Operations Review - ChartNexus

Operations Review - ChartNexus

Operations Review - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS - 31 MARCH 2009 (CONTINUED)<br />

3 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)<br />

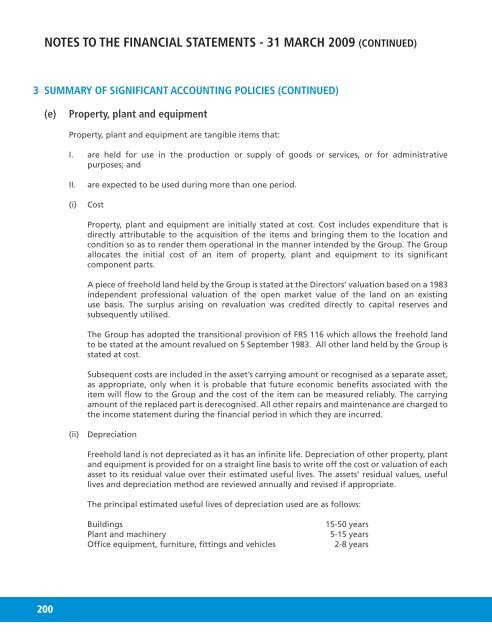

(e) Property, plant and equipment<br />

200<br />

Property, plant and equipment are tangible items that:<br />

I. are held for use in the production or supply of goods or services, or for administrative<br />

purposes; and<br />

II. are expected to be used during more than one period.<br />

(i) Cost<br />

Property, plant and equipment are initially stated at cost. Cost includes expenditure that is<br />

directly attributable to the acquisition of the items and bringing them to the location and<br />

condition so as to render them operational in the manner intended by the Group. The Group<br />

allocates the initial cost of an item of property, plant and equipment to its significant<br />

component parts.<br />

A piece of freehold land held by the Group is stated at the Directors’ valuation based on a 1983<br />

independent professional valuation of the open market value of the land on an existing<br />

use basis. The surplus arising on revaluation was credited directly to capital reserves and<br />

subsequently utilised.<br />

The Group has adopted the transitional provision of FRS 116 which allows the freehold land<br />

to be stated at the amount revalued on 5 September 1983. All other land held by the Group is<br />

stated at cost.<br />

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset,<br />

as appropriate, only when it is probable that future economic benefits associated with the<br />

item will flow to the Group and the cost of the item can be measured reliably. The carrying<br />

amount of the replaced part is derecognised. All other repairs and maintenance are charged to<br />

the income statement during the financial period in which they are incurred.<br />

(ii) Depreciation<br />

Freehold land is not depreciated as it has an infinite life. Depreciation of other property, plant<br />

and equipment is provided for on a straight line basis to write off the cost or valuation of each<br />

asset to its residual value over their estimated useful lives. The assets’ residual values, useful<br />

lives and depreciation method are reviewed annually and revised if appropriate.<br />

The principal estimated useful lives of depreciation used are as follows:<br />

Buildings 15-50 years<br />

Plant and machinery 5-15 years<br />

Office equipment, furniture, fittings and vehicles 2-8 years