br />

At start of year 526,500 (196,814) 329,686<br />

Income statement charge (Note 9) 47,090 77,021 124,111<br />

Charge to equity - (8,756) (8,756)<br />

At end of year 573,590 (128,549) 445,041<br />

Year ended 31 December <strong>2008</strong><br />

At start of year 573,590 (128,549) 445,041<br />

Income statement charge (Note 9) 17,357 69,075 86,432<br />

Credit to equity - (7,718) (7,718)<br />

Currency translation differences - 814 814<br />

At end of year 590,947 (66,378) 524,569<br />

Deferred income tax liability - Tourism Promotion Services (Kenya) Limited<br />

Year ended 31 December <strong>2008</strong> 1.1.<strong>2008</strong> Charged to 31.12.<strong>2008</strong><br />

P/L<br />

Shs'000 Shs'000 Shs'000<br />

Deferred income tax liabilities<br />

Property, plant & equipment<br />

- on historical cost 211,489 10,352 221,841<br />

- on revaluation surpluses 388,261 (8,222) 380,039<br />

Unrealised exchange gains 12,506 8,431 20,937<br />

612,256 10,561 622,817<br />

Deferred income tax assets<br />

Provisions (38,666) 6,796 (31,870)<br />

(38,666) 6,796 (31,870)<br />

Net deferred income tax liability 573,590 17,357 590,947<br />

48 <strong>TPS</strong> EASTERN AFRICA LIMITED | ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2008</strong>