1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fundamentally focused on intermediation –<br />

which accounted for over 90% of total revenues<br />

in <strong>1998</strong> – <strong>Paribas</strong> restricts trading for own<br />

account to the volume necessary to ensure the<br />

success of its clients’ transactions. Coupled with<br />

rigorous risk- and cost-control, this strategy has<br />

enabled <strong>Paribas</strong> to limit the impact of the crisis<br />

in emerging markets and Russia last year.<br />

Primary Market<br />

In the primary markets, the number of issues<br />

was particularly high in Europe. <strong>Paribas</strong> ranks<br />

eighth among book-runners of international<br />

equity issues (source: Capital Data) and third in<br />

international convertible bond issues (source:<br />

Capital Data). As the markets are increasingly<br />

dominated by a shrinking number of world-class<br />

players, <strong>Paribas</strong> is particularly proud of these<br />

performances. The <strong>1998</strong> launch of euro-denominated<br />

convertible bonds will be followed<br />

by additional initiatives this year.<br />

The many transactions lead-managed by <strong>Paribas</strong><br />

in Europe last year comprise:<br />

• in Italy, the very first issue of euro-denominated<br />

convertible bonds, for Parmalat, in February<br />

(see Focus),<br />

• in Germany, on the Neuer Markt stock<br />

exchange for high-growth companies, the successful<br />

IPO of Brokat, an internet technology<br />

specialist, and the capital increase of Mobilcom,<br />

an independent telephone operator,<br />

• in France, the second tranche of the gradual<br />

privatization of France Télécom, combining a<br />

capital increase, the sale of additional shares by<br />

the French State, and the largest issue of<br />

convertible bonds ever carried out in Europe.<br />

In the highly active European secondary equity<br />

markets, <strong>Paribas</strong> has continued to strengthen its<br />

positions with institutional investors around the<br />

world. The Bank improved its ranking in<br />

European equity sales.<br />

In Japan, to complement the success of its quantitative<br />

products, <strong>Paribas</strong> is launching traditional<br />

brokerage activities, based on sector research.<br />

Reflecting the financial crisis, trading volume<br />

dropped in emerging markets, which represented<br />

less than 10% of revenues in <strong>1998</strong>.<br />

Headcount was reduced by 90 people, and the<br />

activity was restructured to offer investors global<br />

coverage of the emerging markets, along regional<br />

or sector lines.<br />

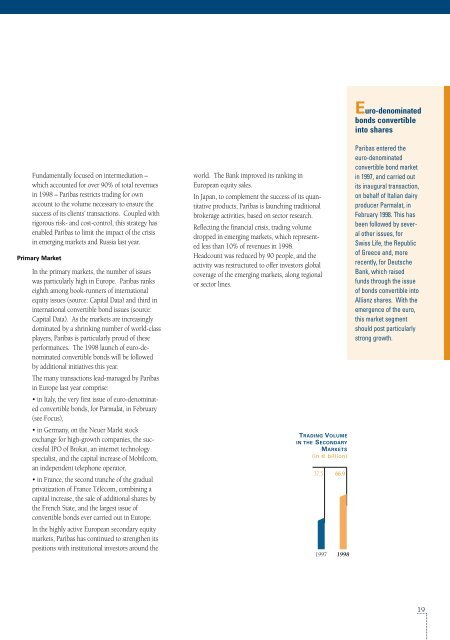

TRADING VOLUME<br />

IN THE SECONDARY<br />

MARKETS<br />

(in € billion)<br />

37.5<br />

66.9<br />

1997 <strong>1998</strong><br />

Euro-denominated<br />

bonds convertible<br />

into shares<br />

<strong>Paribas</strong> entered the<br />

euro-denominated<br />

convertible bond market<br />

in 1997, and carried out<br />

its inaugural transaction,<br />

on behalf of Italian dairy<br />

producer Parmalat, in<br />

February <strong>1998</strong>. This has<br />

been followed by several<br />

other issues, for<br />

Swiss Life, the Republic<br />

of Greece and, more<br />

recently, for Deutsche<br />

Bank, which raised<br />

funds through the issue<br />

of bonds convertible into<br />

Allianz shares. With the<br />

emergence of the euro,<br />

this market segment<br />

should post particularly<br />

strong growth.<br />

19