1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

98<br />

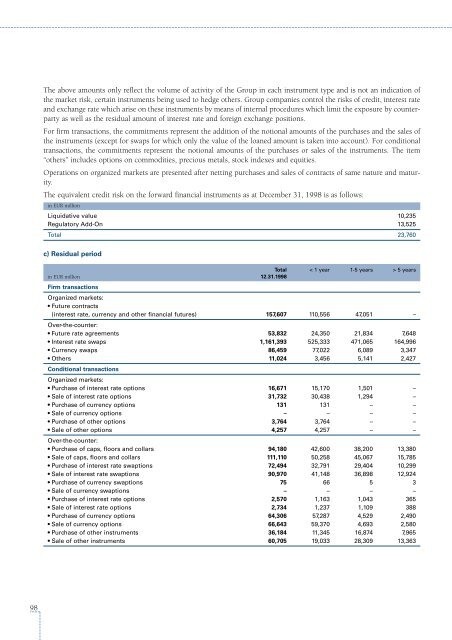

The above amounts only reflect the volume of activity of the Group in each instrument type and is not an indication of<br />

the market risk, certain instruments being used to hedge others. Group companies control the risks of credit, interest rate<br />

and exchange rate which arise on these instruments by means of internal procedures which limit the exposure by counterparty<br />

as well as the residual amount of interest rate and foreign exchange positions.<br />

For firm transactions, the commitments represent the addition of the notional amounts of the purchases and the sales of<br />

the instruments (except for swaps for which only the value of the loaned amount is taken into account). For conditional<br />

transactions, the commitments represent the notional amounts of the purchases or sales of the instruments. The item<br />

“others” includes options on commodities, precious metals, stock indexes and equities.<br />

Operations on organized markets are presented after netting purchases and sales of contracts of same nature and maturity.<br />

The equivalent credit risk on the forward financial instruments as at December 31, <strong>1998</strong> is as follows:<br />

in EUR million<br />

Liquidative value 10,235<br />

Regulatory Add-On 13,525<br />

Total 23,760<br />

c) Residual period<br />

Total < 1 year 1-5 years > 5 years<br />

in EUR million 12.31.<strong>1998</strong><br />

Firm transactions<br />

Organized markets:<br />

• Future contracts<br />

(interest rate, currency and other financial futures)<br />

Over-the-counter:<br />

157,607 110,556 47,051 –<br />

• Future rate agreements 53,832 24,350 21,834 7,648<br />

• Interest rate swaps 1,161,393 525,333 471,065 164,996<br />

• Currency swaps 86,459 77,022 6,089 3,347<br />

• Others 11,024 3,456 5,141 2,427<br />

Conditional transactions<br />

Organized markets:<br />

• Purchase of interest rate options 16,671 15,170 1,501 –<br />

• Sale of interest rate options 31,732 30,438 1,294 –<br />

• Purchase of currency options 131 131 – –<br />

• Sale of currency options – – – –<br />

• Purchase of other options 3,764 3,764 – –<br />

• Sale of other options 4,257 4,257 – –<br />

Over-the-counter:<br />

• Purchase of caps, floors and collars 94,180 42,600 38,200 13,380<br />

• Sale of caps, floors and collars 111,110 50,258 45,067 15,785<br />

• Purchase of interest rate swaptions 72,494 32,791 29,404 10,299<br />

• Sale of interest rate swaptions 90,970 41,148 36,898 12,924<br />

• Purchase of currency swaptions 75 66 5 3<br />

• Sale of currency swaptions – – – –<br />

• Purchase of interest rate options 2,570 1,163 1,043 365<br />

• Sale of interest rate options 2,734 1,237 1,109 388<br />

• Purchase of currency options 64,306 57,287 4,529 2,490<br />

• Sale of currency options 66,643 59,370 4,693 2,580<br />

• Purchase of other instruments 36,184 11,345 16,874 7,965<br />

• Sale of other instruments 60,705 19,033 28,309 13,363