1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

72<br />

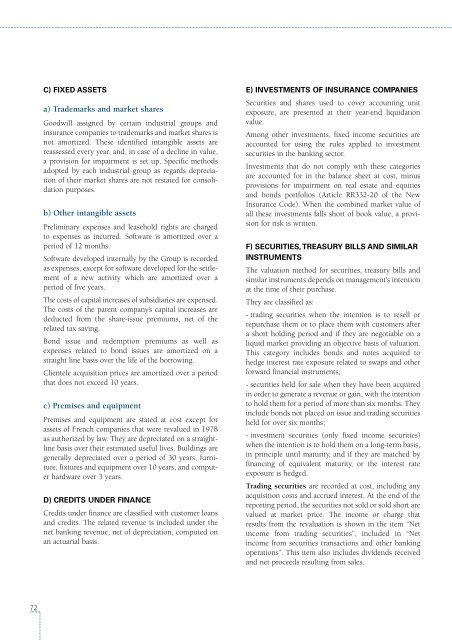

C) FIXED ASSETS<br />

a) Trademarks and market shares<br />

Goodwill assigned by certain industrial groups and<br />

insurance companies to trademarks and market shares is<br />

not amortized. These identified intangible assets are<br />

reassessed every year, and, in case of a decline in value,<br />

a provision for impairment is set up. Specific methods<br />

adopted by each industrial group as regards depreciation<br />

of their market shares are not restated for consolidation<br />

purposes.<br />

b) Other intangible assets<br />

Preliminary expenses and leasehold rights are charged<br />

to expenses as incurred. Software is amortized over a<br />

period of 12 months.<br />

Software developed internally by the Group is recorded<br />

as expenses, except for software developed for the settlement<br />

of a new activity which are amortized over a<br />

period of five years.<br />

The costs of capital increases of subsidiaries are expensed.<br />

The costs of the parent company’s capital increases are<br />

deducted from the share-issue premiums, net of the<br />

related tax saving.<br />

Bond issue and redemption premiums as well as<br />

expenses related to bond issues are amortized on a<br />

straight line basis over the life of the borrowing.<br />

Clientele acquisition prices are amortized over a period<br />

that does not exceed 10 years.<br />

c) Premises and equipment<br />

Premises and equipment are stated at cost except for<br />

assets of French companies that were revalued in 1978<br />

as authorized by law. They are depreciated on a straightline<br />

basis over their estimated useful lives. Buildings are<br />

generally depreciated over a period of 30 years, furniture,<br />

fixtures and equipment over 10 years, and computer<br />

hardware over 3 years.<br />

D) CREDITS UNDER FINANCE<br />

Credits under finance are classified with customer loans<br />

and credits. The related revenue is included under the<br />

net banking revenue, net of depreciation, computed on<br />

an actuarial basis.<br />

E) INVESTMENTS OF INSURANCE COMPANIES<br />

Securities and shares used to cover accounting unit<br />

exposure, are presented at their year-end liquidation<br />

value.<br />

Among other investments, fixed income securities are<br />

accounted for using the rules applied to investment<br />

securities in the banking sector.<br />

Investments that do not comply with these categories<br />

are accounted for in the balance sheet at cost, minus<br />

provisions for impairment on real estate and equities<br />

and bonds portfolios (Article RR332-20 of the New<br />

Insurance Code). When the combined market value of<br />

all these investments falls short of book value, a provision<br />

for risk is written.<br />

F) SECURITIES, TREASURY BILLS AND SIMILAR<br />

INSTRUMENTS<br />

The valuation method for securities, treasury bills and<br />

similar instruments depends on management's intention<br />

at the time of their purchase.<br />

They are classified as:<br />

- trading securities when the intention is to resell or<br />

repurchase them or to place them with customers after<br />

a short holding period and if they are negotiable on a<br />

liquid market providing an objective basis of valuation.<br />

This category includes bonds and notes acquired to<br />

hedge interest rate exposure related to swaps and other<br />

forward financial instruments;<br />

- securities held for sale when they have been acquired<br />

in order to generate a revenue or gain, with the intention<br />

to hold them for a period of more than six months. They<br />

include bonds not placed on issue and trading securities<br />

held for over six months;<br />

- investment securities (only fixed income securities)<br />

when the intention is to hold them on a long-term basis,<br />

in principle until maturity, and if they are matched by<br />

financing of equivalent maturity, or the interest rate<br />

exposure is hedged.<br />

Trading securities are recorded at cost, including any<br />

acquisition costs and accrued interest. At the end of the<br />

reporting period, the securities not sold or sold short are<br />

valued at market price. The income or charge that<br />

results from the revaluation is shown in the item “Net<br />

income from trading securities”, included in “Net<br />

income from securities transactions and other banking<br />

operations”. This item also includes dividends received<br />

and net proceeds resulting from sales.